Inflation races to new 40-year high – but worst is yet to come

UK inflation raced to a fresh 40-year high last month, but economists have warned the cost of living squeeze is set to get even worse.

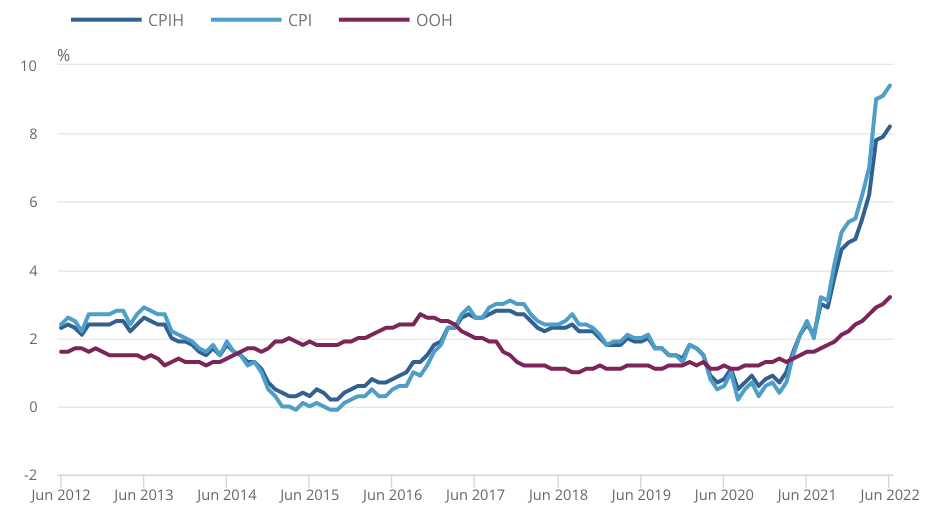

Prices surged 9.4 per cent over the year to June, the quickest acceleration since 1982 and up from an already historic level of 9.1 per cent in May, according to the Office for National Statistics (ONS).

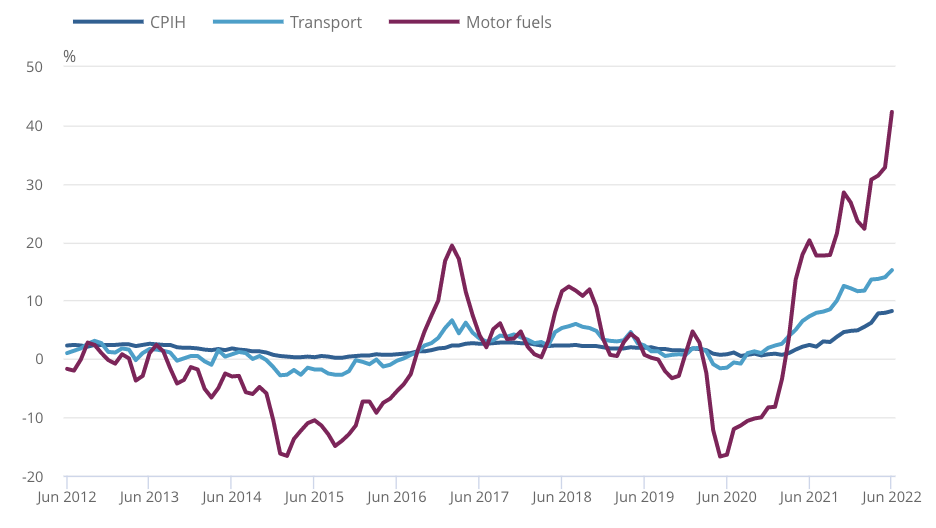

A more than three decade high jump in petrol prices, up over 42 per cent, drove June inflation above the City’s expectations.

The new figures nail on the biggest rate rise in the Bank of England’s 25 years of independence at its next meeting on 4 August, according to analysts.

“Given last night’s comments from governor [Andrew] Bailey… which firmly put a 50 [basis point] increase in bank rate on the table for the August meeting, we already have what looks like a big steer as to the forthcoming MPC decision,” RBC analysts said.

Bailey said at the annual Mansion House bankers’ dinner last night that a larger rate rise is “on the table” next month.

Threadneedle Street has never raised rates more than 25 basis points since it was handed control of UK monetary policy in 1997 by then Labour chancellor Gordan Brown.

“The overall strength of inflation… cement[s] the case for a 50 [basis point] hike,” Paul Hollingsworth, chief european economist at BNP Paribas Markets 360, said.

Mounting expectations of a historic rate hike have been sparked by economists forecasting inflation could surge to 12 per cent – six times the Bank’s two per cent target – in October when the energy watchdog could hike the cap on bills by as much as 65 per cent.

The gap between pay growth and price rises has widened to its largest level since 2001, indicating households, particularly the poorest who spend a greater proportion of their income on necessities, will struggle to shoulder a big surge in bills.

The government has launched an around £37bn cost of living support package, including payments worth around £1,200 to vulnerable households.

A large proportion of UK inflation has been caused by Russia’s invasion of Ukraine propelling European energy prices. Although Britain does not wholly rely on Moscow for oil and gas supplies, prices are influenced by the wholesale European energy market.

But, there are signs domestic inflationary pressures are firming. Services prices climbed 5.2 per cent over the last year, the biggest bump in 29 years, caused by firms passing on the return to the normal VAT rate and higher wages.

This type of inflation is “worrying” as it can “last longer,” Paul Dales, chief UK economist at Capital Economics, said.

Chancellor Nadhim Zahawi said: “Countries around the world are battling higher prices.”

The UK has the highest inflation rate in the G7. Prices are up 9.1 per cent in the US, the biggest rise in nearly 41 years, while in the Eurozone, inflation has never been higher since the euro was created in 1999.