Intu Properties raising £490m to fund swoop on Westfield centres

REAL Estate fund Intu Properties yesterday launched a £488m rights issue to help fund the purchase of several shopping centres in the West Midlands.

The business will use proceeds of rights issue and a new £423.8m loan to buy Derby shopping centre and Sprucefield retail park in Northern Ireland from owner Westfield.

It will also buy out Westfield’s 50 per cent stake out in the Merry Hill shopping centre in Birmingham. The co-owner – QIC – will retain its stake. The total bill for the three deals is £867.8m.

“The transaction is a rare and attractive opportunity to acquire a further two prime shopping centres in line with our strategy to focus on the UK’s largest and most successful destinations,” Intu chief executive David Fischel said.

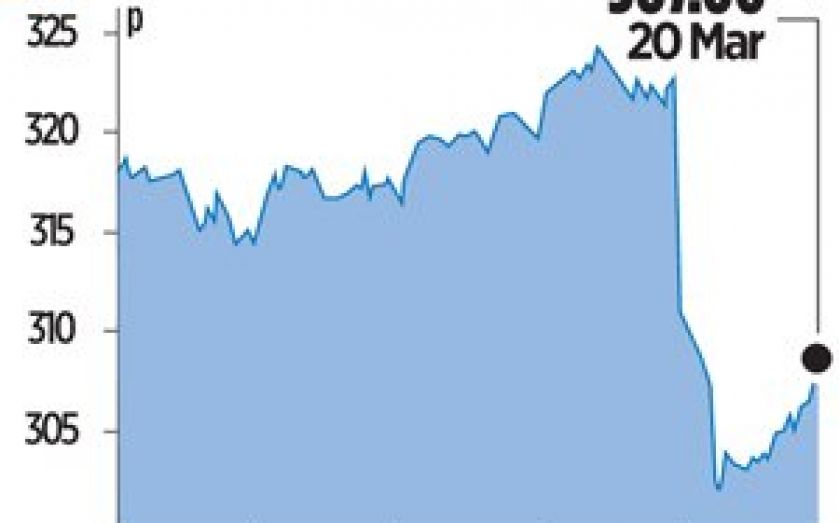

The rights issue will be priced at a 42.5 per cent discount to Intu’s closing price on Wednesday.

BEHIND THE DEAL

UBS | GARETH MCCARTNEY

1 McCartney, 36 this year, joined UBS in 2010 from Icap, where he ran mid-market equities. He started his career at Goldman Sachs before moving to Lehman Brothers then Icap.

2 McCartney is currently a managing director and head of equity syndicate for Europe, Middle East and Africa at UBS and will be responsible for helping place the shares on the Intu deal. Corporate brokers to Intu are UBS’s Hew Glyn Davies and Thomas Raynsford.

3 It’s been a busy period for McCartney, with the current stampede to equity markets. He has previously worked on the flotation of Moleskin .

Also advising…

Rothschild are acting as sponsors on the rights Issue and financial adviser on the acquisitions, with Alex Midgen, Richard Blackwell and William Marshall working on the deal. Alongside UBS, Bank of America Merrill Lynch and HSBC are also acting as joint bookrunners. Hudson Sandler is handling PR in the UK.