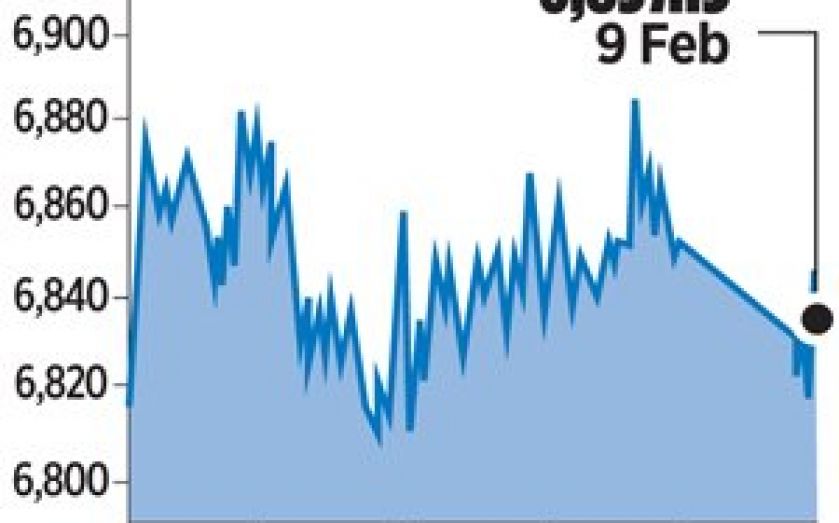

HSBC scandal takes the spark out of the FTSE – London Report

THE UK’s top share index edged lower yesterday, hurt by a fall in HSBC after the bank admitted tax failings at its Swiss unit and by softer utility stocks.

The blue-chip FTSE 100 index was down 0.2 per cent, or 16.29 points, at 6,837.15 points by the close, with United Utilities, National Grid and Severn Trent falling by between 3.1 and 2.1 per cent.

Traders said utility stocks fell on rising debt yields following a drop in shares of their US rivals on Wall Street on Friday, when the S&P 500 index of utilities had its biggest daily percentage drop since August 2011.

US utility stocks were hit after strong jobs data strengthened expectations of a rise in US interest rates by mid-year and pushed up US Treasury yields. The data also pushed up UK gilt yields as it eased some concerns about the health of the global economy.

Utility companies tend to have large amounts of debt in order to operate their networks and so any rise in interest rates would lead to higher borrowing costs for them.

“The rise in the bond yields and the weakness in the US sector is hurting the UK utilities,” said Securequity sales trader Jawaid Afsar.

Banking giant HSBC shed 1.6 per cent, taking nearly eight points off the FTSE 100, the biggest individual weight on the index.

Earlier, the bank admitted failings by its Swiss subsidiary in response to media reports it helped wealthy customers dodge taxes and conceal millions of dollars of assets.

Among other banks, Barclays lost 0.7 per cent, Royal Bank of Scotland shed 0.8 per cent and Lloyds 1.2 per cent.

“Anyone avoiding tax in this current environment is frowned upon, so it will be a big issue for HSBC,” said Manoj Ladwa, head of trading at TJM Partners.

“Some of the other banks, like Lloyds and RBS, don’t have so much exposure to Switzerland, so they should recover quickly.”

Gold miners Fresnillo and Randgold outperformed the broader market to gain 4.2 per cent and two per cent respectively, lifted by a rise in the gold price after weak Chinese data boosted the metal’s appeal as a safe asset.

Randgold also lifted its dividend despite reporting lower profits o yesterday.

High Street bookmaker Ladbrokes and online grocer Ocado saw volatile swings and a surge in volume just before the closing auction. Traders said the moves may have been due to a possible trading error on the two stocks, although London Stock Exchange said they had received no requests to cancel trades.