How to read Bitcoin’s curves and beat the government printing process

Metaversal S-curves

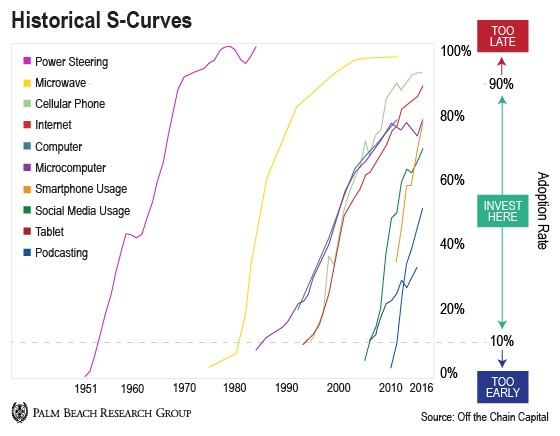

The S-curve showcases how the speed at which new, game-changing technologies are adopted.

At first, the majority don’t understand nor support or even fear the technology. Then once the technology grows to the point where it becomes useful, mass adoption takes place which is seen in the near-vertical portion of the curve. Eventually, the right part of the S shows slowing adoption as the technology becomes more fully integrated into society. Some technologies such as the internet continue to grow exponentially as new use cases are created.

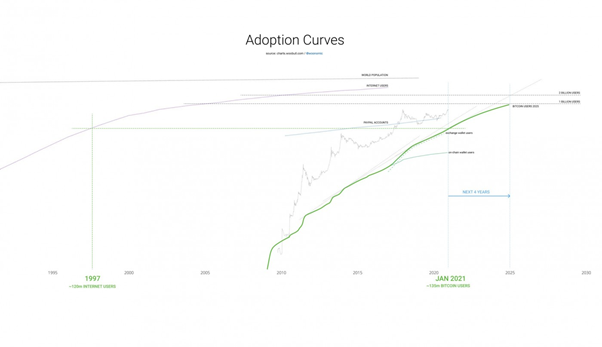

Bitcoin currently has about the same number of users as the internet had in 1997. But Bitcoin is growing faster. By 2025, with Bitcoin users continuing to double each year, the total number will exceed one billion people. It took the internet eight years to get to this same level. The curve for Bitcoin is noticeably steeper even when plotted logarithmically.

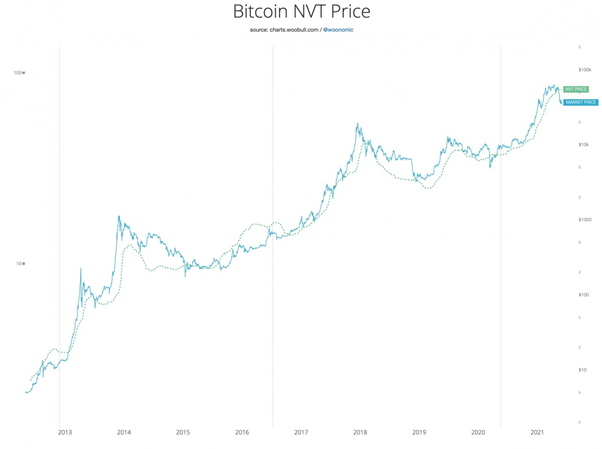

One of the more important metrics, Bitcoin’s NVT price, or network value to transactions is showing how Bitcoin is currently undervalued. As Willy Woo writes, NVT values the network using its on-chain investor volume. You can think of NVT as a PE Ratio. NVT Price is calculated by multiplying on-chain volume by the two year median value of NVT Ratio. That network valuation is then adjusted to price by dividing by the coin supply. This metric uses volume estimates from Coinmetrics Pro under licence.

Here are the months when the price of Bitcoin went well below the NVT price: mid-2013, Jan-2015, Feb-2018, Mar-2020, May-2021. The current price is even more undervalued than in Mar-2020. In every case except in early 2018, Bitcoin has been at a major price low, a key buying opportunity. Those who bought at such low levels became whales. Fancy trading was not even necessary as Bitcoin’s rise in price remains exponential. Of course, market timing and picking the alt coins that outperform Bitcoin goes a long way so can turn one from a one comma (net worth six-figs) to a two comma (seven-figs+) or even three comma (10-figs) investor much faster.

The difference in early 2018 compared to all the other times was that the metrics I use issued a major sell signal in Jan-2018, the first such major topping sell signal issued since Dec-2013. Jan-2018 was the month before the Bitcoin NVT price fell well below Bitcoin’s price. The leading alt coins topped in late Jan-2018, after Bitcoin had topped in Dec-2017. I therefore took profits in my alts which comprised 100% of my crypto portfolio, was mostly in cash by the end of Jan-2018, then did very little trading until Mar-2019 when my website www.selfishinvesting.com issued a major time-stamped buy signal in Bitcoin when it was still under $4,000.

