Exclusive: Industry body warns against more stringent windfall tax

Offshore Energies UK (OEUK) has warned against further changes to the windfall tax, which it fears would “undermine investor confidence,” and hamper an industry that will be “vital to the UK’s energy security for the years ahead.”

This follows media reports – first covered in The Sun – that the Government was considering potentially raising the rate of the Energy Profits Levy or scrapping planned investment relief to develop domestic energy projects.

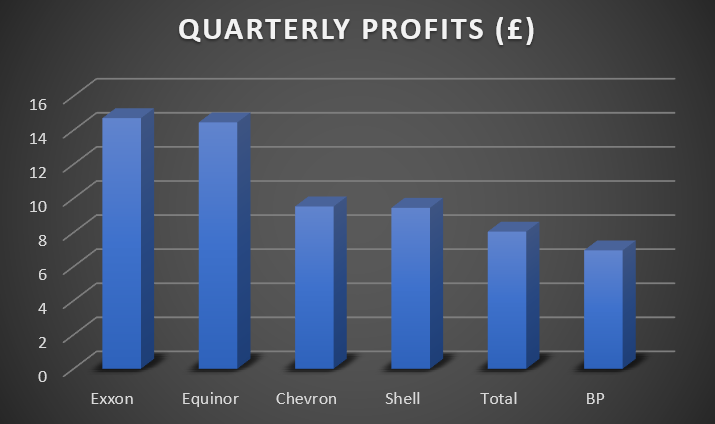

The Labour Party has ignited calls for the 91p relief rate to be removed after multiple energy firms including BP and Shell revealed bumper second quarter profits amid soaring oil and gas prices.

However, OEUK argued that further costs imposed on the North Sea oil and gas sector jeopardised plans to invest in gas and oil projects, which would help ensure secure supplies and reduce the UK’s reliance on overseas vendors.

A spokesperson told City A.M.: “The current media and political focus is on short-term profits but this industry will be vital to the UK’s energy security for years ahead. It needs to be managed and supported for the long-term.”

The Energy Profits Levy is a 25 per cent tax on oil and gas operators producing supplies from the UK Continental Shelf.

This is on top of the 40 per cent special rate they already pay – meaning energy firms working offshore pay a combined tax rate of 65 per cent – the highest faced by any business sector.

Former Chancellor Rishi Sunak brought in the tax to help fund his £15bn support package for households.

The Treasury estimated, at the time, it would provide £5bn of funding towards the relief scheme.

Investment relief key to ramping up projects

Francesca Bell, OEUK’s senior investor relations manager, recognised surging energy bills meant an exceptionally tough year for consumers, meaning that help for households was vital.

However, she argued that help through sudden new taxes risked long-term damage to the UK’s businesses and could undermine its energy security.

She said: “Exploring for oil and gas and then bringing it to shore is inherently a risky and very expensive business so our members need the UK’s fiscal rules and other regulations to be stable and predictable before they consider investing the hundreds of millions of pounds needed for such projects.”

The investment manager also argued that energy prices are being driven by global factors beyond their control.

Instead, she believed the focus should be on how the UK production sector can support energy security and contribute to the economy.

In the short-term, this meant investment in oil and gas, which is responsible for around 75 per cent of the country’s energy consumption.

Bell said: “What’s clear is that if we do not invest in the UK’s oil and gas resources then, by 2030, the UK would be reliant on other countries for at least 80 per cent of our gas and 70 per cent of our oil.”

Shell, one of the leading operators in the North Sea, has committed to investing £25bn in the UK energy system over the current decade – including 75 per cent in low carbon energy.

This includes investing in the Pierce and Jackdaw fields and bringing in cargoes of liquefied natural gas through the Dragon LNG terminal.

When approached for comment, a Shell spokesperson said: “We understand the worry for millions of people about how high energy costs are challenging their household budgets – and the need for support to help make ends meet, and we will work with the government on potential solutions.

Speaking about further changes to the windfall tax, they added: “But as we have said before, stable tax and policy frameworks are necessary to provide certainty for companies to invest. Creating additional uncertainty through further changes to the North Sea fiscal regime is not an outcome we would like to see.”

Thinks tanks raise concerns over windfall tax

Two of the UK’s leading economic think tanks have also warned against toughening the Energy Profits Levy by either raising rates or removing investment relief from the tax for companies developing domestic projects.

Andy Mayer, energy analyst at the Institute of Economic Affairs, argued that windfall taxes are “rarely wise” and are usually justified to correct gain from policy error rather than pure market fortune.

He told City A.M.: “They discourage investment, doubly so if investment relief is removed. A folly when the issue is shortage of energy supply.”

Instead of targeting North Sea oil and gas, he argued there was much more of a case for imposing levies on “old renewables” – long standing generators that gain both gas power prices and a subsidy – yielding 100 per cent plus margins.

The Energy Profits Levy currently does not apply to oil and gas produced in other countries and sold in the UK.

It also does not apply to the energy utilities which distribute energy to consumers.

Nor does it apply to companies producing electricity from offshore wind farms or other forms of low-carbon generation.

Mayer concluded: “This could be ‘windfall’ corrected, suspending the subsidy, and possibly capping market returns closer to levels in the new renewables scheme.”

John MacDonald, director of strategy at the Adam Smith Institute, warned that “hiking up a supposedly ‘one-off’ windfall tax” just months after it was introduced would add “to business uncertainty at a critical time for the UK economy.”

It also would not “help households being slammed with rapidly rising bills.”

Commenting on speculation over the price cap, he argued the Government was scrambling for ways to shift the blame away from decades of failed energy policy – pointing to the price cap and stifled investment in nuclear power.

He concluded: “There is a reasonable discussion to be had about raising the headline rate of tax energy companies pay if the Treasury is looking to raise revenue. But this must also be paired with significant write-offs for investment. This would avoid the uncertainty of windfall taxes and maintain the incentive for companies to continue investing. Unfortunately, this doesn’t seem to be the discussion the Government is having. “