Covid-19 could be the largest insured loss in history. How can the insurance industry adapt?

Covid-19 has us all living through a live, catastrophic event. It is dramatic but makes the non-life insurance world a fascinating place to be.

There will be significant insured losses from Covid-19 with obvious examples of the Olympics being postponed, Wimbledon and other sporting events being cancelled, and hundreds of thousands of travel insurance claims being made. These are the “known knowns”.

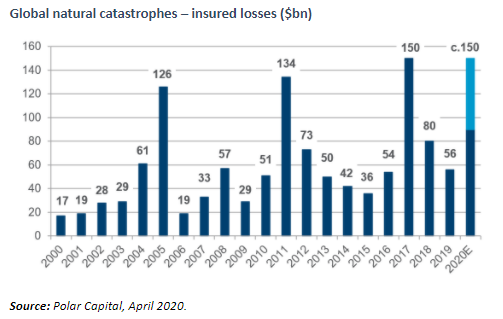

The “known unknowns” include the major catastrophes that Mother Nature throws at us. In our view, Covid-19 is likely to become the largest insured loss in history. Our base case is a $60–70bn loss, surpassing the $50bn-plus from Hurricane Katrina alone in 2005. The worst year for insured losses was 2017, with $144bn paid out thanks to multiple hurricanes, wildfires, landslides and floods globally.

The insurance industry helps customers and communities in difficult times by paying out on claims. Today’s pandemic is different from the usual hurricanes and earthquakes that non-life insurers deal with, as it is ongoing with any number of potential outcomes. Pandemics, unlike hurricanes or earthquakes, are not limited by geography or time which makes potential losses open-ended and, in the extreme, largely uninsurable.

No regulator wants to see companies take on unquantifiable risks, as the whole principle of insurance is that the premiums of the many will pay for the losses of the few.

As pandemics potentially impact everyone, there is no way to diversify risk, making pandemics incredibly difficult to insure. That is why they are routinely excluded in policy wordings.

At the end of March/early April, there was talk of lawmakers retroactively wanting to change policy wording that would make insurance companies pay out for business interruption claims, whether there was coverage or not. This kind of retroactive conversation has since gone quiet as it flies in the face of contract law, certainly in countries like the UK and US.

Ahead of Covid-19, many companies in the insurance industry were already struggling and needed to get their underwriting houses in order. The pandemic has simply added to their problems. However, there are plenty of quality insurance companies, run by strong, proven management teams. Many have been patient over the past few years, waiting for a better opportunity to deploy underwriting capital. That opportunity has arrived. Pricing momentum was building pre-Covid and is now accelerating virtually anywhere we care to look.

Covid-19’s impact is shocking on so many personal, corporate, social and economic levels, but looking at the insurance sector, some of the clouds of uncertainty around Covid-19 losses seem to be lifting. Insurers today are being paid more appropriately for the risks they take on. That needs to be the case as insurance remains the oil that greases the wheels of world trade.

Main image credit: Getty