HNWIs such as Bitcoin billionaire Brock Pierce are not traders. They could greatly enhance their substantial wealth by proper market timing methods designed to catch the major trends such that very little trading except at key tops and bottoms would be required. As stated, I myself did almost no trading from Feb-2018 to Feb-2019. I would have shorted but such platforms were sketchy and thin at best in 2018, unlike today.

Note that the Bitcoin NVT Price metric is one of a number of key metrics that, taken together, offer great insight as to whether Bitcoin has topped or not. In my prior Inside the Metaverse piece, I discuss why we are still in the middle of a major cryptobull market.

QE ∞

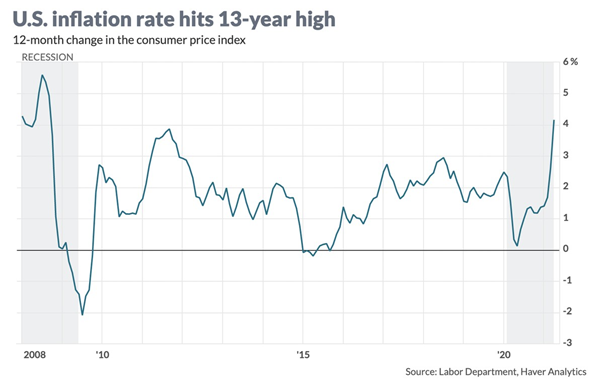

Helping to drive Bitcoin’s store-of-value narrative is the endless QE coming our way. President Biden has $6 trillion in spending packages on the launchpad, and this, despite the CPI having risen the most in April since 2008. The Fed is betting that consumer prices will fade as the economy fully reopens due to renewed demand.

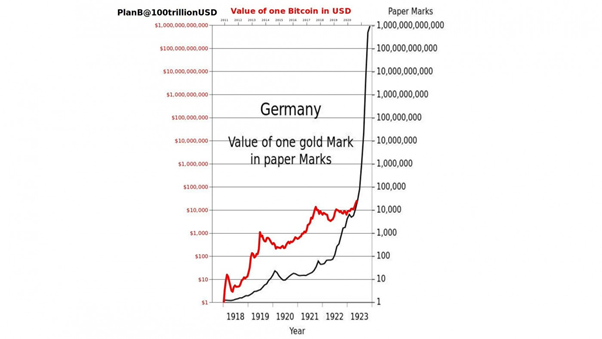

Hyperinflation could be around the corner on a global level as fiat’s race toward zero remains in place. Countering this possibility is the rise of technologies growing at exponential rates (ExpoTech) which create substantial wealth in the form of greater efficiencies at lower cost. Certainly blockchain, AI, and other forms of bleeding edge tech are formidable forces that could go a long way to averting a massive crash, revolution, and global war, unlike prior key turning points in history when such technologies did not exist.

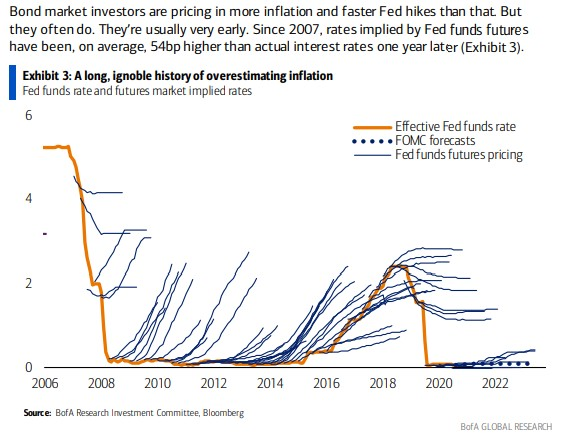

So while the stock market is skittish about how bond yields on the longer end of the curve have been on the rise due to an expected rise in inflation, Fed Fund futures tend to overestimate future inflation by an average of 54 bps than actual rates a year out.

But if history is any guide, when the German economy improved in the 1920s, Germans came out of their austere economic hibernation and started to spend which sent inflation soaring. This, together with the onerous repayments due to post WW I agreements, required the Reichsbank to print print print to meet its debt payments which spurred hyperinflation. The price of gold in German marks soared in the 1920s. The price of Bitcoin could follow as the world sits at record low interest rates, record high debt, and the printing continues to accelerate.

Countering this projection, the US dollar continues to drop.

The Fed may therefore not need to act quite so fast on raising rates. Such an act would topple markets as each time they have tried since 2010, markets started into a correction, typically of around -20 per cent, before the Fed stepped in and reversed their hawkish decision. While it seems the Fed largely painted themselves into a QE-corner, ExpoTech may help greatly soften any crash which may just end up being a very hard landing.

Dr Chris Kacher, bestselling author/top 40 charted musician/PhD nuclear physics UC Berkeley/Record breaking audited accts: stocks+crypto/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr. Kacher bought his first bitcoin at just over $10 in January-2013 and participated in early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

Virtue of Selfish Investing Crypto Reports

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoin

https://www.linkedin.com/in/chriskacher/