‘Incredible undervaluations’: Why this boss thinks the time is right to float on AIM

A new acquisition vehicle announced plans to float on AIM last week despite a barrage of warnings over its future ahead of the budget. Its boss, Iain McDonald, tells City AM why.

In a letter to the City minister, Tulip Siddiq, last month, the boss of the London Stock Exchange had some stark words on the future of her junior stock market, AIM.

Rumoured changes to an inheritance tax break on AIM shares would, Julia Hoggett said, remove a “core source of capital” and bring the exchange’s “viability into question over the short to medium term”.

In the days following, some 120 AIM-listed companies sounded the alarm, while FTSE 250 money manager Abrdn, the Quoted Companies Alliance, and think tank New Financial warned the future of London’s small-cap market could be in jeopardy if the changes go ahead.

Shares on AIM currently enjoy a break from inheritance tax if they have been held for at least two years. However, the Chancellor, Rachel Reeves, has been urged to remove the relief in her Autumn Budget in a move that could raise around £1.2bn for the Treasury’s coffers.

According to City broker Peel Hunt, these changes could have a devastating impact on the market.

The broker has estimated some stocks could lose as much as 30 per cent of their value if the changes go ahead. It’s also estimated that 15 per cent of the total capital that makes up the market could be sucked out.

It might seem a strange time to be eyeing up AIM as a home for the longer term. But Iain McDonald, who announced plans to float a new acquisition vehicle, Selkirk, on the market last week, insists it’s ripe with undervalued opportunity.

“The reality is that for all the negativity about AIM, the best and most flexible way of [listing] on the UK market is on AIM,” McDonald, who will serve as executive chairman, tells City AM.

“It’s easier to get things up and running quickly; there is still a good depth of capital out there, and there are some fantastic institutional investors who’ve been at this for a long, long time and understand a good company when they see one.

“So actually, I don’t think this would work unless we were doing it on AIM actually.”

McDonald’s comments are a far cry from the gloom that has gripped AIM well beyond just the Budget speculation of the past few weeks.

At its peak in 2007, 1,694 firms were listed on AIM. That number has now cratered to just over 700 and only ten new firms floated on the market last year.

The AIM all share index is trading down from where it was in the 90s and about 74 per cent down from a peak in 2000.

However, as the more optimistic City fund managers like to say, it’s a stock picker’s market. A slide in the performance of an all-share index risks shrouding the fact there are still diamonds in the rough.

McDonald’s reason for listing Selkirk on AIM follows a similar logic: build a good company, and the investors will come.

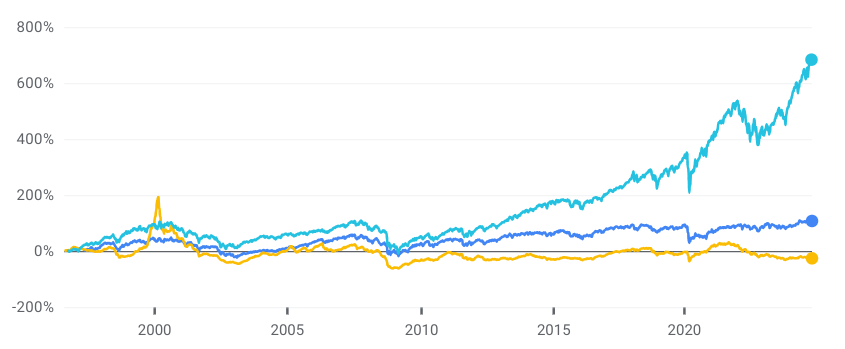

The S&P 500 (light blue) has left the FTSE All Share (dark blue) and AIM All Share index (yellow) in the dust

Why investors are still looking at AIM

The single-purpose acquisition vehicle is looking to strike a deal for a firm in the e-commerce and consumer sector with a value between £30m and £1bn.

While it will be bolstered by a £7.5m initial raise, a group of heavyweight investors, including McDonald’s investment outfit Belerion and the activist investor Kelso, will provide the bulk of the firepower for a deal.

Selkirk is in the early stages of identifying a target, but a downturn in value across the public and private markets is making it an excellent time to be a buyer, he says.

“I’m looking at the UK markets and also UK private companies, day in, day out. And I’m aware of what I consider to be incredible undervaluations of really good businesses,” he says.

“This is going to be a focused investment. We think there are tons and tons of opportunities out there, and we’ll be looking at lots of them once we raise our first pool of capital.”

Selkirk is bolstered by the fact it is “starting with a blank sheet of paper” rather than a historic shareholder base at risk of fleeing in the event of a raid from Reeves.

However, McDonald is still troubled by the prospect of a punitive series of revenue raisers from the Chancellor at her budget on 30 October. More damaging still, he says, is the fact that no one knows what she’ll.

Budget vacuum

The government has waited over 100 days since taking power to reveal its fiscal plans, and fear and speculation have filled the vacuum of concrete policy.

Reports that ministers could whack capital gains tax as high as 39 per cent, since dismissed by Starmer, and cut reliefs on business asset disposal relief, which reduce the capital gains rate for entrepreneurs selling up, have eroded optimism, says McDonald.

“There’s one thing that ultimately destroys business, and that’s uncertainty,” he adds. “I think everybody acknowledges and understands that we’ve all got to pay our tax. And I for one, have paid a ton of it, but on the other hand, it’s really difficult to operate when there could be some really material tax changes around the corner.”

The Treasury won’t be drawn on rumours and says businesses will have to wait until the end of the month to know the lay of the land.

McDonald insists he has no plans to pull back from the AIM listing even if Reeves does press on with her much-feared scrapping of AIM inheritance tax relief. But in terms of its impact on the wider market, he’s clear.

“If you abolish that, it’s going to go backwards,” he adds.