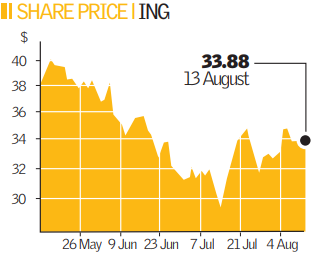

ING profits hit as asset fears build

ING, the Dutch bank and insurer, reported a slide in second-quarter earnings of 25 per cent yesterday, as it yielded smaller returns on its investments.

Net profit fell to €1.9bn (£1.5bn) from €2.56bn a year earlier, beating market expectations but signalling a downturn in the fortunes of its investments. CEO Michel Tilman said: “We are, of course, not immune to the challenging environment around us, and the sustained weakness across financial markets put pressure on earnings.”

He said lower real estate and private equity valuations, coupled with lower investment results, accounted for the majority of the profit decline.

ING said the impact of writedowns on risky assets, including subprime mortgages, was just €44m, although it also wrote down around €260m through shareholder equity.

The only division to report a rise in underlying profits was its online savings arm ING Direct, which saw profits rise 4.7 per cent to €179m.

The bank remains well leveraged, with €3.9bn of spare capacity, despite a €5bn share buyback and the payment of last year’s dividend in the second quarter. But it followed the trend in recent interim reports by predicting no imminent improvement in economic conditions.

“Financial services companies are facing unprecedented market volatility, limited liquidity, and intensified competition for deposits, which we see continuing into 2009,” ING said in a statement.