Investment firm with Icahn links takes out large News Corp stake

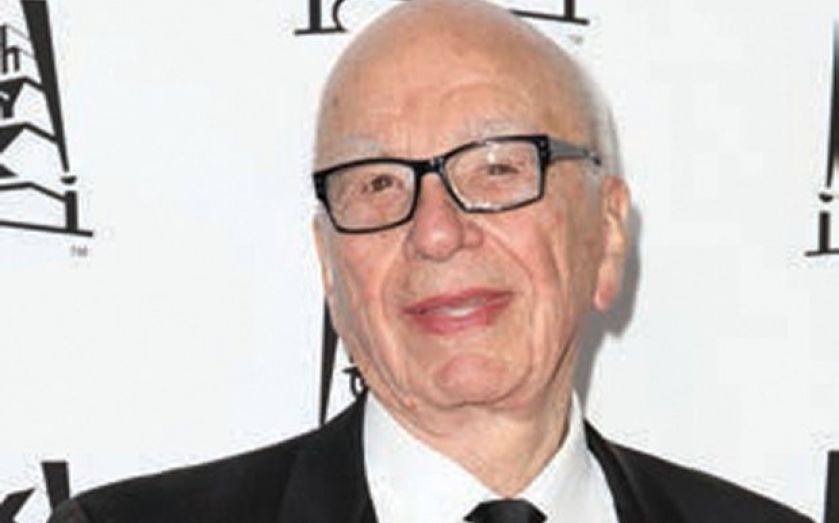

THE INVESTMENT firm that joined Carl Icahn in his failed bid to block Dell’s buyout bid on Tuesday, took a 12 per cent stake in News Corp yesterday, the largest holding behind founder and chairman Rupert Murdoch.

Southeastern Asset Management, based in Memphis, Tennessee, took 23.8m class B shares in News Corp, valued at $397m (£252m).

Icahn announced in an open letter that Icahn Investment Group and Southeastern would be withdrawing from the battle over Dell.

Icahn posted the letter to his 77,000 Twitter followers and on the US securities regulator’s website, that he still believed the $24.4bn offer from Dell and Silver Lake undervalued the firm, and “freezes stockholders out of any possibility of realising Dell’s great potential”.

Southeastern previously teamed with Icahn in a shareholder revolt at Chesapeake Energy.

The News Corp holding, disclosed in regulatory filings, is in Murdoch’s publishing business which split from the entertainment group, 21st Century Fox, in June.