Inflation falling rapidly but not enough to avert 14th straight Bank of England rate rise, experts warn

Inflation is still hanging around in the UK economy due to businesses continuing to pass on higher wage bills, although there are signs price pressures have turned a corner, a closely watched survey out today reveals.

A reduction in energy and transport bills caused by international gas markets and supply chains repairing from a series of shocks is being cancelled out by elevated wage costs.

The claim from S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) latest purchasing managers’ index (PMI) for the UK services economy suggests the Bank of England may have to keep hiking interest rates.

Strong demand for workers among services firms – which include pubs, bars and restaurants – is being driven by optimism that the UK’s economic slowdown will be short lived.

S&P Global and the CIPS’ future activity index slimmed to 68.7, only slightly lower than its long term average, compelling services companies “to add to headcounts at a solid pace,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Businesses are still lifting prices, but at the slowest pace since August 2021 due to overall cost inflation dropping to its weakest level since May 2021.

“Price rises appear to be slowing, but not quickly enough to avert further rate hikes,” Tombs added.

Overall services activity is growing but at a slower pace, with the pair’s index slimming to 53.7 in June, down from 55.2 in May. The reading was above the 50 point growth threshold and in line with the City’s expectations and an initial estimate.

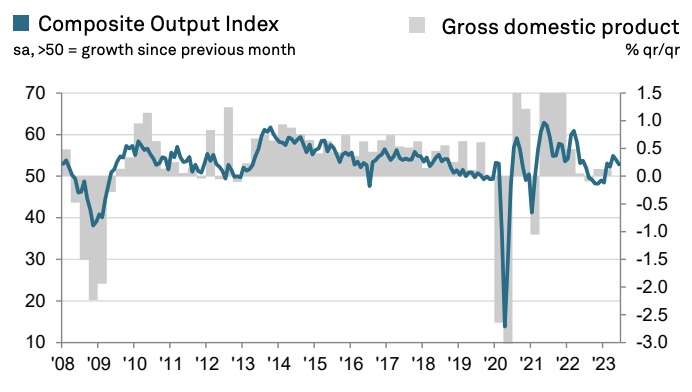

The composite PMI – which measures output in the UK’s entire private sector – fell to 52.8 from 54.

Expectations of strong growth to come is keeping pay elevated as companies try to outbid rivals by lifting wages to secure new talent.

“Despite another slowdown in service sector growth, the latest survey indicated that labour market conditions remained relatively strong. Job creation reached a nine month high as an improvement in candidate availability allowed firms to backfill vacancies and rebuild business capacity,” Tim Moore, economics director at S&P Global Market Intelligence, said.

UK growth is still in positive territory

According to official figures from the Office for National Statistics, wages are up more than seven per cent over the last year, the second quickest acceleration on record. However, over the long-term, pay in real terms has barely budged higher.

That has raised concerns that the UK’s inflation problem is becoming more resistant and led by domestic factors. Wages represent a large cost to services companies, partly causing them to lift prices. Services inflation topped seven per cent in May, a historic high.

Domestically generated inflation can be harder to eradicate than price surges that are engineered by external economic shocks, like the energy price shock caused by Russia’s invasion of Ukraine.

Workers’ and businesses’ expectations of future inflation can ratchet up in such a scenario, forcing each to demand higher pay and bump up prices respectively.

The Bank has lifted borrowing costs 13 times in a row to a near 15-year high of five per cent to prevent expectations from rising sharply. Financial markets think borrowing costs will peak at 6.25 per cent.

So far this year, Britain has avoided a much tipped recession. But experts think there’s a chance the economy could weaken sharply after around 2m homeowners switch onto a new mortgage with a much higher rate.

Data from Moneyfacts shows the average rate on 2-year and 5-year mortgages is over six per cent.