How to invest in Veganism

We have a look at how companies are responding to the rise in veganism and explain how investors and traders can capitalise as people around the world begin to reduce their meat intake and consume more plant-based alternatives.

Many food products are naturally friendly to vegans, like vegetables, which means the vegan market is already large. The global vegan and vegetarian market is worth over $50 billion, according to Euromonitor, and sales of vegan alternatives to meat reached $19.5 billion in 2019.

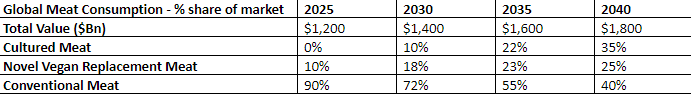

Separate figures from US management consulting firm AT Kearney predicts sales of plant-based meat alternatives will grow annually by 20 per cent to 30 per cent in the coming years. The global meat market is thought to be worth $1,000 billion, meaning veganism still represents only a fraction of the market, but this gives the market plenty of headroom to grow.

However, there is an expectation that today’s plant-based meat alternatives will only be the number one alternative to meat for a few years, with cultured meat – currently in its infancy – expected to quickly overtake plant-based alternatives as technology and acceptance develops.

The adoption of vegan food is being driven by a number of key factors. Veganism is particularly popular among younger generations, and plants are regarded as a more efficient way of feeding the world’s growing population – set to rise from 7.6 billion to around 10 billion by 2050 – than rearing livestock.

But the main reason for the success of vegan alternatives to meat has been its reception from meat-eaters. When hype was at its peak, vegetarianism was polarising: you either ate meat or you didn’t, and if you enjoyed meat then vegetarian alternatives were off the menu. But veganism, partly because of how it links to climate change and because of growing awareness of the possible health benefits, is more fluid. In fact, the vast majority of people that are consuming meat alternatives are not strictly vegan but simply trying to reduce their meat intake. These people are often called ‘flexitarians’ (a semi-vegan or vegetarian diet) or ‘reducetarians’ (people who are trying to reduce but not eliminate their meat intake). In the UK, over one-third of people regularly take days off from eating meat, with the likes of ‘Meat Free Mondays’ becoming increasingly popular. The Vegan Society claims non-vegans in the UK accounted for 93 per cent of meat alternative sales last year.

But it’s not all about winning over meat-lovers. Vegan alternatives to other everyday staples are now commonplace with almond milk and dairy-free cheeses also experiencing rapid growth. The vegan trend also goes well beyond food: the vegan cosmetics market was worth $13.5 billion in 2018 and is forecast to grow to $15.5 billion in 2020, $18.4 billion in 2023 and $20.8 billion in 2025, according to Statista.

Those striving to make vegan food are primarily focused on one dietary requirement: protein. Whilst the human diet has traditionally sourced protein from meat there are a growing number of vegan products sourcing it from plants like lentils and chickpeas.

Vegan products should not be mistaken for plant-based ones, especially when it comes to food. All vegan food is plant-based but not all plant-based food is vegan. Although some foodstuffs source protein from plants, they can still contain or be made using secondary ingredients that are sourced from animals. For example, Guinness is not made using animal products but was filtered using isinglass, made from fish bladders, which made it unsuitable for vegans. Drinks maker Diageo has now stopped using isinglass to make Guinness a vegan-friendly option, and has made vegan alternatives to other beverages in its portfolio such as Baileys.

It is also worth mentioning ‘cultured’ foods, better known as lab-grown meat. Protein is grown in a bioreactor using ingredients such as sugar, creating ‘meat’ without having to rear an animal.

Companies vie for the vegan dollar

The fact vegan products appeal to non-vegans means businesses have been more motivated to move with the times. It means they can cater to larger, rather than niche, markets. Of all the new food products launched in the UK last year, 16 per cent were vegan – double the 8 per cent seen in 2017, according to Mintel, and enough to overtake Germany as the leader in Europe. The Vegan Society says just under half of the UK population is expected to have some form of flexitarian-related diet by 2025, about twice the number of expected vegans. For perspective, less than 2 per cent of the British population identifies as vegan at present – although half of them are thought to have converted in 2018, demonstrating how fast veganism is growing.

Almost every big company has either launched new vegan products to capitalise on demand or because they have been pressured by customers or shareholders, but most of them offer these alongside non-vegan ones. This has been achieved by either developing new products in-house or by acquiring smaller businesses to get a head start.

The trend is taking hold across the entire food supply chain. Large food producers have launched their own-brand vegan product lines. Nestle purchased plant-based food producer Sweet Earth, while consumer goods giant Unilever has made its popular everyday products tolerable for vegans by introducing new tea bags for PG Tips that work better with the likes of almond or soy milk. Those that sell food, like supermarkets, are not only stocking more third-party vegan products but developing their own lines, with, for example, Tesco launching its Wicked Kitchen range that includes products like sweet potato pakoras. Catering to vegans goes well beyond food, with people becoming increasingly particular about the contents of non-edible goods, such as beauty products. Companies such as Superdrug have introduced more plant-based products in response. Even companies like Tesla, not a prime candidate to discuss when pondering whether they its vegan friendly, is making changes, with the electric car maker removing the leather option for seats for environmental reasons.

How to invest in veganism

You can currently gain exposure to the rise in veganism and growing consumption of plant-based products in numerous ways:

- Investing in vegan stocks

- Backing VCTs that invest in vegan and plant-based stocks

- Trading soft commodities that underpin vegan and plant-based diets.

In the near future, an investor may also be able to buy vegan ETFs.

