Imperial sells out to Indian rival for £1bn

Oil explorer Imperial Energy recommended a £1.4bn takeover offer from Indian state-controlled rival ONGC yesterday.

A bid battle had broken out between ONGC and China’s biggest state-owned oil company, Sinopec, which conducted due diligence on the London-listed firm but has not yet submitted a formal offer.

But a counterbid from the Chinese firm cannot be ruled out.

Sinopec chairman Su Shulin said: “A unit of the Sinopec Group is conducting an internal assessment, but no decision has been made.”

Imperial, which operates in western Siberia, and ONGC said in a joint statement yesterday that they had agreed a pre-conditional cash offer of £12.50 a share.

Peter Levine, the founder and chairman of Imperial, stands to make £90m from his 6.1 per cent stake and share options.

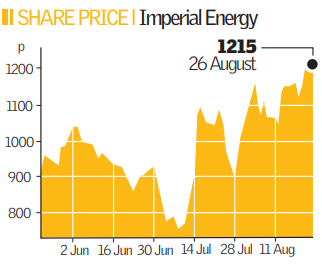

Levine said the offer reflected a “fair value” and was a premium of 62 per cent on Imperial’s share price the day before it revealed it had received an approach.

Imperial has been in talks with ONGC since July, when the two companies were discussing a bid at £12.90 a share. Since then, the price of oil has fallen by around $20 a barrel, reducing the value of Imperial’s reserves of 920m barrels of oil.

Analysts at Daniel Stewart said: “This is a good price, given consideration for the current softening in oil prices, the turbulence on global stock markets and the geopolitical stage.”