How strong might the UK’s post-Covid economic recovery be?

It has been a tough start to the year for the UK. As lockdown restrictions continue to slowly ease, we examine the progress made in tackling the Covid-19 pandemic, and whether hopes for a strong economic recovery are well founded.

Vaccines offered hope, speedy inoculation will solidify the recovery

A year on from the start of the pandemic, the UK has generally underperformed. It has seen some of the highest infection and fatality rates, one of the worst recessions, and numerous lockdowns.

However, its success in rapidly vaccinating its population will aid recovery.

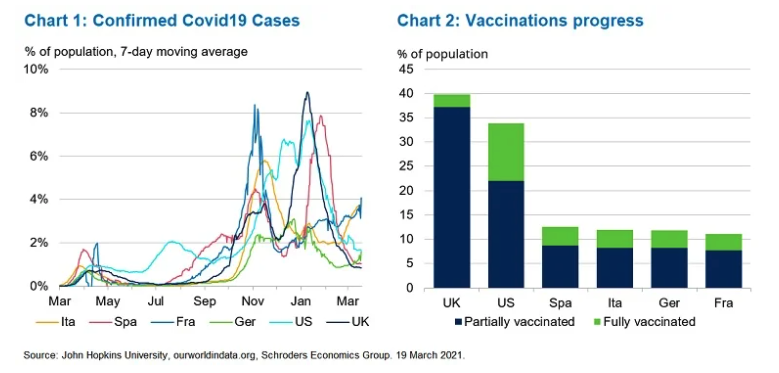

The UK currently has one of the lowest numbers of confirmed Covid-19 cases (see chart 1) and 37.2% of the population has received one of two doses, while 2.6% is now considered fully vaccinated (chart 2).

The decisions to place early and large orders of vaccines, along with spreading the stock thinly through the population, appear to be paying off.

Progress will slow in the coming few weeks as supply issues delay first jabs. Meanwhile, Europe’s progress is woefully behind, which is already leading to lockdowns being extended.

What does the “road to freedom” mean for the economy?

On 22 February Prime Minister Boris Johnson outlined a “one way road to freedom”. Schools have reopened and non-essential retail is expected to re-open from 12 April. Hospitality is to follow from 17 May, with remaining restrictions removed from 21 June. This is somewhat slower than we had expected, but sufficient for us to upgrade our UK growth forecast.

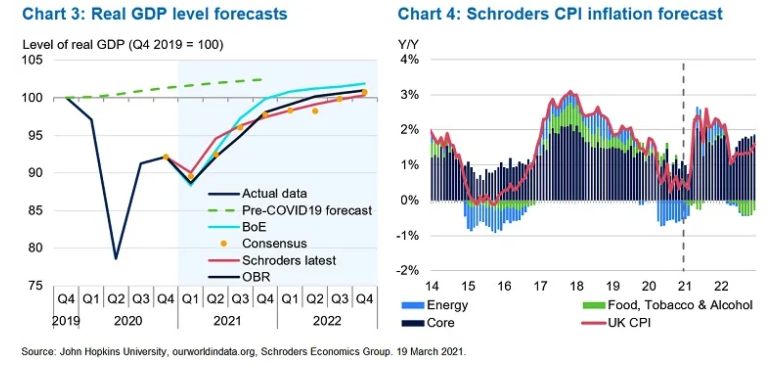

We now forecast real GDP growth to rise from -9.9% in 2020 to 5.3% in 2021. The first quarter is likely to see a larger contraction than previously expected, but the economy should more than offset this in the following quarters.

We have revised up our forecast for 2022, from 4.5% to 5.1%. This is partly due to improved business confidence, but also an upward revision to our estimate of household savings.

Overall, our forecast is for the economy to complete its recovery – that is, the level of GDP to rise back above its pre-pandemic peak – in the second half of 2022 (chart 3).

As for inflation, we have revised our forecast up largely due to a rise in wholesale energy prices (chart 4). Compared to our November forecast, the price of a December 2021 contract for Brent Crude has risen by over 30%.

Core inflation (excluding energy, food, alcohol and tobacco), is due to rise as the effects of the “eat out to help out” scheme and VAT reduction on hospitality services fade. Though headline inflation is forecast to rise above 2% in the near-term, by 2022, inflation is then expected to fall back below 2%.

Discover more from Schroders:

– Learn: The pros and cons behind the SPACs craze sweeping the market

– Read: The equity sectors best at combating higher inflation

– Learn: FOMO market is over – what next?

