Huw Pill’s “let them eat cake” moment could get its just desserts with a slice of Bitcoin

The week in Review

with Jason Deane

Since my last update another Bitcoin anniversary has passed.

On April 23 2011, Satoshi Nakamoto officially passed Bitcoin’s custody to the growing community with a simple message that read: “I’ve moved on to other things, Bitcoin is in good hands”

Any google search usually attributes this quote as his very last, but in actual fact, it does seem that Nakamoto kept his communication lines open until April 26th when this message was received…

“I wish you would stop talking about me as a mysteriously shadowy figure. The press just turns that into a pirate currency angle. Maybe instead make it about the open source project and give more credit to contributors. It helps motivate them.”

I have used the masculine here purely for convenience, but, of course, we can’t be sure what Nakamoto’s pronouns were.

In any case, the only thing we can be sure of is that 12 years ago this week, the community took over and the rest, as they say, is history.

One thing that has always intrigued me about Bitcoin’s creation is actually nothing to do with who Nakamoto was – something that I personally believe should remain unknown for all time – but the timing of it.

Throughout history money has always been the product of our latest technology so, in that sense, it’s not revolutionary. But could Nakamoto really have foreseen what was going to happen with the fiat system we were all so dependent on?

Maybe. Many, including myself, think that the events of the global crisis in 2008 were a contributing factor to Nakamoto’s work as the signs of eventual collapse were, in retrospect, already visible even then.

And, in a week where the Bank of England’s chief economist, Huw Pill, looked down on us mere mortals from his golden pulpit and pointed out that we should “accept that we are now poorer” while inflation continues to rocket ahead at 10.1%, the fact that those same mere mortals now have a viable alternative for the first time in history is not lost on me.

To me, Pill’s comments are a modern day “Let them eat cake” moment, words allegedly spoken by Marie-Antoinette, Queen of France during the French Revolution, when being told that her starving peasant subjects had no bread. It didn’t end well for her and I have a feeling Pill’s quote will come back to haunt him, albeit in a less lethal way.

Meanwhile, credit card debt in the US is about to reach a trillion dollar milestone for the first time, and pretty much every other debt indicator is red-lining across the board. For anyone who is paying attention, the alarm bells are going off.

Countries like El Salvador have already nailed their colours to the mast, and, thanks to the tireless work of Samson Mow’s Jan3 team, other countries are exploring the possibilities of doing the same.

Could Nakamoto really have foreseen all of this?

Who knows? But if and when the (financial) revolution comes, we’re all going to have to pick a side eventually.

Have a great weekend!

New to Bitcoin? Learn all about it here, for free, with the Bitcoin Pioneers!

Yesterday’s Crypto AM Daily

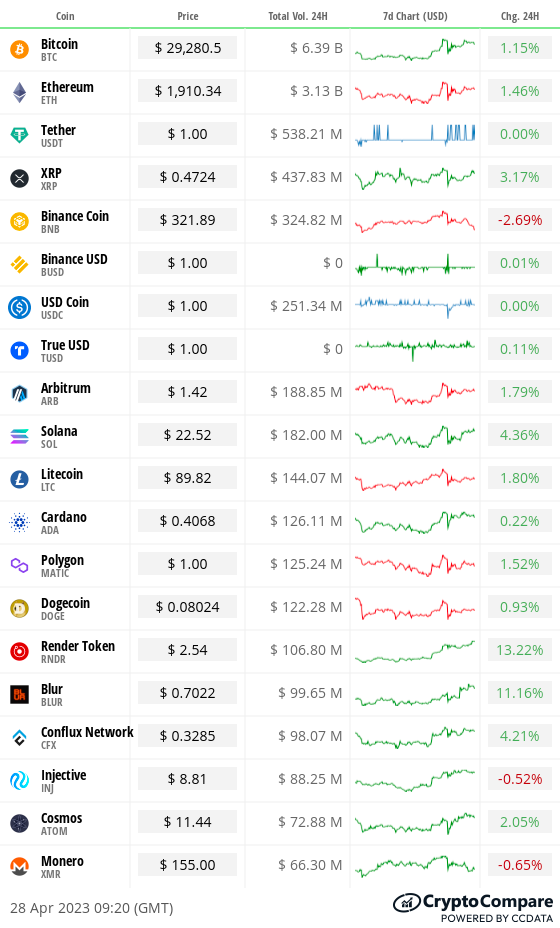

In the Markets

The Bitcoin Economy

*Data can be found at https://terminal.bytetree.com/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market this morning was $1.202 billion.

What Bitcoin did yesterday

We closed yesterday, April 27, at a price of $29,473.79. The daily high yesterday was $29,871.55, and the daily low was $28,402.89.

Bitcoin market capitalisation

Bitcoin’s market capitalisation this morning was $565.58 billion. To put it into context, the market cap of gold is $13.145 trillion and Tesla is $507.72 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $34.931 billion.

Fear and Greed Index

Market sentiment today is 64, in Greed.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 48.54. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 47.93. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Soundbite of the day

“I like Bitcoin for the same reason that the Chinese communist government doesn’t like Bitcoin. They don’t like Bitcoin and they banned it because they can’t control it.”

Ted Cruz, US Senator

What they said yesterday

Has he recovered?

Probably nothing…

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

ChatGPT urges crypto conference panel not to become over-reliant on AI

Mt. Gox customers will have to wait until November to recover lost Bitcoin funds

Sam Bankman-Fried: A tissue of lies soaked with fake tears?

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.