Investing in vegan stocks

While some big-names have stolen much of the limelight, such as Beyond Meat which listed earlier this year, there are older publicly-listed companies that are either shifting toward plant-based products or already positioned to naturally benefit, such as fresh food producer Total Produce. Below is a list of eight stocks to consider, although not all of them can be classed as 100 per cent vegan-friendly:

- Beyond Meat

- Ingredion

- Bunge

- AAK

- Total Produce

- Archer Daniels Midland

- Hain Celestial Group

Beyond Meat

It is likely that Beyond Meat will be mentioned when discussing how the vegan trend is gripping consumers around the world. The company is famous for its Beyond Burger, the “world’s first plant-based burger that looks, cooks, and satisfies like beef without GMOs, soy, or gluten,” but it also has other alternatives covering sausages and minced beef. Beyond Meat has found success by selling its product to the mass market, with its products being stocked in the meat aisle alongside traditional meat products and mostly sold to flexitarians or reducetarians.

Ingredion

Ingredion is a Fortune 500 company that turns grains, fruits, vegetables and other plant materials into ingredients. It makes starches, sweeteners, gums, biomaterials and other specialty ingredients for a wide-array of applications. Over 50 per cent is used in food, almost 20 per cent in soft and alcoholic beverages, and another 20 per cent of its sales come ‘additional applications’, including toiletries and supplying materials that help plastics and paper become more environmentally-friendly. It recently said it would raise investment in plant-based proteins to $185 million by the end of 2020, up from a previous budget of $140 million, as part of a partnership with Verdient Foods. However, some vegan investors may be put off by the fact that up to one-tenth of its business is made-up of supplying ingredients used to make feed for livestock.

Bunge

Bunge is a New York-listed agri-business that supplies plant-based staples like grains, oilseeds and sugar used to make a variety of foods. It also has milling operations that create milled wheat, corn and rice products and acts as a middleman that helps transport goods from farms to food processors. Bunge operates across the world but is predominantly based in the US and South America. Its strongest area is oilseeds, where it has an industry leading footprint producing soy, canola, sunflower seed and rapeseed oil. Its vertically integrated business model means its agribusiness and food and ingredients operations reinforce one another. However, it is also growing its bioenergy business, in part through a joint venture with oil giant BP.

AAK

Scandinavian firm AAK is the world’s leading producer of specialty and semi-specialty vegetable oils and fats and advises clients on everything from tinkering with recipes to logistics and analyzing market trends. It also helps make products suitable for different dietary and nutritional needs. Its products are popular in chocolates, confectionary and other sweet treats. It recently launched AkoPlanet, its new portfolio with tailor-made solutions for food manufacturers developing plant-based alternatives within the meat, dairy and ice cream segments. The company says its raw materials come from plants and have a “minimum impact on the environment”.

Total Produce

Total Produce is one of the largest producers and suppliers of fresh food in the world, operating in 26 countries from 260 facilities spanning farms, manufacturing plants and cold storage warehousing that collectively produce over 300 lines of fresh food products. It has operations in North and South America, Europe, South Africa and India. The company serves the retail, wholesale and restaurant sectors. Total Produce does not specifically target the growing trend for vegan and plant-based foods but is a natural beneficiary nonetheless, particularly after it splashed out to buy global fruit and veg giant Dole.

Archer Daniels Midland

Archer Daniels Midland, also known as ADM, is another firm poised to capitalise on growing demand for plant-based foods. The US company supports companies in over 200 countries “all the way from plant to plate” from its 450 crop procurement facilities and 330 food and ingredient manufacturing plants. It has strengths in producing soy meal, oil and sweeteners. ADM recently unveiled a slew of new “on-trend ingredients”, including new plant-based proteins and non-dairy frozen treats, demonstrating it is aware of how consumer diets are changing. However, investors should also be aware that it has a large industrial business and also produces animal feed.

Hain Celestial Group

Hain Celestial Group is a natural food producer spanning North America, Europe and India. The company has well-known brands that feed off growing demand for healthier, plant-based alternatives, such as its Almond Dream, Better Bean and Yves Veggie Cuisine, in addition to a smaller portfolio of personal care products. It makes most of its money in the US and the UK. Hain Celestial is another firm that looks set to benefit from changing diets, with an ambition to create “organic, natural and better-for-you brands”.

Investing in vegan VCTs

Investors can also gain exposure to this area through Venture Capital Trusts, or VCTs. There is a wide variety of VCTs that have dipped their toes into the vegan and plant-based food and wellness categories but it is important to understand that VCTs tend to have broad fields of interests, meaning they may hold investments in other areas that are less appealing to vegan investors such as meat production.

For example, Octopus Titan VCT has backed the likes of allplants, which delivers frozen plant-based meals to subscribers, and Plum, which produces organic plant-based foods for children and babies. But its portfolio spans everything from energy to property to healthcare. Similarly, Pembroke VCT has investments in companies like Plenish, a UK-based alternative milk and cold-pressed juicing business, but again has investments in other firms, like burger outlet Five Guys, that may reduce its appeal.

One of the biggest benefits of investing in a VCT is that it can allow you to gain exposure to private companies that are not publicly-listed. The fact they hold a variety of investments in multiple sectors also reduces risk.

Investing in vegan commodities

A third way of gaining exposure to this trend is by trading the commodities that underpin vegan and plant-based diets. As the world starts to reduce its meat intake and consume more plants, demand for common agricultural products should increase while new, more exotic ingredients are likely to become more popular. Beans, grains, soy, nuts, fruit and veg, vegetable oils and seeds are just some of the common staples of a vegan diet.