Two vulnerabilities to watch

1. The build-up of inventories

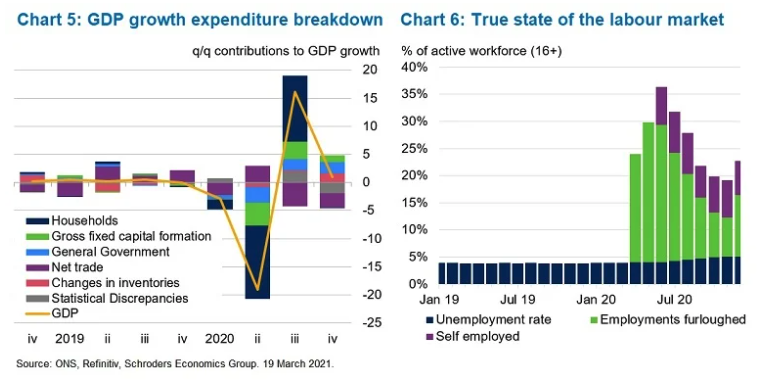

The latest trade release brought to light the extent of the disruption to businesses and trade in goods from Brexit. The value of exported goods to the European Union (EU) in January 2021 fell by £5.5 billion (40.5%). Imports were down £6.6 billion (-28.9%). The fall in the UK’s trade deficit with the EU unwinds the sharp 20% increase seen at the end of 2020.

Interestingly, the build-up of inventories helped the UK avoid a technical recession, as it boosted GDP growth at the end of last year (chart 5). However, it now means that inventory levels are very high, and UK companies will probably reduce production, and possibly even discount stocks, in order to clear excess inventories.

2. Furlough dependency

The second cause for concern is the high dependence on the furlough scheme. Despite asking firms to pay part of the contribution for furloughed staff, chancellor Rishi Sunak backtracked with the full cost of the scheme again shouldered by the exchequer.

The official unemployment rate was 5.1% in the three months to December 2020, but this excludes 4.7 million employees furloughed (13.8% of the working population), 2.2 million self-employed workers receiving aid (6.4%), or the estimated 3 million self-employed that have been “excluded” from receiving aid (8.8%).

The true unemployment figure is likely closer to 20% (chart 6).

As the economy opens up, and support is withdrawn, we do expect the official unemployment rate to rise to over 6%. The re-opening of businesses is likely to help most of those currently furloughed back to employment.

Policy response: spend, spend, tax?

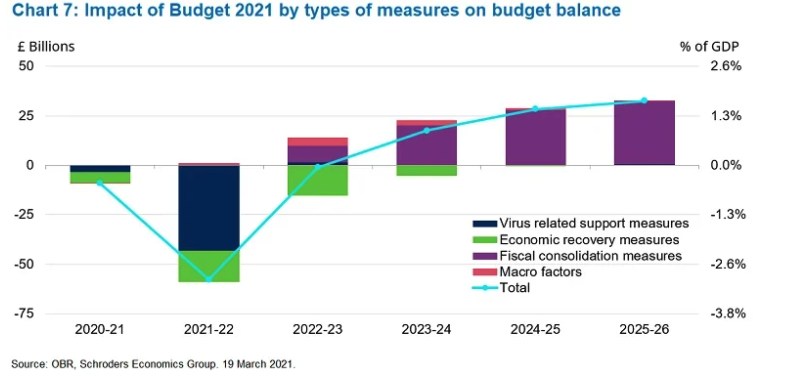

In only his second annual Budget, Rishi Sunak extended most pandemic related support measures to September. This would raise borrowing by a further £67 billion (3.4% of GDP) over this financial year and next (chart 7).

Virus-related support measures would then be reduced in 2022-23. This has the effect of capturing more tax as people’s incomes grow.

There was an increase in corporation tax which will make the UK a less appealing base for companies. The hike in the corporation tax rate is the first since 1974. Overall taxation is set to return to highs not seen since the mid-1970s.

There were, however, plenty of incentives to help boost business investment, including the super deduction on investment costs, where companies will be able to reduce taxable profits by 130% of the cost of investment projects.

This has only been introduced for investments on plants and machinery, and is to be capped at 25% of profits. So, while it will help boost demand for construction projects and manufacturers, it excludes the services sectors.

The lack of economic recovery measures is a little disappointing, and the rush to re-introduce austerity seems odd.

Bank of England: optimism returns, but no rush to raise rates

Getting public finances back on track was the other main theme of the budget. The UK’s budget deficit for financial year-to-date stands at £261.4 billion.

Markets had priced in the possibility of the Bank of England cutting interest rates below zero earlier in the year. The committee kept rates and asset purchases unchanged citing better news on vaccinations, the plan to re-open the economy, stronger than expected growth and higher inflation in the near-term.

We continue to expect the BoE to disappoint savers by keeping its main interest rate at 0.1% until 2023, and to maintain current asset purchases until the end of this year.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.