Imperial Brands: Profits up a quarter as price rises and vaping offset smoking decline

Tobacco giant Imperial Brands’ profits were up 26.8 per cent for the year, as “strong pricing” for its products helped offset the continued decline in smoking.

Stefan Bomhard, chief executive, said the “stronger, more sustainable” financial and operational outcomes can be attributed to a “new performance culture.”

The brand behind Lambert & Butler, Winston and Gauloises anticipated delivering its full-year guidance just last month due to high prices of cigarettes and demand for tobacco alternatives.

The cigarette company, which also makes Golden Virginia tobacco, said that strong pricing led by the rising costs helped offset historic declines led by fewer people smoking.

Bomhard said: “In combustible tobacco, improving brand equity and investment in our salesforce capabilities has led to the third consecutive year of stable or growing aggregate market share in the five priority markets which account for 70 per cent of our operating profit.

“At the same time, we have offset structural volume declines with strong pricing in all key markets.”

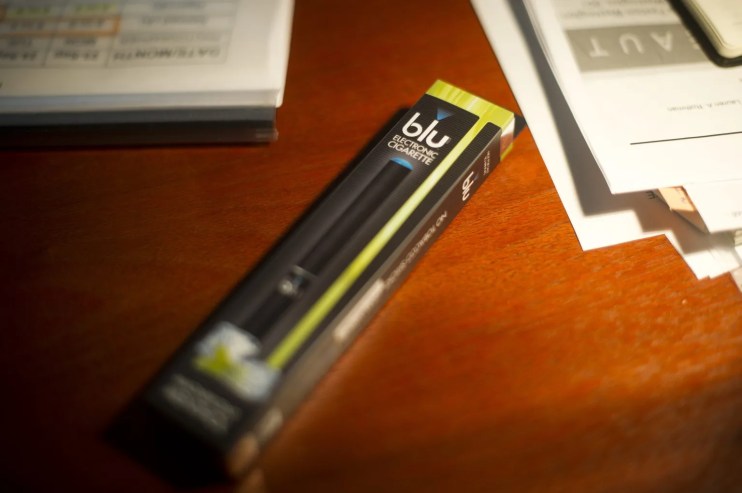

Recent launches have allowed the company to offer “potentially reduced-harm” options in more than 20 European Markets and the US, which has positively affected net revenue growth, Bomhard said.

He added: “Looking ahead, we expect the continuing benefits of our transformation to enable a further acceleration in our adjusted operating profit growth in the final two years of our five-year strategy.

“We look forward to building on our growing operational track record to deliver sustainable returns to shareholders and play a positive, distinctive role in this industry’s transition to a healthier future.”

It has also announced last month a £1.1bn share buyback for 2024 on the heels of a £1bn buyback this year.

Like other big tobacco companies, Imperial Brands has focused on rolling out smoking alternatives in recent years.

Chris Beckett, head of equity research at Quilter Chevio, said: “Ultimately, for those investors without any ethical criteria, this cashflow generation and high shareholder returns remain the primary reason to hold the stock.

“Imperial is not as well placed in the transition to e-cigarettes or heated tobacco as Philip Morris or BAT. Indeed, while revenues in next generation products grew 26%, they remain immaterial to the total group.”