Insolvencies jump 18 per cent in October as high rates squeeze firms

The number of firms going bust in England and Wales has jumped yet again as the higher-for-longer interest rate environment continues to put pressure on businesses and consumers.

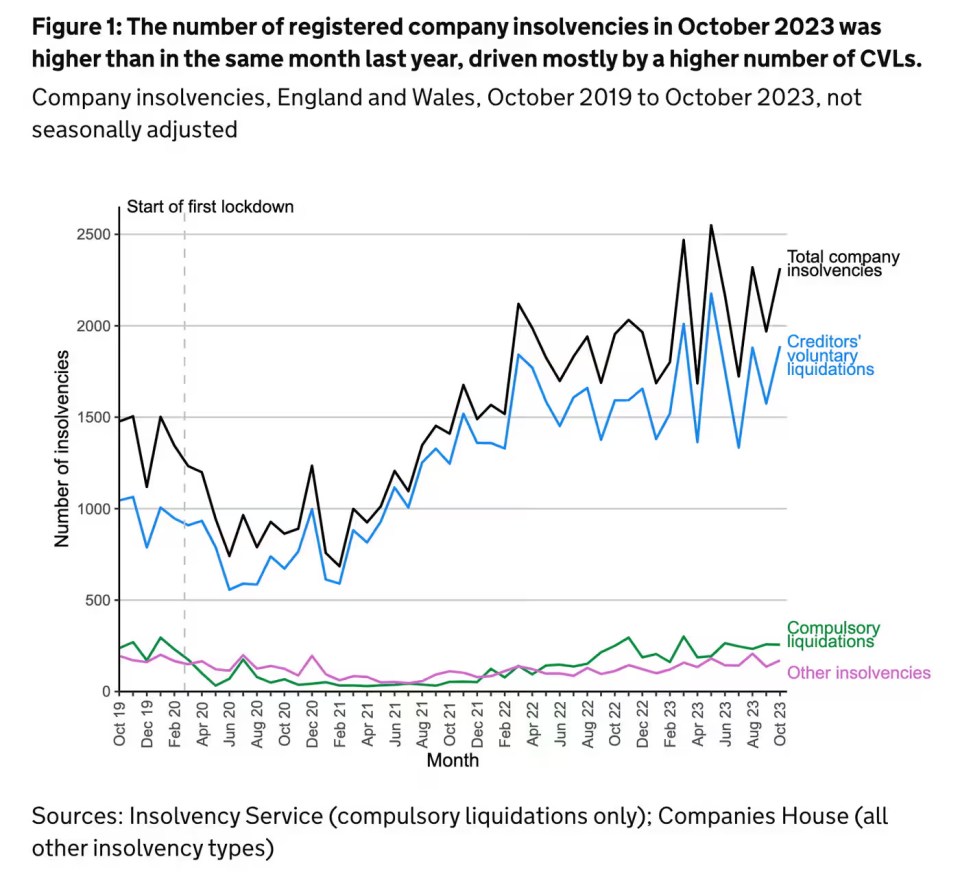

Monthly data from the Insolvency Service showed there were 2,315 insolvencies among registered companies in October, up 18 per cent from last October when there was 1,954.

Around 82 per cent (1,889) of last month’s insolvencies were creditors’ voluntary liquidations (CVLs), where an insolvent company’s directors choose to wind up.

There were an additional 256 compulsory liquidations, 146 administrations, 23 company voluntary arrangements and one receivership appointment. These kinds of insolvencies were all higher than in October 2022.

Quarterly statistics published at the end of last month showed the number of insolvencies hit its highest level since the height of the financial crisis in 2009.

The figure comes as UK firms continue to struggle with weak consumer spending and high interest rates, which were hiked by the Bank of England in a bid to bring down inflation.

Recent figures from the Office for National Statistics showed that consumers have been cutting back on spending by more than expected in September, with retail sales falling 0.9 per cent.

“Continuing supply chain pressures, energy costs, inflation and the high cost of debt mean that many corporate balance sheets remain fragile, particularly those of smaller owner-managed companies,” said David Kelly, head of insolvency at PwC.

“Engineering, business services, and hospitality and leisure continue to be the sectors facing the most pressure, with 70% of insolvencies coming from these four sectors,” he added. “Looking ahead, unfortunately we expect the number of insolvencies to remain high in the final months of this year, with no sector immune from the prevailing external challenges.”

Matthew Richards, a partner at accountancy firm Azets, said: “As we head into the Christmas period, the pressure on construction and real estate business will persist and we expect that insolvency numbers will continue to remain at current levels.

“Insolvency numbers will probably increase further in 2024, particularly in the hospitality, retail, and leisure sectors if consumers continue to curb their spending to cope with higher mortgage and rent payments.”