HSBC pushes further into Saudi Arabia: Canary Wharf approves $10bn loan so mass polluter Saudi Aramco can expand

HSBC is in line to finance a $10bn revolving credit facility to one of the world’s biggest polluters, the Saudi Arabian Oil Company, or Saudi Aramco, despite the bank’s commitment to ‘Net Zero emissions by 2050’.

HSBC’s latest venture in the Middle Eastern kingdom, in partnership with Standard Chartered, is likely to draw scrutiny from investors, shareholders and environmental groups as the financial giant is intensifying its relationship with Saudi Arabia’s national oil company.

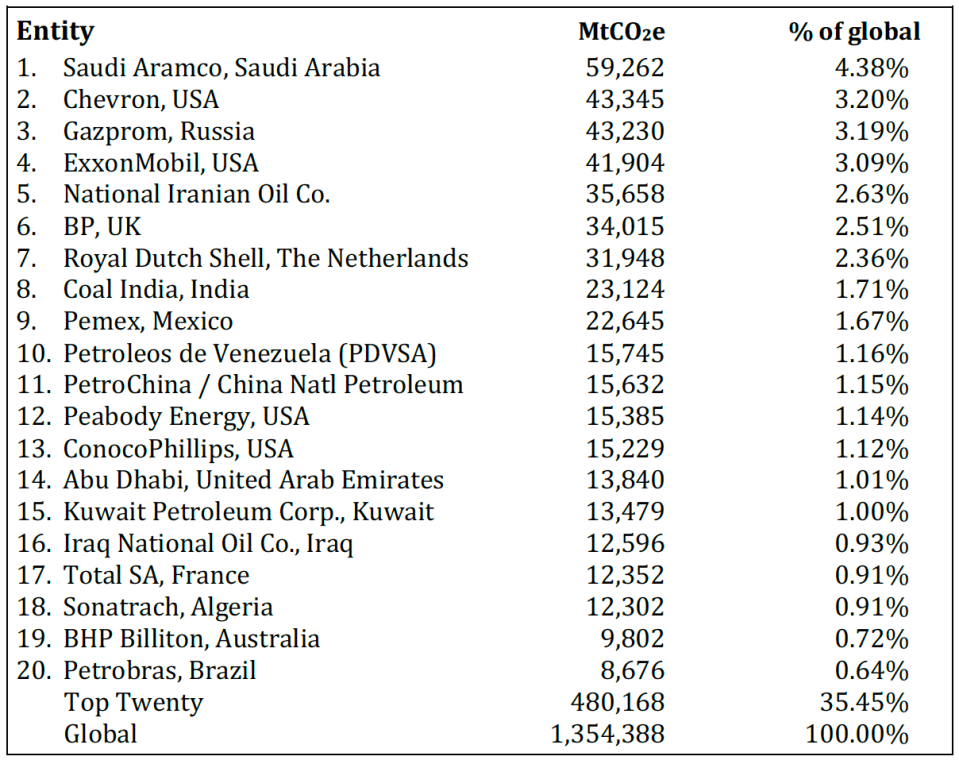

Saudi Aramco, the world’s single biggest polluting company, has plans to increase its production of oil and gas equivalent to 27 billion tonnes of carbon dioxide by 2030 , 4.7 per cent of the entire world’s carbon budget to stay under 1.5ºC.

Since 1965, Aramco is believed to be responsible for 4 per cent of the entire world’s greenhouse gas emissions.

HSBC in the Saudi Kingdom

While other financial institutions distanced themselves from the Saudi Kingdom in the wake of the killing of journalist Jamal Kashoggi in 2019, HSBC was the only global bank playing a lead role in arranging Saudi Aramco’s Initial Public Offering (IPO) on the Saudi Stock Exchange.

It was the world’s largest IPO at that point, raising $25.6bn to finance Aramco.

HSBC also provided $97m for the refinancing of Aramco’s 305,000 barrel-per-day refinery in Jubail in December 2019, two months after HSBC made its ‘Net Zero’ commitment.

The bank also acted as a financial advisor on an April 2021 $12.4bn transaction where a coalition of investors bought a large stake in a newly-formed Saudi Aramco subsidiary, Aramco Pipelines.

In June 2021, both HSBC, together with Standard Chartered, helped arrange a $6bn bond issuance to Saudi Aramco.

Response from HSBC

When approached by City A.M. today, a spokesperson declined to discuss the Saudi activities but did say “HSBC is firmly committed to align its portfolio of financed emissions to net zero by 2050 or sooner.”

“In December, we set out a detailed plan to phase out the financing of thermal coal-fired power in EU and OECD countries by 2030, and worldwide by 2040,” he added.

“We will publish targets to align financing for the Oil and Gas and Power and Utilities sectors with the goals and timelines of the Paris Agreement in our 2021 Annual Report and Accounts on 22 February 2022,” the spokesperson said.

World’s biggest polluting companies, 1965-2017