New car market misfires as confusion over government policy and incentives dents demand

Rule changes to government policy and automotive grants caused hybrid and diesel car sales to plummet in May.

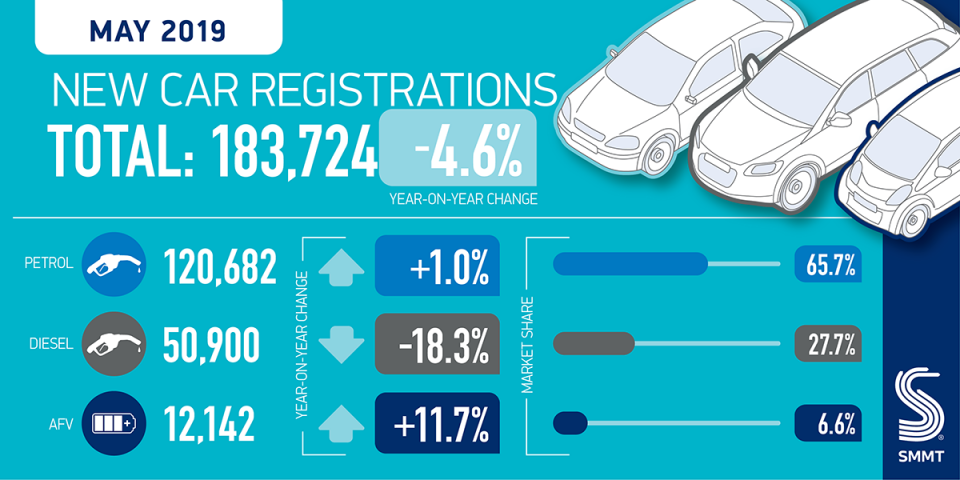

Overall new car sales fell 4.6 per cent year-on-year to just 183,724 units. The figures come from the Society of Motor Manufacturers and Traders (SMMT).

Read more: Car sales fall as removal of subsidies takes its toll

The SMMT said uncertainty over clean air policies and the removal of incentives for hybrid cars was behind the drop.

Meanwhile, ongoing economic uncertainty over the terms of the Brexit deal hurt consumer and business confidence, it added.

Hybrid sales power down

Plug-in hybrid car sales fell 40 per cent compared to May 2018. The drop comes after the government cut the subsidy for those buying electric cars from £4,500 to £3,500. It also excluded a number of plug-in models from qualifying for the grant. The government has repeatedly denied reducing the subsidy has had a detrimental effect.

SMMT boss Mike Hawes said: “Confusing policy messages and changes to incentives continue to affect consumer and business confidence, causing drivers to keep hold of their older, more polluting vehicles for longer.”

Over the first five months of 2018, hybrid car sales soared 36 per cent as consumers enjoyed leaving polluting models behind. In stark contrast, they have fallen by 25 per cent in the same period this year.

By comparison, batter car sales revved up considerably. The all-electric vehicles still qualify for subsidies, and sales were up 80 per cent year-on-year. However, these only make up 1.1 per cent of the market.

Overall alternatively fuelled (AFVs) car sales rose 11.7 per cent as petrol hybrids continued to boom, recording a 34.6 per cent sales rise.

Diesel falters

New diesel car sales fell for the 26th consecutive month, plummeting 18 per cent in May. Until a few years ago, diesel made up around half the UK’s new car market. But that has nearly halved, with market share standing at 28 per cent.

Ongoing anti-diesel sentiment and the forthcoming introduction of low emission zones continues to affect buyer confidence.

Petrol car sales rose one per cent, meaning they now make up two-thirds of the UK’s new car market. This is up from a 62 per cent share this time last year.

Read more: Car sales fall 34 per cent in key month for industry

Law firm DWF partner Jonathan Moss said: “Policy makers need to devise much more aggressive incentives strategies, in order to make AFV [alternative fuel vehicles] significantly more affordable and appealing to customers who are impeded by the high price tags for the electric cars and electric hybrid vehicles.

“From an industry perspective, the current market also puts a significant strain on manufacturers, who are dealing with increasing pressure on carbon emission standards in the face of significant uncertainty and declining registrations numbers.”