IMF ditches UK recession call and lifts GDP growth from bottom of G7

The International Monetary Fund (IMF) today joined the Office for Budget Responsibility and Bank of England in admitting they were wrong to forecast the UK will suffer a tough recession this year.

The globe’s lender of last resort in fresh forecasts hiked its gross domestic product expectations in 2023 to 0.4 per cent.

It previously said just last month that Britain’s economy would shrink 0.3 per cent this year, which would have put the country at the bottom of the G7 growth table.

Since January, the IMF now raised its UK output forecasts twice, sparking criticism that it has been too pessimistic on the UK’s economic fortunes.

Expansion is poised to bump up to one per cent next year, driven by families lifting spending in response to their finances strengthening as a result of softening inflation.

An average of two per cent growth in 2025 and 2026 is pencilled in by the IMF, “mainly on the back of a projected easing in monetary and financial conditions,” the organisation said in its latest assessment of the UK economy.

The Fund characterised that growth outlook as “subdued”.

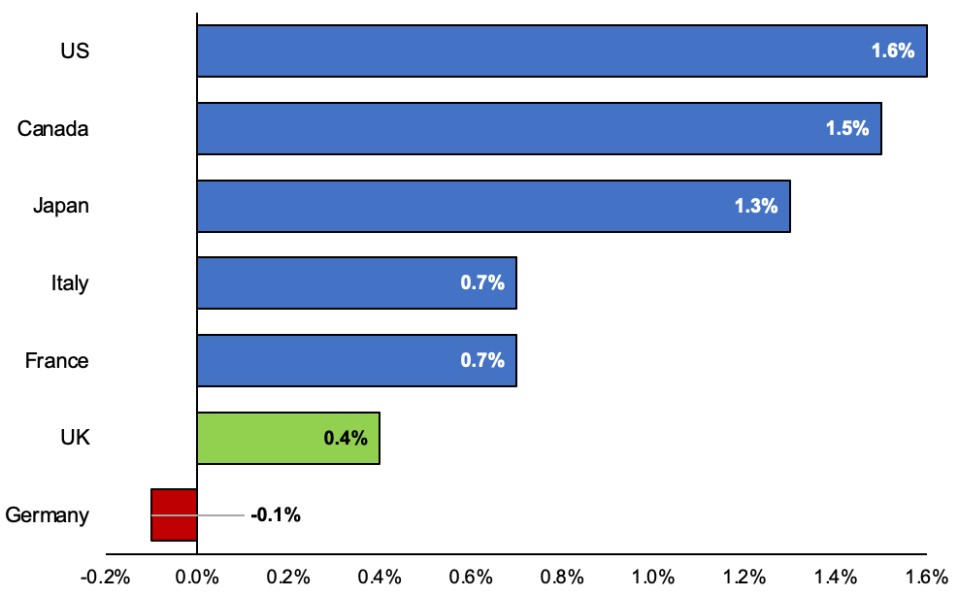

The new projections mean Germany is now tipped to be the weakest economy in the group of rich nations in 2023.

But there are “significant risks to this outlook,” Kristalina Georgieva, the IMF’s chief told reporters, mainly due to uncertainty over how long high inflation will stick around.

IMF experts said they don’t expect headline inflation to return to the Bank of England’s two per cent target until the middle of 2025, six months longer than they previously expected in April. Core inflation risks staying higher, the forecasts warned.

As a result, Bank Governor Andrew Bailey and the rest of the monetary policy committee may have to keep interest rates “higher for longer,” Georgieva added. They have already lifted borrowing costs twelve times in a row to a near 15-year high of 4.5 per cent.

IMF G7 2023 GDP growth projections

Speculation that Chancellor Jeremy Hunt could offer up tax cuts to win over voters in the run up to the next election – which has to be held before January 2025 – has gathered pace of late.

Borrowing last year come in lower than the Office for Budget Responsibility projected in March, opening up around a £15bn kitty for Hunt, though some of that is likely to be eroded by higher debt interest spending.

The IMF praised Hunt’s decision to rebalance the public finances at the November autumn statement and March budget, calculating it will slim the deficit by three per cent of GDP over the next five years.

Georgieva stressed that the Bank of England and government need to continue to partner on taming inflation by not cutting rates too soon or launching tax cuts or spending rises prematurely.

Such a loosening in economic policy can only happen “when it is affordable,” she said, adding the tighter stance could have to be employed for “quite some time” to stave off inflation.

New numbers from the Office for National Statistics tomorrow are expected to show inflation fell to its lowest level in over a year in April to 8.2 per cent, down from 10.1 per cent. Core inflation is tipped to fall only marginally from around six per cent.

A shallower than expected reduction in household spending due to collapsing energy prices and the government stepping up cost of living support means “the UK economy is expected to avoid a recession and maintain positive growth in 2023,” the forecasts said.

Chancellor Jeremy Hunt welcomed the GDP bump.

He said: “Today’s IMF report shows a big upgrade to the UK’s growth forecast and credits our action to restore stability and tame inflation.”

“It praises our childcare reforms, the Windsor Framework and business investment incentives. If we stick to the plan, the IMF confirm our long-term growth prospects are stronger than in Germany, France and Italy – but the job is not done yet,” he added.