IEA urges OPEC+ to boost oil production amid market rallies

The head of the International Energy Agency (IEA) Fatih Birol has called on OPEC and its allies such as Russia (known as OPEC+) to boost production to meet agreed output targets.

Birol said: “There is a significant difference between the targets that OPEC+ countries set in terms of their production levels, and what is produced today It will be important for OPEC+ to narrow this gap and hopefully provide more volumes to the market.”

This follows continued calls from the White House to boost production and ease market rallies, with President Joe Biden facing key mid-term elections later this year amid an escalating cost-of-living crisis.

OPEC+ producers have raised output targets to 400,000 barrels per day (bpd) each month since August, as key producers unwind production curbs.

However, the group has repeatedly failed to hit those targets as some producers struggle to restore output.

Despite the setbacks, it has maintained the output targets and forecasts rising demand over the course of the year.

The IEA in its last monthly report said the gap between the target and output in January had widened to 900,000 barrels per day.

Supply shortages drive price rallies

This has exacerbated concerns over supplies, driving oil rallies on both major benchmarks as demand rebounds from the pandemic.

Prices have rebounded despite easing concerns over conflict in Ukraine, with Russia announcing a partial pull-back of troops.

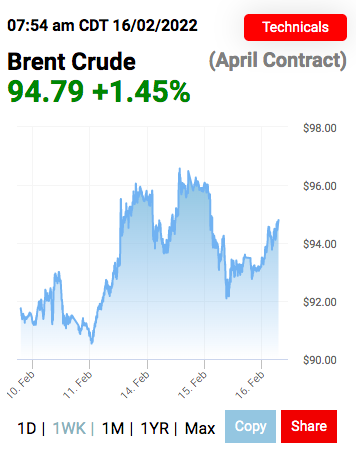

Brent Crude has risen 1.48 per cent to $94.66, near the seven-year-high it recorded earlier this week after nearly two months of weekly gains.

WTI Crude has also enjoyed a 1.36 per cent bounce to $93.32.

Markets slumped amid yesterday profit taking and reports of reduced tensions, however the US has not confirmed the Kremlin’s withdrawal while the key driver of prices – shortening supplies and rising demand – remains the same.

Ricardo Evangelista – senior analyst at ActivTrades said: “Yesterday’s price drop resulted from investors closing positions to realize profits when some of the geopolitical tension started to fizzle-out; however, the fundamentals behind oil’s recent price gains remain in place, with insufficient supply in the face of growing global demand. Even as chances grow of a peaceful resolution for the dispute in Eastern Europe, mounting demand and a tight supply will keep prices supported, with the $100 per barrel mark looming ever closer.”

Craig Erlam, senior analyst at OANDA added: “The softening of tensions may have only delayed the march to $100, rather than preventing it.”