Hunt mini-budget overhaul right for now but investment relief needed, Thatcherites urge

New chancellor Jeremy Hunt’s decision to junk pretty much all of prime minister Liz Truss’s botched mini-budget has damaged the UK’s tax competitiveness, a new report out today says.

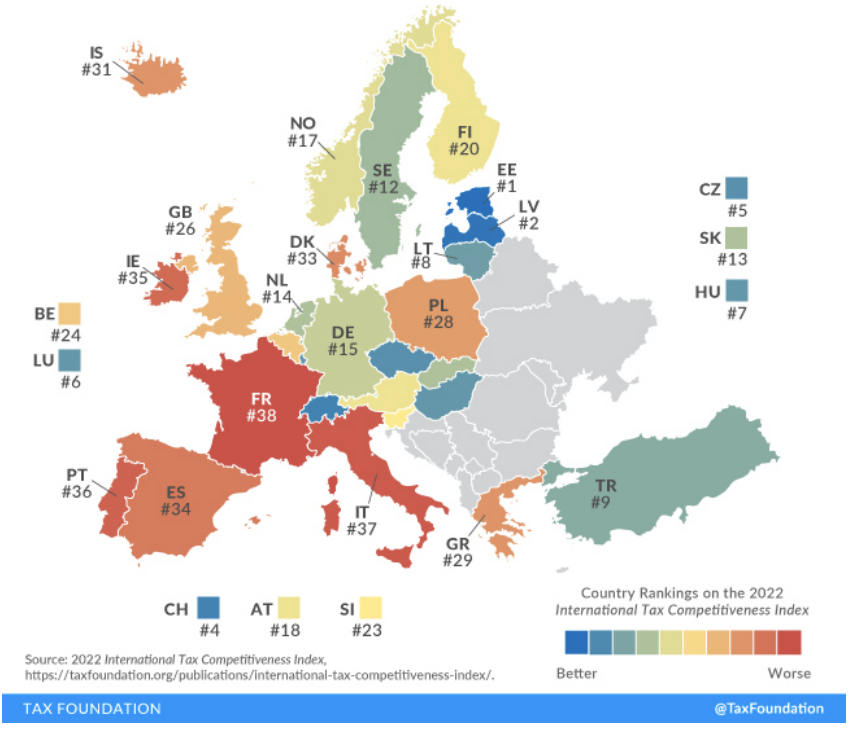

Britain has dropped to 33rd out of the 38 nations part of the Organisation for Economic Cooperation and Development (OECD) as a result of Hunt’s tax cut reversals, according to Thatcherite free market think tank the Centre for Policy Studies (CPS).

Before the U-turns, the UK ranked 26th in the International Tax Competitiveness Index, compiled by the Washington-based Tax Foundation organisation.

Despite the ranking drop, Britain’s tax system is still more competitive than France and Spain’s, the CPS said.

Germany came 15th, with Estonia, which has a relatively welcoming business tax regime, topped the table.

Hunt ditched plans to reverse the six percentage point corporation tax hike. It will now jump to 25 per cent in April.

The chancellor has yet to sketch a permanent successor to former Number 11 resident Rishi Sunak’s super-deduction, which allows businesses to deduct 130 per cent of certain investment spending from their tax bill.

Hunt was forced to U-turn on nearly everything in the mini-budget to tame chaos on UK financial markets. The decisions amount to £32bn of tax rises.

“Once market conditions have stabilised, the Treasury should start thinking about a carefully-designed package of tax reforms that would boost our competitiveness without threatening our fiscal sustainability,” Tom Clougherty, research director and head of tax at the CPS, said.

“Reviving Rishi Sunak’s plan to overhaul capital allowances is the best place to start,” he added.

Original Tax Competitiveness Index ranked the UK 26th