Imperial Brands issues profit warning amid vaping crackdown

UK tobacco giant Imperial Brands has warned that its first half earnings per share and full-year profit are likely to fall amid a global crackdown on e-cigarettes.

Shares tumbled 9.5 per cent following today’s announcement, hitting 1,768p.

In a trading statement, Imperial said the US’s ban on certain flavours of vapour devices or vapes, which comes into force tomorrow, has resulted in a writedown of its stocks at a cost to full-year profit of about £45m.

It added that the first-half hit to earnings per share would be around 10 per cent.

The British firm also said “regulatory uncertainty” and negative news stories about vaping are set to dent profit by around £40m.

Regulators around the world have cracked down on vaping products, which health officials have linked to deaths – although far fewer than from smoking.

The US has been particularly vociferous, with the Food and Drug Administration (FDA) banning some flavours of vape in a bid to limit their appeal to younger audiences.

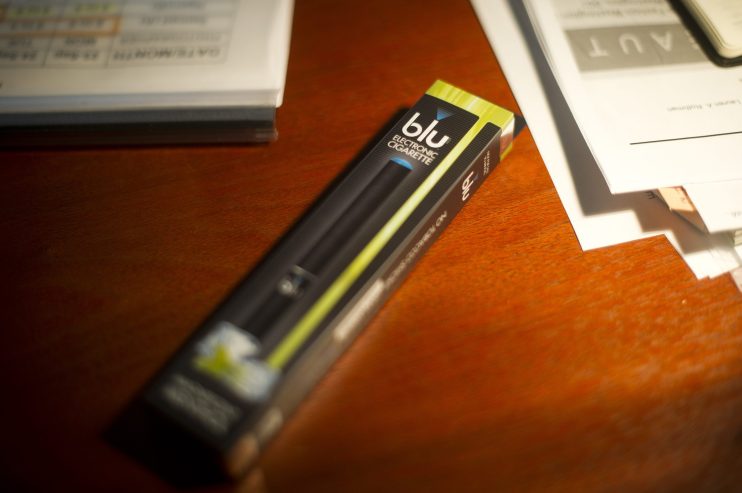

Tobacco firms such as Imperial have branched out into vaping in a major way. Imperial owns the Blu brand of e-cigarettes. Yet the firm now faces new challenges from regulators.

Imperial’s warning on revenue came just two days after it named Stefan Bomhard, the boss of car dealership Inchcape, as its new chief executive.

Bomhard will replace Alison Cooper, whose departure was announced in October and who today stepped down with immediate effect.

The new chief executive’s main task will be to boost profits following weak full-year results amid “tough trading”, particularly in its vaping arm.

The results, released in November, followed a profit warning in September that led to Cooper stepping down after 20 years with the tobacco giant, nine of those in the top job.

Russ Mould, AJ Bell investment director, said today’s trading update was a “messy” one after boss Alison Cooper’s departure last year.

“The company’s forecast of a 10 per cent slide in the first half puts ever greater emphasis on the second six months of Imperial’s financial year to September and increases the risk of earnings disappointment,” he added.

Sign up to City A.M.’s Midday Update newsletter, delivered to your inbox every lunchtime

Today’s warning came ahead of Bomhard’s arrival at the tobacco giant, which faces a slew of pressure from shareholders and regulators.

The regulatory crackdown led former chief executive Cooper to abandon plans to grow Imperial’s dividend by 10 per cent a year before she said she would quit last October.

Imperial only announced her successor two days ago. Bomhard will be charged with delivering the tobacco firm’s new strategy to build a tighter business model and focus on growth markets.

“Dangers still abound,” Mould added. “Strong fund flows … away from names that are seen to be less ethical could mean Imperial Brands’ shares keep falling. Regulatory pressure remains intense, and price increases may not be enough to compensate if stick volumes fall at a high-single-digit percentage rate.”