Inflation forces one in three Brits to trade down to cheaper products

Brits are trading down to cheaper products in response to rampant inflation squeezing their finances, a survey published today shows.

A third of consumers are buying more own brand products, while one in four are turning to cheaper retailers in a bid to cap their weekly shop, according to consultancy KPMG.

The research illustrates the scale of pressure household finances are under as a result of rapidly rising prices.

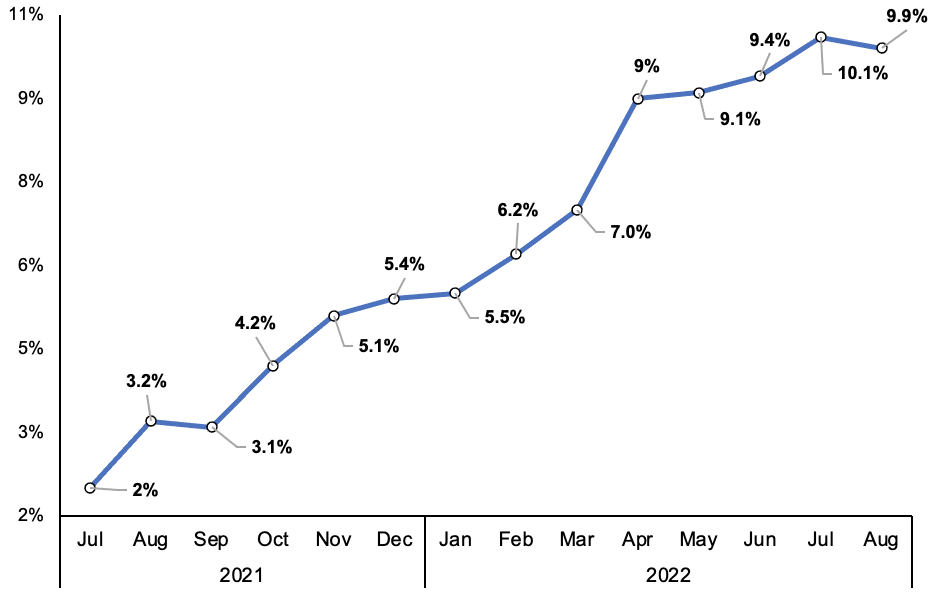

Inflation has climbed to 9.9 per cent, the highest level in around 40 years.

Annual UK CPI inflation

A large chunk of overall inflation has this year been driven by food prices accelerating quickly.

Food producers are being squeezed by swelling energy, transport and worker costs, forcing them to raise prices to shield margins.

Experts said the government’s decision to freeze domestic energy bills at £2,500 for two years and partially cover businesses’ energy costs will ease some pressure on Brits’ finances.

“Increased certainty regarding energy costs will provide some further confidence,” Linda Ellett, UK head of consumer markets, retail and leisure at KPMG, said.

“But unsurprisingly, in the face of rising costs, regardless of cutting back and searching out lower prices, some consumers are struggling to meet even essential costs. They feel less financially secure than when the year began and face a tough winter ahead,” she added.

Households are partly raiding savings built up during the Covid-19 crisis to maintain spending. On average, consumers that had savings at the start of 2022 have 43 per cent remaining, KPMG said.