Insolvencies hit highest level since 2009 as firms feel pressure from rates and inflation

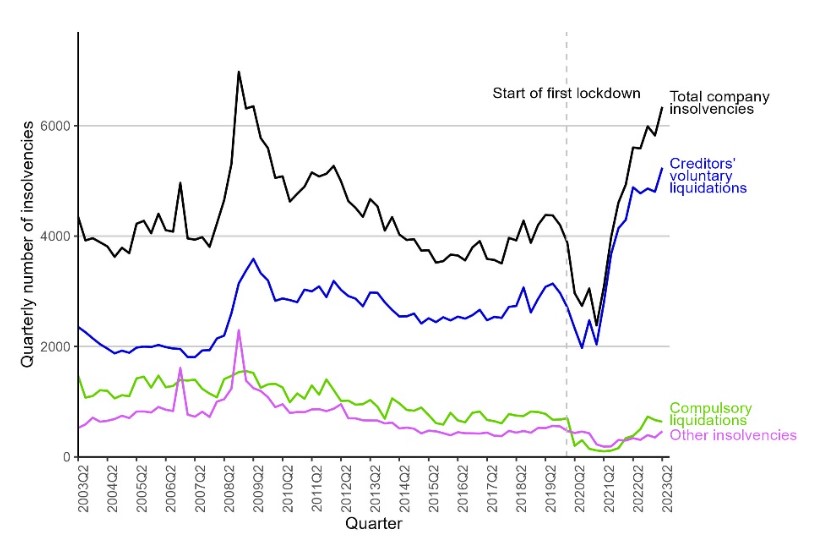

The number of company insolvencies in the second quarter hit its highest level since 2009, new figures showed, as firms struggled with a cocktail of rising costs and a tightening lending environment.

In the three months to June 2023, there were 5,240 seasonally adjusted registered company insolvencies, nine per cent higher than last quarter and 13 per cent higher than last year.

At 6,342, the number of creditors’ voluntary liquidations (CVLs) was the highest quarterly level since data began back in 1960.

The number of compulsory liquidations also increased, but remained slightly lower than levels seen prior to the pandemic

The number of insolvencies did not simply reflect the existence of more companies, as the rate of firms facing insolvency per 10,000 also increased.

Construction businesses were most under the cosh, making up 18 per cent of cases while wholesale and retail trade comprised 16 per cent. Accommodation and food services was another sector that struggled, making up 14 per cent of insolvencies.

The rise in insolvencies reflects the unwinding of decades of low interest rates. In an attempt to contain stubbornly high inflation, the Bank of England has hiked rates 13 times in a row bringing the base rate to its highest level since the financial crisis. This has piled pressure onto firms as it forces the cost of borrowing higher.

Sam Fenwick, Partner at Wedlake Bell commented: “More and more businesses are struggling to make ends meet due to increased overheads and their customers having less money to spend. Directors are increasingly throwing in the towel, particularly in smaller businesses.”

Experts at EY noted that things are likely to get worse, as nearly one-in-five listed firms have issued profit warnings in the past year, with many citing tighter credit conditions.

Traditionally restructuring activity increases after a peak in profit warnings as firms look to implement a turnaround plan.

“The tighter lending environment will have an ongoing impact on profitability so it’s imperative that businesses continue to build solid operational and financial foundations as well as conduct robust forecasting to ensure they are fully equipped to adapt to changing conditions in their market,” Samantha Keen, UK turnaround and restructuring strategy partner at EY-Parthenon said.