Imperial Brands: Investors brace to see if cigarette titan can light up vaping future

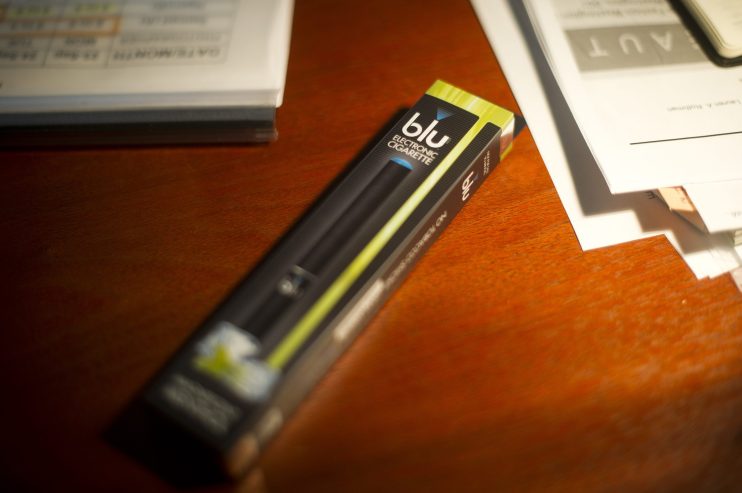

Imperial Brands will be looking to convince investors its vaping and so-called ‘next generation products’ can light up profits in the long-term as it updates the City with its first half results on Tuesday.

Like its competitors, the tobacco giant is grappling with a downturn in traditional tobacco sales and a pivot from consumers to vaping.

The chief of the FTSE 100 firm, Stefan Bomhard, struck out on a five year plan in 2021 to try and ensure its long-term profits don’t go up in smoke, with a re-set in its ‘next generation products’ (NGPs) and a focus on five key markets for tobacco central to the plans.

Last year, Imperial Brands compensated for a 4.8 per cent drop in its so-called stick equivalent, or traditional tobacco products, with a six per cent increase in prices.

Analysts are pricing in a further 5.6 per cent drop in traditional tobacco product volumes this year to 209m, including the loss of seven billion stick equivalents after the withdrawal from Russia, meaning analysts will be keenly watching Tuesday’s numbers as a benchmark for the months ahead.

Total pre-tax profits for the full year to September 2023 are expected to come in at £3.56bn, according to analysts’s consensus figures, with NGPs expected to contribute £247m of total £8.13bn across its products.

Analysts at AJ Bell said investors that are still open to investing in tobacco firms would be looking at the numbers to suss out the long term viability of the industry in the context of a regulatory clampdown and health concerns.

“Even those investors who do not run strict ESG screens must continue to ponder the long-term future for smoking in the wake of a respiratory virus pandemic; the ongoing regulatory pushback against the industry; and Imperial’s own efforts to adapt to the possibility of a brave new world by developing its next-generation products,” said Russ Mould and Danni Hewson, AJ Bell analysts in a note.

“Imperial continues to look to market share gains, price increases and changes in sales mix to offset the ongoing decline in global stick-equivalent (SE) volumes,” they added.

Mould and Hewson said the first-half results would be viewed in the context of Bomhard’s long-term plans but also against the full-year guidance given in September, which included a jump in group revenues and profits on a constant currency basis and an increase in sales from next generation products for the full year.

Bomhard has also pledged broadly flat first-half profits on a constant currency basis, a 6.5 per cent benefit to first-half earnings from currency movements and the completion of a £1bn share buyback.