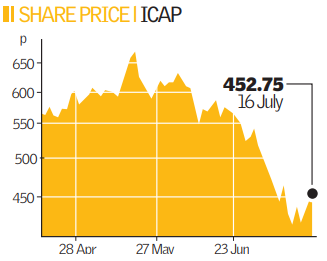

ICAP cashes in on turmoil

Inter-dealer broker ICAP proved to be an isolated bright spot on the horizon yesterday as it posted buoyant revenues for the first quarter and said it had benefited from the recent financial market volatility.

In an interim trading statement for the three months to June, the group said that revenues, excluding the recent acquisition of equity derivatives broker Link, were up 15 per cent year-on-year and predicted that pre-tax profits for the year to the end of March would be broadly in line with analyst forecasts.

“ICAP has continued to benefit from higher than average levels of volatility as well as the investment we have made in recent years to broaden our business,” said chief executive Michael Spencer. “We remain very positive about the outlook for the business.”

Activity levels in interest rates, foreign exchange and energy markets were high over the period, the group said. Revenues in the corporate bond markets also increased, although emerging market revenues were weaker than in the same period last year and growth in the credit derivatives market has slowed.

The geographical spread of ICAP’s business has also provided a buffer for the effects of the credit crunch, with the group now active in 50 countries worldwide and no single customer accounting for more than 5 per cent of revenues. “Delivering double digit growth in revenue this year after an exceptional year last year is very commendable,” said a research note from Numis Securities, where Spencer is chairman. The broker reiterated its ‘buy’ recommendation.