Inflation wipes out Christmas sales as Britain stumbles toward recession

Inflation is forcing Brits to rein in spending to shield their finances, prompting experts today to warn of a rise in high street bankruptcies as the country stumbles into a recession.

Retail sales fell in real terms over the Christmas period, when consumers tend to splash the cash on food, new clothes and decorations, according to two surveys out today.

While spending jumped 6.9 per cent over the year to December, the British Retail Consortium (BRC) and KPMG said today, accounting for inflation, real sales actually dropped.

Nominal spending climbed over three per cent in 2022 as a whole, again, lower than the year’s average inflation rate.

The Office for National Statistics (ONS) will release its December estimates for inflation on 18 January and most analysts think they will come in around 10 per cent, indicating real retail sales dropped around three per cent last month.

Separate data from Barclaycard, which covers £1 in every £3 spent in the UK, painted a similar picture.

The card provider said spending climbed 4.4 per cent annually in December, up from 3.9 per cent, but far behind the rate of price increases. The firm measures inflation using the CPIH index from the ONS, which topped nine per cent in November.

The ONS produces two main inflation readings: the consumer price index, which is the official measure, and the consumer prices index including owner occupiers’ housing costs.

The latter captures costs such as rents, while the former is more focused on day-to-day prices.

“Whilst the numbers for sales growth in December look healthy, with sales values up by nearly seven per cent on last year, this is largely due to goods costing more and masks the fact that the volume of goods that people are buying is significantly down on this time last year,” Paul Martin, UK head of retail at KPMG, said.

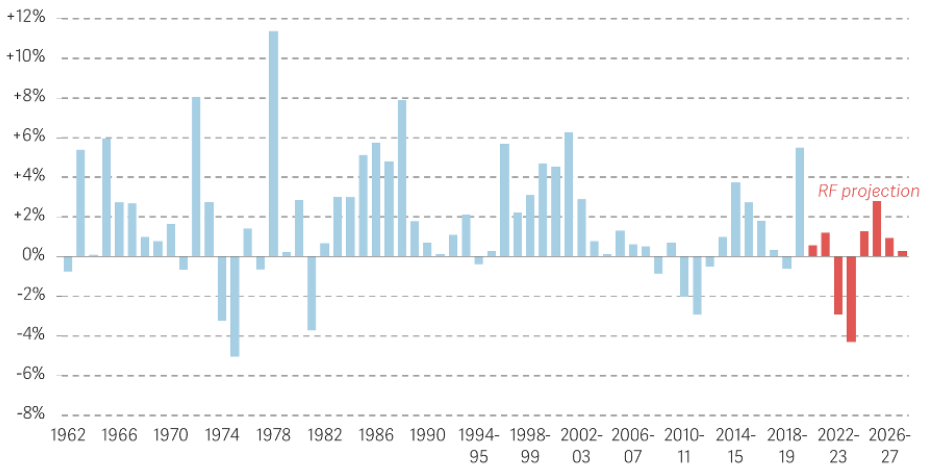

Spending power – measured by subtracting inflation from nominal income growth – is on course to drop more than £2,000 by the end of this year, according to the Resolution Foundation, mainly caused by energy bills remaining high, elevated mortgage rates and tax hikes.

Changes in real incomes over coming years

As a result, consumers are expected to retreat as their budgets are stretched by swelling essential bills.

Martin warned the spending slow down risks driving high street bankruptcies higher.

“With Christmas behind us, retailers are facing a challenging few months as consumers manage rising interest rates and energy prices by reducing their non-essential spending, and industrial action across a number of sectors could also impact sales.”

“The strong demand across certain categories that has protected some retailers will undoubtedly fall away so we can expect high street casualties as we head into the Spring,” he said.

Experts think Britain has entered an at least year-long recession sparked by the cost of living crisis.

New GDP figures out from ONS on Friday are forecast to reveal the economy contracted 0.3 per cent in November, meaning the country almost certainly met the technical recession definition of two consecutive quarters of contraction in the final months of 2022.

World Cup boosts pubs and bars

Pubs and bars received a sales bump as football fans headed to their local to watch England in the Qatar 2023 World Cup, Barclaycard said.

Travel spending also surged as Brits sought to shake off the winter blues by booking summer holidays.

Travel agents and airlines trousered a 87.3 per cent and 62.4 per cent respective spending increase.