Impersonation frauds soar 85 per cent during pandemic as scammers exploit government loan websites

Impersonation frauds almost doubled during the pandemic, as scammers scooped up around £208m from fake government loan forms, phishing emails and bogus websites.

More than 15,000 impersonation scams were reported in the first half of 2020, marking an 84 per cent increase compared to the same period last year, according to a report released today by banking sector trade body UK Finance.

UK Finance said the sharp hike “has been driven by criminals exploiting Covid-19”, with fraudsters pretending to be officials from trusted organisations including banks, utility companies, government departments and even fraud prevention agencies.

Covid cons

Criminals became more savvy online during the pandemic, taking advantage of Covid-related government loan websites including the furlough scheme and emergency business support schemes to groom customers into handing over their details.

“Criminals are constantly adapting the methods used to try and trick consumers into handing over their money or personal information,” said the report.

“Since the pandemic began, we have seen how quickly they have adapted to and exploited Covid-19 with a growth in fraud and scams that target people online.”

This month, HM Revenue & Customs (HMRC) set up a website issuing urgent advice on how to spot coronavirus scams as fraudsters rapidly adapt to new government advice.

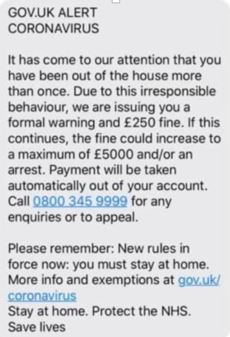

Scams listed by HMRC included fake tax rebate links and text messages issuing fake £250 fines for breaking quarantine rules.

Fraudsters also jumped on lockdown trends to scoop up cash from fake hot tub adverts, dating profiles and airlines offering refunds for cancelled flights during the pandemic, according to the UK Finance report.

UK Finance said fraudulent sales of pet supplies, PPE equipment and home testing kits boomed in the first half of the year, as customers sought alternative suppliers after stockpilers hoarded available kit.

Investment scams rocketed nine per cent during lockdown, with criminals raking in £55.2m by duping investors into handing over money on cloned websites impersonating FCA-regulated firms.

Authorised payments

The bulk of scams that took place during the pandemic were made through authorised push payment (APP) fraud, in which customers unwittingly authorise payments to fraudsters by submitting an online form or entering their details over the phone.

Almost £208m was stolen from UK bank accounts in the six months to June through APP fraud.

A new voluntary code on APP fraud introduced in May last year meant fraud victims saw more of their stolen cash reimbursed during the pandemic, with £71.3m of APP losses returned to customers in the first half of 2020.

Meanwhile, losses from unauthorised card transactions sank eight per cent to £288.2m during the coronavirus crisis compared to the same period last year.

UK Finance said the drop was likely due to scammers abandoning traditional fraud methods to exploit new vulnerabilities created by the pandemic, with customers handing over personal account details on an unprecedented level.

The banking and finance industry prevented £853m of attempted unauthorised fraud in the first half of 2020, meaning around £6.95 in every £10 of attempted fraud was blocked.

However, UK Finance warned that there is often a significant lag time between criminals obtaining people’s details and using them to commit fraud, meaning the full scope of Covid-related scams is likely to be much higher than current figures.

New regulatory framework

Measures currently in place to tackle fraud in the UK include collaboration with mobile providers to block scam text messages, and the implementation of “Confirmation of Payee” functions on banking apps, which help prevent APP scams.

The new banking measure has now been implemented by the UK’s six largest banking groups, covering around 90 per cent of bank transfers.

However, the trade body urged the government to introduce a “new regulatory framework” to adapt to the rapid rise in online scams.

“The finance industry is working hard to tackle fraud but it is vital that government, regulators, and other sectors

continue to step up and play their part in detecting and preventing this criminal activity,” said Katy Worobec, managing director of economic crime at UK Finance.

“In particular, vulnerabilities exploited by fraudsters which are outside the control of the banking industry need to be addressed.”

Worobec said she expected criminals will “continue to adapt and exploit the impact of coronavirus as we move onto the next stage in this crisis”.

“This could include more social engineering scams exploiting people’s financial insecurities by offering

payments related to the pandemic, purchase scams offering bogus products… and social media posts aimed at recruiting money mules who are looking to make quick and easy money,” she said.

“The banking and finance industry will keep taking action on every front to protect customers from this threat, while calling for a stronger regulatory framework that ensures online platforms and other sectors play their part in tackling fraud.”

Before the Open: Get the jump on the markets with our early morning newsletter