Inflation tumbles faster than expected to its lowest level in over a year at 7.9 per cent

Inflation has slimmed to its lowest level in over a year and is falling faster than expected, raising the chances of the Bank of England hiking interest rates at a slower pace next month, official figures out today reveal.

The rate of price growth fell to 7.9 per cent in June, down from 8.7 per cent in May, according to the Office for National Statistics (ONS).

Markets expected the reading to fall to 8.2 per cent, while the Bank of England thought it would drop to 7.9 per cent. June’s figure was the lowest since March 2022 when inflation was seven per cent.

Last month’s figure also reverses a long trend of inflation topping the Bank’s and City analysts’ projections.

Pound sterling weakened 0.6 per cent against the US dollar and London’s FTSE 100 climbed more than one per cent on the news.

UK debt rates capsized, with the yield on the 2-year and 10-year gilt down 27 basis points and 19 basis points respectively. Yields and prices move inversely.

Bank Governor Andrew Bailey and co are still far away from reaching their target of bringing inflation down to two per cent, a goal they have not clinched since July 2021.

June’s inflation slow down was mainly driven by an unwinding in food and energy price increases, although both categories remain much more expensive compared to a year ago. Petrol prices slowed sharply.

UK inflation finally shows signs of easing

Groceries prices jumped 17.3 per cent, heaping pressure on poorer families who tend to spend a greater share of their income on basic goods, though that was down from an increase of over 18 per cent in May.

Core inflation – which removes volatile food and energy prices – remains hot, but is also falling quicker than projected, hitting 6.9 per cent last month, down from 7.1 per cent in May, which was the highest rate since 1992.

Services inflation – a measure the Bank of England examines closely to inform its interest rate decisions – is also very high compared to its long-term trend at 7.2 per cent.

Analysts cheered the batch of data as a signal that inflation in the UK may have finally turned a corner.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said this is a “watershed moment”.

“The headline rate of CPI inflation will continue to fall quickly” especially in July when the lower Ofgem energy price cap of just over £2,000 finds its way into the calculations, he added.

However, others cautioned not to read too much into one set of numbers.

“Core inflation has only eased slightly. The Bank of England will also be concerned that inflation in the services sector is proving relatively persistent,” Kitty Ussher, chief economist at the Institute of Directors, said.

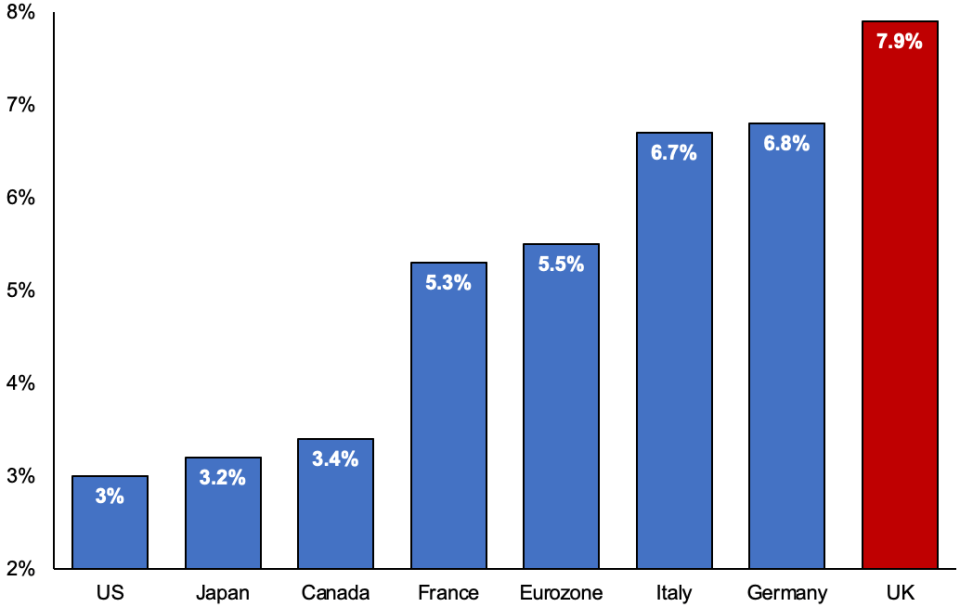

Britain still has the worst inflation in the G7 and is far ahead of the US’s rate of three per cent.

UK inflation is still highest in G7

Scorching core and services inflation indicates UK price pressures are now being controlled by domestic factors, like wage setting and corporate profit margins. Such dynamics typically require interest rate rises.

According to the ONS, wages are up 7.3 per cent over the last year, a joint record high, mainly due to private sector pay climbing 7.7 per cent. City workers have received the largest pay increases. Public sector pay growth has lagged behind.

Chancellor Jeremy Hunt said: “Inflation is falling and stands at its lowest level since last March; but we aren’t complacent.”

Economists have questioned whether he and Prime Minister Rishi Sunak will hit their promise of halving inflation to around five per cent by the end of the year. June’s quicker than expected drop makes meeting that goal more likely.

Although down, today’s inflation numbers are likely to be far too high for the Bank of England’s nine-strong monetary policy committee (MPC) to tolerate.

Traders before the release of today’s fresh data thought they would back a repeat of last month’s larger 50 basis point interest rate rise at their next meeting on 3 August. They also thought borrowing costs would peak at 6.25 per cent, but now think they will reach 5.75 per cent.

Interest rates have risen quickly

That would bring the UK’s official interest rate up to 5.5 per cent and be the 14th straight increase in a row, by far the Bank’s strictest tightening cycle since it gained independence in the 1990s.

However, a deceleration in price growth “could shift the dial to a 25 basis points rise to the Bank of England base rate in August, rather than 50 basis points,” Jake Finney, economist at PwC, said.

Analysts at BNP Paribas said strong core and services inflation “tile the balance in favour of another [bigger] move” of 50 basis points.

Dave Ramsden, a member of the MPC, tonight indicated he is minded to back another rate rise next month. “CPI inflation has begun to fall significantly but remains much too high,” he said.

Mortgage rates have soared over the last month due to a hotter than expected inflation print for May compelling investors to price in sharp rate increases from the Bank.

According to data firm Moneyfacts, the rate on the average 2-year mortgage is around 6.7 per cent, a 15 year high.

Traders scaling back bets on peak rates will, if sustained over the coming weeks, bring down home loan costs. Lenders price their mortgages on the overnight index swap rate, which compiles an average of traders’ expectations on interest rates over time.

Homeowners are tipped by experts to trim spending after they roll on to contracts with more punitive rates, prompting some to warn a recession may hit the UK.

The effect of the Bank’s previous 13 rate increases is taking longer than usual to spread through the economy due to a sharp reduction in people on floating rate mortgages since the 2008 financial crisis.

Around 4m property owners have been subjected to higher monthly mortgage repayments since the Bank’s first rate hike in December 2021. A further 4m are forecast to feel that pinch.