Imperial Brands: Profit up on back of ‘next generation’ tobacco alternatives

Cigarette maker Imperial Brands reported a 27 per cent spike in operating profit on last year, while its foray into vaping and e-cigarettes also proved lucrative.

The London-listed firm said it made £1.53bn operating profit in the six months ended 31 March, with revenue for its ‘next generation products’ offering an alternative to tobacco up by a fifth.

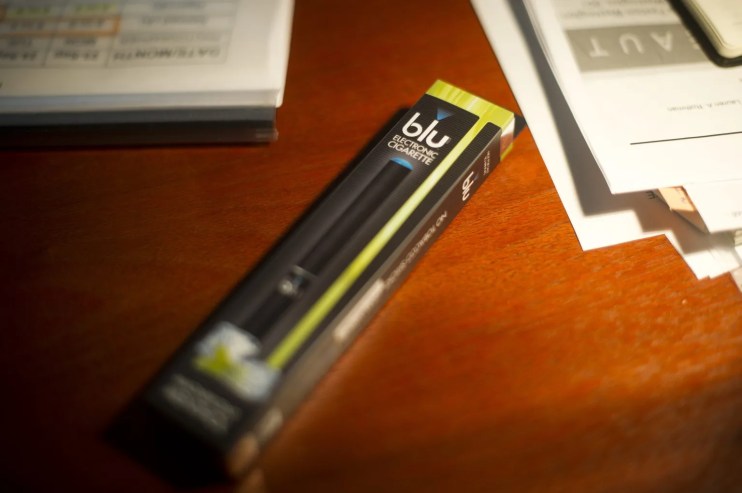

The results will help to convince investors its vaping and so-called ‘next generation products’ such as blu can light up profits in the long-term.

Imperial Brands did however say its volumes continued to be impacted by both the pandemic and exit from Russia last year, as well as investment in NGP.

Its share price was down 1 per cent after the open.

This comes after chief of the FTSE 100 firm, Stefan Bomhard, struck out on a five year plan in 2021 to try and ensure its long-term profits don’t go up in smoke, with a re-set in its ‘next generation products’ (NGPs) and a focus on five key markets for tobacco central to the plans.

He said after profits went up 27.7 per cent this morning, that “we are now in the third year of our five-year strategy, and this means we are moving from the initial foundation-building phase to a period of improving financial delivery.

“We remain strongly committed to an ongoing programme of shareholder returns and will complete our initial £1 billion buyback during the second half.”

“Business performance for the first half of fiscal year 2023 was resilient, despite temporarily increased volume declines against a strong comparator.

“As expected, this reflects a return to pre-COVID buying patterns as well as our decision to exit Russia last year.”

He added that the results were “underpinned by targeted investments” including the opening of “a new innovation facility in Liverpool, which brings together consumers, product developers and third-party partners in a single collaborative space.”

Analysts said the results were a reminder of the attractiveness of the tobacco industry, and prospects for investment in new products like e-cigarettes.

Chris Beckett, head of equity research at Quilter Cheviot say they “are a good reminder, for those without ethical investment considerations, of the attractions of a tobacco stock – low valuation, strong cash flow, a high dividend yield and share buybacks.”

He added that “while the traditional cigarette market is in decline, Imperial has taken advantage of rising prices to grow that business’ market share over the last six months

“Its next generation products, …it will be looking to increase this over time as more and more people shift to less harmful products.

Meanwhile, Roberto Rivero, market analyst at Admirals said “shareholders are likely to be particularly pleased with the continued revenue growth emanating from new generation products”.

“Although, like most tobacco companies, Imperial’s NGP division is yet to turn a profit, revenue growth of almost 20 per cent suggests it is moving in the right direction.”