Inflation falls to 2.5 per cent in boost for Chancellor Rachel Reeves

UK inflation came in below expectations in December, new figures show, easing the pressure on the Chancellor as she deals with a sell-off in the bond markets.

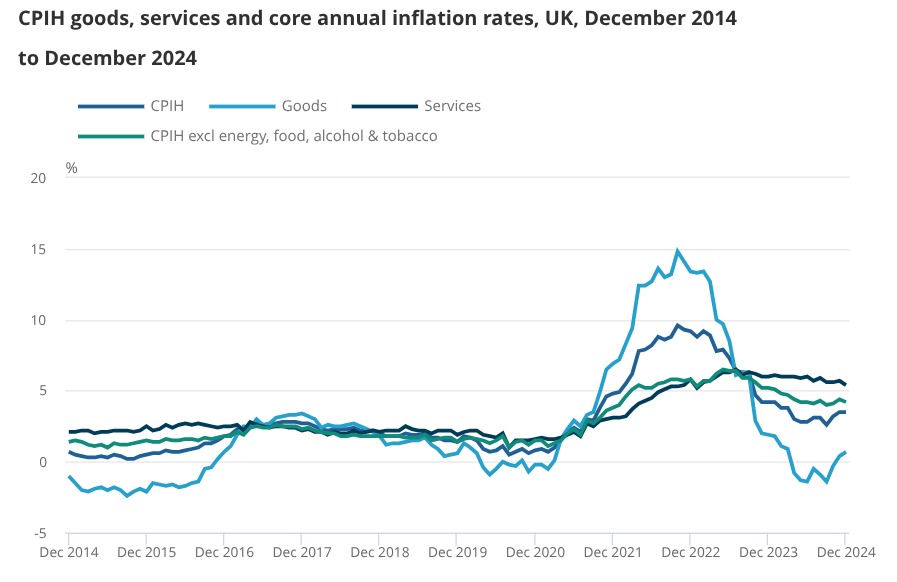

The headline rate of inflation fell to 2.5 per cent last month, according to figures from the Office for National Statistics (ONS).

This was down from 2.6 per cent the month before and slightly below economists’ expectations. City experts had expected the headline rate to remain unchanged.

Services inflation, a crucial gauge of homegrown inflationary pressure, fell to 4.4 per cent. This was down from 5.0 per cent previously and well below expectations of 4.8 per cent.

Core inflation, which strips out more volatile components like food and energy, dipped to 3.2 per cent, down from 3.5 per cent previously and also below expectations.

The fall in the headline rate was driven by lower hotel prices, which fell in December having increased the year before. Tobacco prices also increased at a slower pace than last year.

This was partially offset by the rising cost of fuel and higher prices for second-hand cars.

Gilt market jitters

The inflation figures will likely help to ease jitters in the gilt market, which has faced a major sell-off in recent weeks.

Yields on the 10-year and 30-year gilt hit their highest level in decades last week, partly due to fears that the government’s fiscal plans will push up inflation in the coming months.

Yields and prices move inversely. Higher yields represent the cost of government borrowing, meaning that the Treasury has to pay out more in order to attract investors towards UK debt.

Zara Nokes, global market analyst at JP Morgan Asset Management, said that a “sticky” inflation reading could have been a “catalyst for further volatility in the gilt market”.

The pressure in the gilt market has raised doubts about the government’s fiscal plans and even prompted calls for the Chancellor to resign.

Rachel Reeves’s fiscal plans

Economists estimate that the upward move in yields has wiped out the £10bn buffer Reeves left to meet her key fiscal rule in October. This rule forces Reeves to ensure that day-to-day spending – including the cost of servicing servicing debt – is funded through tax receipts.

But weaker price pressures suggest that the Bank of England might be able to cut interest rates at a slightly faster pace than markets expect, which would ease pressure on gilts.

Before the figures were released, markets anticipated the Bank would reduce rates just once this year, but traders now think two cuts are likely.

Ruth Gregory, deputy chief UK economist at Capital Economics, said the figures will “strengthen the case for a 25bps interest rate cut in February”.

The Bank of England cut rates twice last year, bringing the Bank Rate down to 4.75 per cent.

Still, a number of commentators warned that the Bank would continue to take a cautious approach, as concerns grow about inflationary risks in both the domestic and global economy.

A growing cadre of economists have projected that inflation could pick up to over three per cent this year due to higher energy prices and the impact of the government’s Budget.

“Inflation was already anticipated to accelerate in 2025 due to unfavourable base effects, but the policies announced in the October Budget have added fuel to the fire,” Nokes said.

Monica George Michail, associate economist at the National Institute for Economic and Social Research said, said that rates would remain “higher for longer” due to international factors.

“The upcoming Trump presidency has heightened global uncertainty and inflation expectations,” she pointed out.

Traders have dialled back bets on rate cuts from the Fed, with some economists predicting rates will be left on hold all year.

Responding to the figures this morning, Rachel Reeves said: “There is still work to be done to help families across the country with the cost of living”.