How to read financial news: coronavirus, confirmation bias, and political bias

Now more than ever we need to read the news with a clear eye about our emotions and biases, especially tendency towards confirmation bias and political bias.

Coronavirus affects people across the globe and across the dinner table, and our personal experiences can affect our judgment for better or for worse, depending on our process for reading, interpretation and decision-making.

Here I explain how a framework for reading financial news can help us maintain our objectivity during a crisis.

As I write, my wife Janet is working in a hospital where she treats patients with COVID-19. She is a nurse in the intensive care unit (ICU) and has worked 84 hours during the past eight nights.

Meanwhile, I run a business managing money for clients with retirement accounts. I own a registered investment advisor (RIA) in New Jersey, and my clients are worried about their wealth and their health at a time when the coronavirus has turned the world upside down.

Coronavirus has also turned my world upside down, as I balance concerns about my wife and family with the needs of my clients and my own health. (I have three joint replacements and chronic pain from an autoimmune disease). Nevertheless, I try to stay objective.

Reading the news

I read the news like everyone else, and I aim for impartiality in my role as an adviser and portfolio manager. It is not easy these days.

Reading the news has become more challenging as digital media have swept the landscape. I have found myself reading more and learning less.

So in 2016 I began to ask my peers about how they read the news, and I have written a series of articles for CFA Institute – How to Read Financial News – to improve my own investment process and to help reduce my biases when I read news and research.

Confirmation bias

I have had a lot of experience with confirmation bias in my 35 years as an investment professional. Confirmation bias means that we favour information that confirms what we already believe. For example, if we own a stock, we tend to believe positive news about the stock, the company, the economy and the stock market. We tend to ignore information that contradicts what we believe because we don’t want to be wrong or to look stupid in front of clients or colleagues. Simply put, pride makes us blind. No one is exempt.

So I developed a framework that attempts to minimise our biases. The framework appears in ‘How to Read Financial News Redux: The Complete Series’. The following graphic summarises the process:

A framework for reading financial news

Framing of stories and political bias

The second step of the process — Analyse the Frequency and Framing of Stories — will be my focus for the remainder of this article.

I have written previously about how to understand consensus and discussed how events are shaped by the media. Market prices rise and fall, and the media create a narrative that may or may not be true and is always limited and incomplete. The media have the power to describe events or ‘frame’ the price action in capital markets, and this affects us as readers.

Like it or not, politics shapes how the media deliver information. It is important to look for changes in the framing of stories by liberal and conservative media: editorial deviations from the left/right paradigm show that a significant change is underway. When conservative media frame a story in a liberal manner, something important is happening. Likewise, when the liberal media frame a popular narrative in a conservative manner. How can we measure media bias and improve our political filters? Now I turn to…

Vanessa Otero’s work on media bias

I am a financial adviser, not a political scientist, so I defer to the expertise of Vanessa Otero, founder of Ad Fontes Media and creator of the Media Bias Chart. I came across Otero’s work when I was researching how to read financial news, we have corresponded by e-mail, and I interviewed her for this article on 2 April 2020.

Let’s start with a graphic.

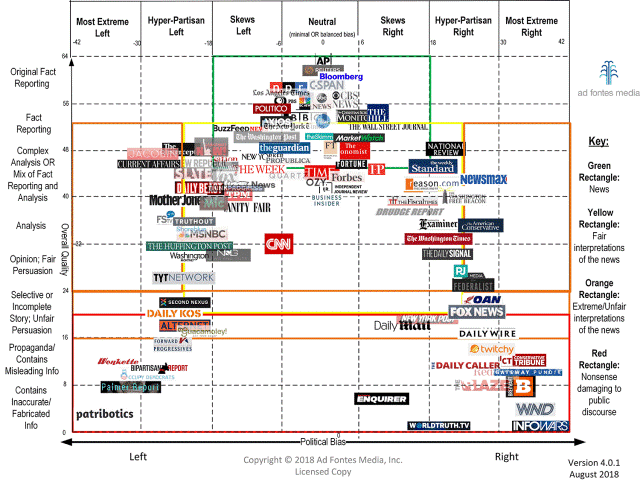

The chart arranges news outlets according to where they sit on the liberal–conservative spectrum, as shown on the horizontal axis. It also shows how reliable these news outlets are as information sources (vertical axis).

The chart shows that most sources fall into the middle of the vertical axis, and are reasonably reliable as sources of information, with a few outlets at the top that do original reporting of facts.

Media bias and the junk news pandemic

To put things in context, it is worth quoting from Ad Fontes Media’s website: ‘Our mission is to make news consumers smarter and news media better. This is a tall order, because we have a big problem in our news media landscape: too much junk news. Junk news is like junk food, and just like junk food has caused massive health epidemics in our country, junk news is causing a massive polarisation epidemic.”

I recommend Otero’s recent article about digital advertising in the social media age: “Advertisers Cannot Differentiate between Junk News and Good Journalism.” I highly recommend it if you want to understand how digital advertising business models have made it virtually impossible for reputable companies to direct their advertising dollars to good journalism rather than junk news. It is a complex topic and Otero describes the dynamics of modern news quite well.

Coronavirus and political bias

Otero also wrote the ‘Polarization of Coronavirus Stories’, which describes how the news ecosystem tends to frame stories about coronavirus in biased ways. For example, Otero notes how facts about the virus are often viewed through the lenses of such controversial political topics as the economy, immigration issues, Donald Trump’s performance as president and racial/ethnic discrimination.

Otero notes: “The inclusion of these political topics therefore introduces left-right divides into coronavirus articles. Most news readers conflate all issues within an article and don’t mentally separate the non-partisan coronavirus facts from the related partisan topics. As a result, there are now entire conflicting left-right narratives related to coronavirus facts themselves. These conflicting narratives are causing people of different political orientations to take different levels of precaution, which is nuts.”

I agree that this is nuts, and it is tragically disappointing that political bias is influencing the medical precautions we take as individuals.

Fiduciaries, clients and political bias

I manage money for clients as a fiduciary, which means that I put client interests first. I read all types of news, from conservative to liberal. I have noticed that clients are reacting to coronavirus in a wide variety of ways, based on their worldviews and their political views.

I respect my clients and their differences, and I try to give sound financial advice despite a client’s political beliefs. These days it is tough to have a candid discussion about the economy, fiscal policy and the proper role of government.

Clients are all over the place and it is tough to remain objective. I have opinions like anyone else, but I put them aside when I make portfolio decisions. This is easier said than done because we are continually bombarded by biased media that frame the news about coronavirus in misleading ways. I described this challenge on 20 March in ‘7 Things that Covid-19 Taught Me About Confirmation Bias’, and my first point is that we must confirm the integrity of our sources.

The COVID-19 crisis has spawned a diseased and dysfunctional set of conspiracy theories. In order to fight our biases, we need to filter our sources carefully to ensure that the authors do not have a hidden agenda. We also need sources with intellectual honesty and intellectual courage to help us discover our blind spots and correct our mistakes.

Confirmation bias means that we believe what we want to believe, so we must remember to respect the other side of the trade — their money is as good as yours. If we put our biases aside when we read the news, we can see more clearly, whether we are looking across the globe, across the street, or across the table.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

Visit CFA Institute for more industry research and analysis.

By Robert J. Martorana, CFA, the founder of Right Blend Investing.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Drazen Zigic