Interview: Why Octopus Energy boss Greg Jackson is still powered up

“I don’t have any amazing news to break,” admits Greg Jackson, the boss of one of the UK’s leading energy companies as he sits down for our interview – which is a surprise as Octopus Energy has been driving a raft of industry headlines in recent weeks.

In the past month alone, it has wrapped up three wind farm deals in France, signed an agreement with UAE-based Masdar to manage UK battery storage, unveiled nearly £3bn of investment in renewable energy and technology across Asia and the Pacific regions, and made a £70m investment pledge with Legal and General to ramp up domestic heat pump production.

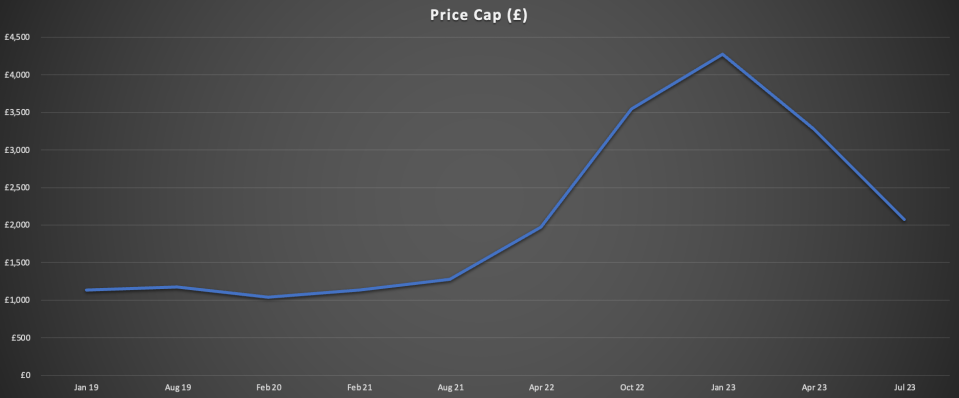

Such activity could reflect a market returning to a degree of normality, with wholesale costs easing in line with falling gas demand, and Ofgem confirming the price cap will drop around 50 per cent next month – halving from this year’s peak of over £4,000.

It could even mean energy firms being ready to compete again over prices, offering new deals to customers.

However, when I put the question to Jackson, the usually highly affable Teessider’s face falls – with the energy boss still highly wary over higher bills this winter.

Jackson hopes that “we’re in a better position to absorb any future shocks” but warns energy bills will still be elevated well above pre-crisis levels – before the surge in post-pandemic demand in summer 2021 and Russia’s invasion of Ukraine last year.

“I think because there’s less government support available for customers in the coming winter than there had been in the previous one, there’s every chance that a lot households are not going to be ready for it and may not be able to cope. So we need to do everything we can again this winter, to support people,” he says.

However, Jackson is unsure over Ofgem’s proposals to bring in a social tariff to support vulnerable customers – warning that it is “very easy to be in favour until someone defines it” with disagreements within the industry over how to fund support for millions of households, and how to define each customer as vulnerable or not vulnerable.

No more ‘Del Boy bargains’

One way to prevent energy bills spiralling again, he argues, is to ensure “customers are empowered to switch when they want to” as long as the market isn’t “driven by Del Boy bargains”.

He says: “I think we need to be very aware of the turbocharged hyper-switching market that Ofgem created prior to the crisis because it was one of the key drivers of failures. Companies went bust because they were unhedged. It was almost the only cause of every failure – unhedged companies.”

Octopus completed its takeover of fallen rival Bulb Energy, and is now the third-biggest energy supplier in the UK with five million customers.

When I question whether it is healthy for a market to be dominated by six energy firms, taking up 90 per cent of the country’s customer base, he explains that most sectors that serve customers well have a relatively small number of extremely well run companies.

“This is not to say that we shouldn’t have new entrants. Octopus was a new entrant, but we started with 25 times more capital than – for example – Bulb and through our time we raised another 20 times more than them. If you’ve got a vision and you’ve got the capabilities to bring something new, there’s always going to be opportunity to enter and improve the market,” he explains.

Energy watchdog Ofgem is ‘too sensitive’

Questions have been raised over Octopus’s conduct, after the firm was named and shamed by watchdog Ofgem – which last month revealed the energy firm was compelled to pay £750,000 to 19,000 of its customers for delaying statutory compensation payments to customers.

This means funds owed to households after switching regarding leftover credit, which can be an administrative challenge between suppliers.

Jackson defends Octopus’s conduct, arguing it had tried to make the system neater by waiting until payments were settled before compensating customers, but Ofgem did not agree – demanding Octopus pay customers immediately, even if there had to be revisions later.

The energy boss believes Ofgem blew the story out of proportion, accusing the watchdog of being “so sensitive” following the market crisis, with increasing scrutiny from the media and politicians for the regulator to be tough.

He calls on Ofgem to “spend more time looking at the big picture stuff”, such as dealing with 200GW of energy in the queue waiting for a connection, and decoupling gas from electricity prices.

“It’s got major issues, and indeed so do energy suppliers, like companies that kick in the doors of vulnerable customers and pay extra bonuses for forcing prepayment meters,” he says, alluding to the recent crisis involving rival British Gas.

Yet Jackson still hopes Octopus can be a unifier, and that everyone can work together in the industry to resolve the problems facing the energy sector.

“If we could focus on driving down energy costs for everyone, then Ofgem, the market, the industry and the consumer will all benefit,” he says.