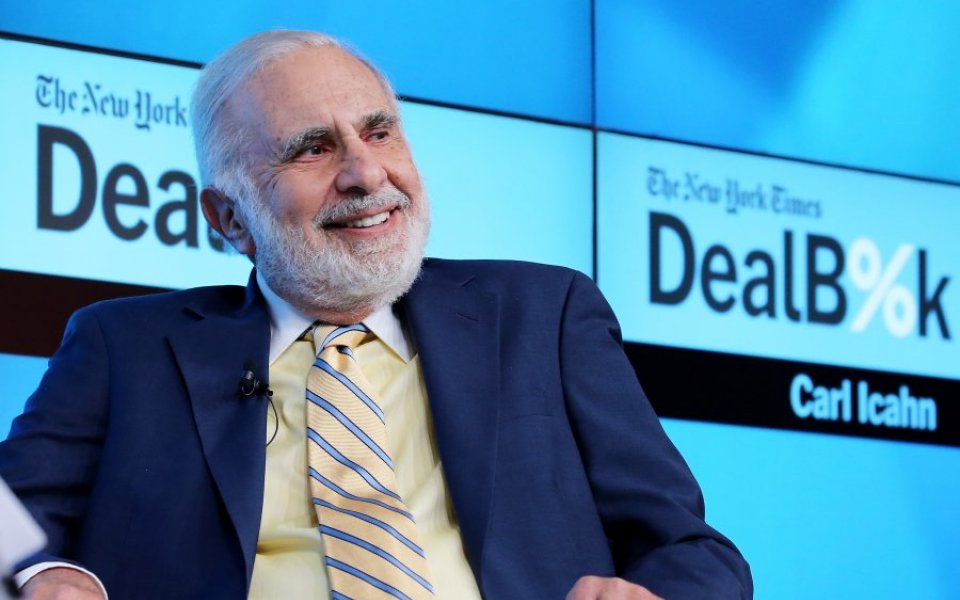

Icahn Enterprises share price rises despite widening losses and falling revenues for the full year ended December 2015

Share price in Icahn Enterprises rose today despite the company revealing that its revenues had fallen and its losses widen.

The conglomerate company announced net losses attributable of $1.2bn (£860m) for the year ended December 2015, down from a loss of $373m the year before.

Meanwhile, the company, which has investments across numerous sectors such as rail, mining and real estate, also reported a fall in revenue to $15.3bn, down from $19.2bn in 2014.

The company also saw revenues and losses tumble throughout its fourth quarter of 2015, with net losses of $1.1bn and revenues of $2.6bn. By comparison, in 2014, the company had net losses of $478m and revenues of $3.4bn.

However, share price in the company rose after the announcement, trading up 3.8 per cent at $59.58 just after 3pm London time.

The company has seen its share price drop sharply over the last 12 months, and it is now trading roughly a third lower than it was at the same point last year.