How Sainsbury’s, Tesco and even discounters Aldi and Lidl reined in property expansion plans and ended the supermarket turf wars

In the never-ending quest for growth, for decades supermarkets held a major arsenal in their weaponry – land.

But not any more. Sainsbury's today revealed it took a £682m writedown on its property portfolio in another sign the decades-long land grab by supermarkets has failed to pay off. Tesco's property writedowns run into the billions of pounds, while 43 stores have closed. Both those supermarket heavyweights, along with Morrisons, have mothballed planned developments.

In a well-documented tale of woe, supermarkets' sales have fallen, costs and margins have been squeezed and shoppers have moved online, meaning a once-sound investment in land to build new stores, expand existing locations, or even prevent rivals from building new stores, has become a burden.

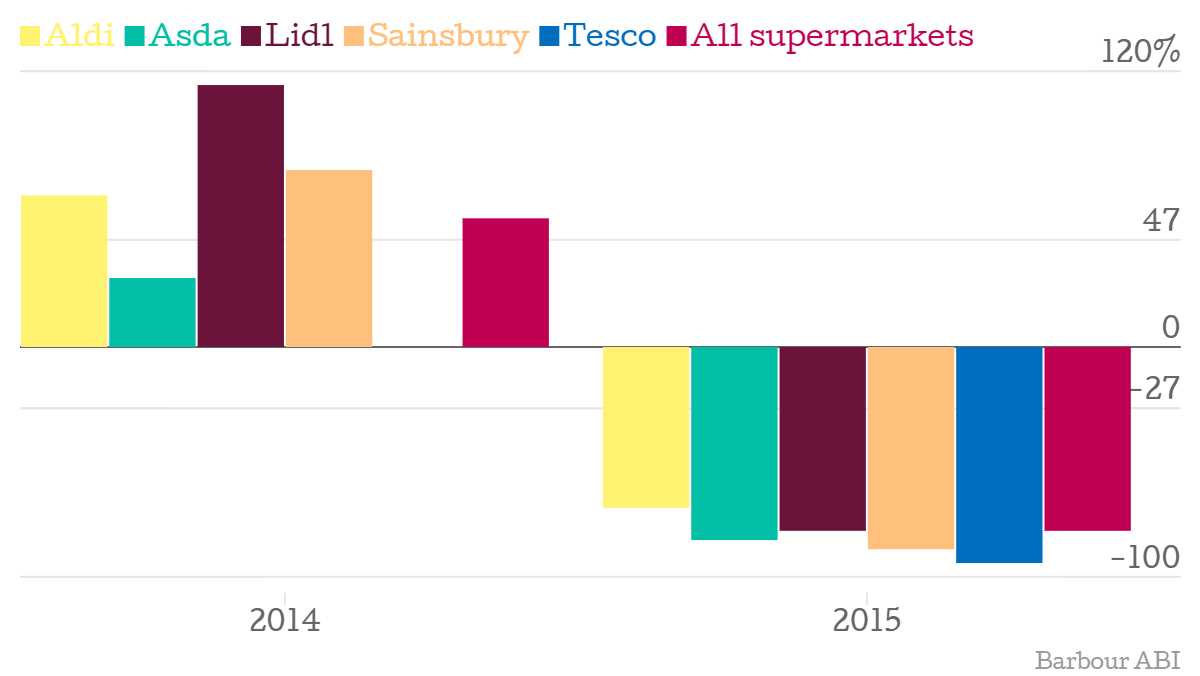

The sharp end of that has been felt over the past 12 months, with the overall value of supermarket expansion through new projects plummeting 77 per cent this year. That compares to 2014 when the value of planned developments grew 39 per cent on the previous year.

Sainsbury's experienced the steepest fall in the value of its projects, falling from more than £75m in 2014 to less than half a million for development projects in 2015 and beyond.

However, it's not just the "big four" – the value of these expansion projects fell across all supermarkets.

Change in value of property projects

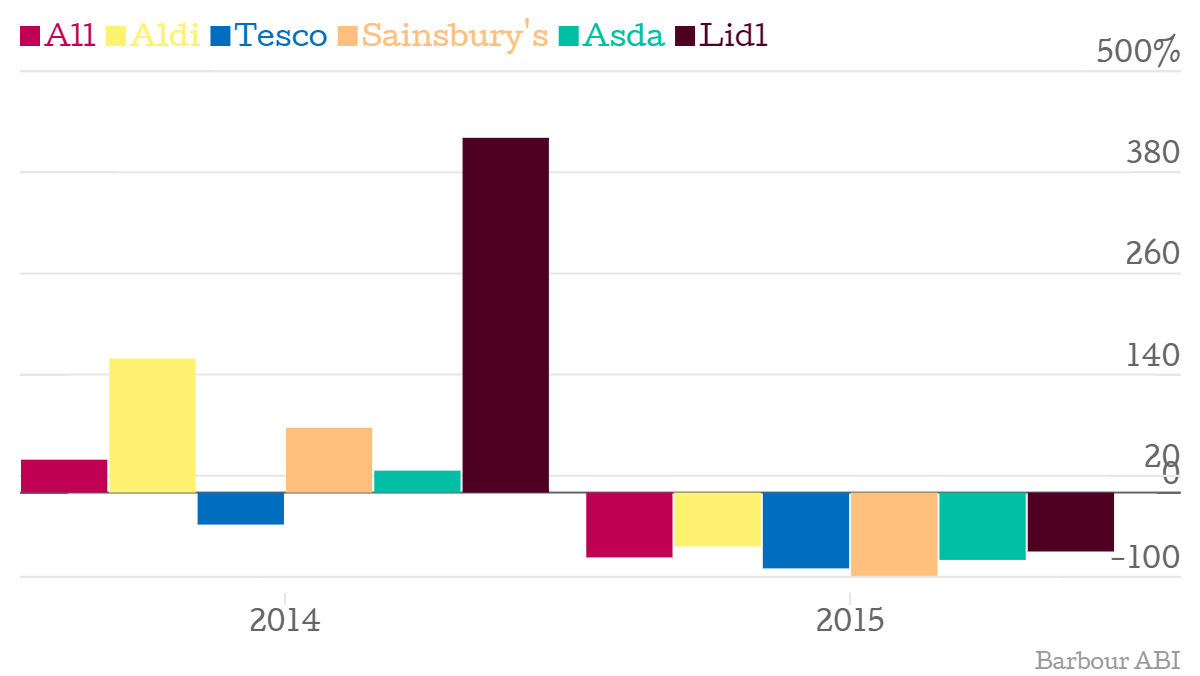

While the discounters may be stealing a march on the "big four", when it comes to its expansion plans this year, all six have reined in its development projects – although Aldi and Lidl hold five times the number of planning applications of Sainsbury's, Tesco, Asda and Morrisons combined,.

Across the board, the number of developments fell 80 per cent on last year.

Change in number of property projects