How We’re Trading US CPI This Week

Not much action to kick off the week unfortunately, but US CPI on Thursday is probably the reason for that. With markets lying in wait, hopefully that means there are some opportunities to be taken advantage of as we head into it tomorrow.

Bigger Picture

In the lead up to the release we need to take the context into consideration. To put it simply if we look back to the same time last year, inflation was ramping up while central banks still had ultra-loose monetary policy, with near zero interest rates and QE still being carried out. A lot of people would say that this was a mistake, but that is a conversation for another day. The situation since then is that inflation had reached a point that has not been seen in 40 years in many of the major economies around the world. This caused a global hiking cycle and removal of the loose monetary policy stance in order to combat the record levels of inflation. What has ensued since has been a dampening of global economic growth projections and stoked fears of an impending recession, due to the removal of QE and the fastest hiking cycle in a generation, coupled with Russia’s ongoing war with Ukraine, which further fuelled inflation fears.

Now, with the FED Funds Rate ramping up to a range of 4.25% – 4.5% the picture is a little different a year on. We’ve had aggressive hikes, but these will not last forever. It’s been communicated to us that these are approaching the end of the cycle, but we have not received a terminal rate for definite, and this CPI print will hopefully give us a further clue that the end is near. The FED’s latest projections are for a 5.1% terminal rate, however, markets are currently pricing in 4.9% and with this print tomorrow, we may get a further clue as to whether markets are right, or the FED. Maybe we don’t even need any more as it is, who knows?

Current Inflation Situation

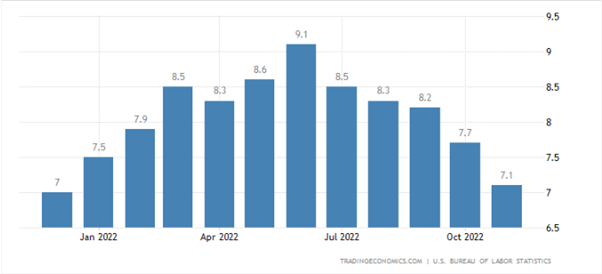

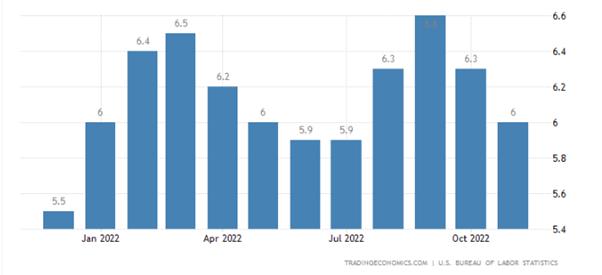

As we can see above, since June of last year the total rate of inflation has been trending lower quite aggressively. However, as seen below, the Core CPI print has not moved lower over the same length of time.

6.6% was the high printed in September, and then we have trended lower. The last time this happened was between March and June, but we did not get the follow through that we are expecting this time.

Piecing This Together

The picture we’ve now built is that of an aggressive hiking cycle reaching an end. On a medium-term outlook, I think it is a bit tricky. We’re unsure as to whether the recession will definitely happen. Goldman Sachs yesterday revealed they no longer think the Eurozone will enter a recession, which I thought was quite interesting. Can the US follow suit? If so, that is a massive positive for risk, and is a back story we should keep in our minds as we head into tomorrow. The reaction back on the 13th of December was an initial spike higher in stocks which we predicted well, and then a pretty aggressive move lower which was alluded to with us being unsure about the future. Personally I am going with the same opinion that a weaker than consensus print pushes stocks higher and the Dollar lower, but any lasting move after that may prove tricky to predict, as we still have the underlying factor of a potential recession after the terrble PMI’s last week but with the employment data remaining strong, it does give the FED a bit more room to keep the foot on the gas in terms of hawkishness., which is not positive for Stocks.

The Core CPI is the one to keep an eye on. The previous figure is 6%, with a consensus of 5.7% this time round.

Personally, I am hoping for a print of 5.5% or below, which will send me long stocks looking for a short term spike higher. How long this lasts for if it plays out is another question, but with a 120 handle move higher on the spike last time, even half of that is enough to make some profits.

The flip side is interesting though. Markets are expecting inflation to slow further, but what if we print 6%? That means the FED need to keep the foot on the gas and will surely send stocks lower and probably continue in the aftermath, so a print of 6% is not a bad play on a risk/reward basis. My preference is for stocks long on a weak print, but it is important to remain flexible on releases like these where anything can happen.

These are my personal views and are not intended as investment advice, if you choose to trade it then it is completely at your own risk. Best of luck if you do.

How to Learn to Trade on Financial Markets?

It’s essential to ensure you have the right skills and knowledge to capitalise on the opportunities presented from a recession and studying a trading course at an accredited, award-winning academy can help provide you with an advantage. The London Academy of Trading has a combination of practical application and theory that can provide you with the skills to thrive in financial markets, whilst their 10h/day support can help provide immediate help and advice.