How much should I be saving for retirement?

Investors globally are saving actively toward their retirement, but how much is enough?

It is a question that has confounded people for generations: how much is enough when it comes to saving for retirement?

The unfortunate truth is that no one can know for sure. Our desires and needs in retirement change – as do our incomes during the course of our lifetime. That is before mentioning many of life’s other uncertainties.

The investment industry’s general rule of thumb is to save at least 15% of your pre-tax income each year. That’s assuming you save for retirement from age 25 to age 67. Together with other factors, this broad rule should help you achieve the same standard of living you enjoyed in your working years when you reach retirement although this is not guaranteed.

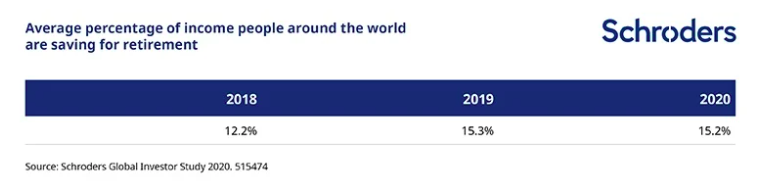

Reassuringly, on average, investors around the world are saving slightly more than industry guidance.

Schroders Global Investor Study (GIS) 2020 found, on average, investors are saving 15.2% of their income specifically for their retirement.

GIS is an independent online survey of more than 23,000 investors across 32 worldwide locations was conducted between 30 April and 15 June 2020.

The 2020 figure is only slightly lower than 2019 (15.3%), despite the pandemic which has torn through the globally economy and jobs market. It also remains much higher than it was in 2018 (12.2%).

- Find out more about Schroders Global Investor Study 2020 by visiting www.schroders.com/gis.

Where does the responsibility lie for retirement savings?

The rise in retirement savings could perhaps be attributed to the growing realisation that people can no longer rely on government provision in the form of state pensions to help significantly fund retirement.

More than half of investors (55%) agreed that the state provision for retirement is not enough to live off, according to GIS 2020.

It may also be that some countries have actively adopted policies to shift the responsibility for funding retirement from the state to individuals.

For instance, the UK has introduced initiatives such as auto enrolment. That means an employee is automatically enrolled into their company’s pension scheme. At the same time, the UK is increasing the ages at which people can qualify for state pensions.

However, the constant changing of the rules has undermined investors’ confidence, so much so that some don’t even see the point in trying to save specifically for retirement at all.

Who is likely to be worse off?

Avoiding saving for retirement is not the answer. It creates bigger problems further down the line. But there is also potentially an issue for those that are uncertain as to whether they are saving enough.

GIS 2020 found that where there was an element of uncertainty, people tend to save less – not more. Those investors who describe themselves as undecided as to whether they are saving enough for retirement are only saving 13.9% of their income. That is less than the recommended 15% and much less than those investors who thought they were saving enough (16.8%).

Rupert Rucker, Head of Income Solutions, said: “It is simply disastrous not to think about saving for retirement. Previous generations benefitted from generous final salary pensions and more certainty over state provision, but that is no longer the case.

“Though it may not feel like it, even if you can only put a small amount away it can still make a big difference.

“The earlier you start saving the more you can benefit from the miracle of compounding. The concept simply involves earning a return not only on your original savings but also on the accumulated interest that you have earned on your past investment of your savings.

”If your money is invested it means it is doing a lot of the work for you. An earlier start makes it less likely that you will have to save a larger percentage of your income later in life.”

Retirement savings should be more of a priority

Perhaps one of the most difficult aspects of saving for retirement is making it a priority, and picturing your ‘future self’. How will the future you want to spend your time? How much money will you want to spend? And where will you want to live?

And if these answers aren’t immediately clear, it’s easy to fall at the first hurdle and simply never think about retirement savings until you really have to – by which time it may be too late. Historically this has been true, with many people failing to make later life a priority.

However, the GIS 2020 shows that this attitude is changing.

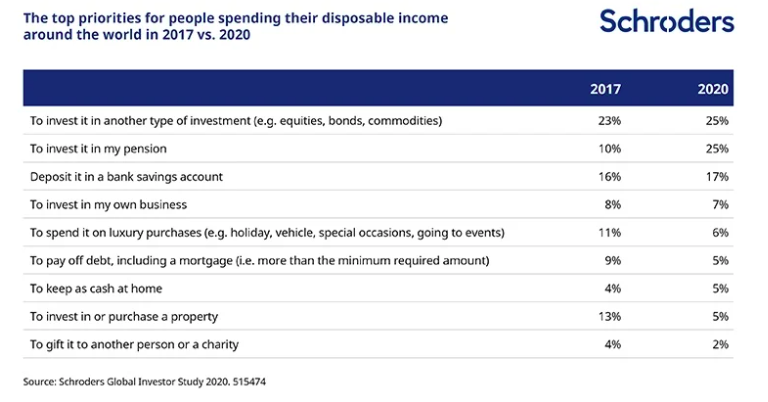

It revealed that pension investing is a joint top priority when it comes to investors use of disposable income (see table, below). This is a far cry from just three years ago when only 10% of people considered investing in their pension first.

Investors also recognise that in an era of low interest rates they need their money to earn a return higher than they are likely to get from cash.

A quarter of people (25%) invest another type of investment (e.g. equities, bonds and commodities), compared with 17% depositing money in a savings account.

Interestingly, spending on luxuries and property investments have dropped down in respondents priorities. This could be linked to a greater sense of caution as the impact of the coronavirus continues to unfold.

- Find out more about Schroders Global Investor Study 2020 by visiting www.schroders.com/gis.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.