How much is Donald Trump worth? Judging by his Scottish golf resorts, not as much as you think

You might have missed the news in the avalanche of election stories pouring out of America, but earlier this month, Donald Trump received planning approval for a new golf course at his Aberdeenshire resort.

But before you get too excited (or outraged), understand that it is unlikely to ever be built. The President’s Scottish properties have been struggling and underperforming compared to their peers, even before Covid-19 struck.

Now, they will likely be haemorrhaging cash.

President Trump likes to project himself as a highly successful businessman — this was, after all, the cornerstone to his pitch to the American people in 2016. But surprisingly little is known about his true financial position.

Claims and counter-claims have been thrown about his wealth for years — from Trump himself, who pitches his fortune at some $9bn, to journalist Timothy O’Brien, suggesting that it is as “low” as $150-250m.

It’s doubtful whether we shall ever know the truth, even now the President’s federal tax returns have been published. But as a small indication, we at Behind the Balance Sheet have compared Trump’s two Scottish properties, Trump International in Aberdeenshire and Turnberry, with two established golf resorts, Loch Lomond Golf Club (considered by cognoscenti to be one of the finest in the world) and the internationally renowned hotel Gleneagles.

Loch Lomond is owned by a Caymans vehicle and we understand (from a member there) that this belongs to its members. Gleneagles was sold by Diageo in 2015 to Ennismore, which previously bought the Hoxton Hotel in Shoreditch.

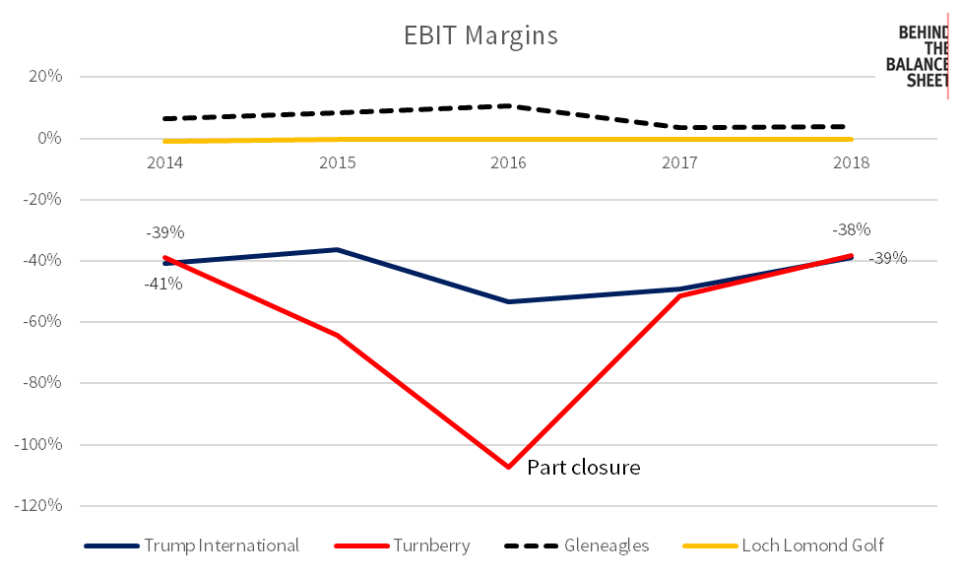

At Trump International, accumulated losses to end-2018 were £13m, compared to £44m at Turnberry, in spite of interest-free loans from the owner and no directors’ fees. Both properties were making losses in 2018 (when the last accounts were last filed). In that time, Gleneagles and Loch Lomond have consistently made modest profits. The chart shows that Trump’s Scottish properties are significantly underperforming these peers (note that Turnberry’s 2016 results were impacted by its redevelopment).

We estimate that Trump has also made significant losses on loans to these companies. Both rely on loans from Trump vehicles, which have injected cash each year. The dollar value of these sterling loans has fallen since the pound weakened after the Brexit vote — Trump experienced an estimated currency loss of nearly $40m to end-2018.

More importantly, his investments are also worth far less than he has put in.

Trump paid $65m for Turnberry and has invested £56m in developing the course in the first five years. We estimate that Gleneagles sold for 2.6 times sales, and on that basis the two Trump properties would be valued at just £56m. There may of course be additional development value, but the initial investments plus accumulated losses and capital expenditure mean that Trump’s losses are significant — we estimate on this basis over £150m to the end of 2018.

By the end of 2020, post-Covid, the losses will be even greater.

Moreover, there has been a huge opportunity cost to this investment. Had Trump invested instead in a simple S&P500 tracker, we estimate that the total invested and lent to the Scottish companies would by now have accumulated a value of around $420m. This figure is reached by simply assuming that the cash extended to the companies was instead invested in the S&P on 1 January of the following year; reinvested dividends would have added another $35m.

It is clear that the Scottish golf resorts have been a drain on the Trump empire. There has been recent talk of asset sales, with rumours both of the Westchester estate being up for sale and of losses at Trump’s Washington hotel. Journalist David Enrich who wrote Dark Towers, a book about Deutsche Bank, has suggested that Trump owes the bank over $400m, and a recent article in Forbes suggested that he owes over $1bn (although the latter seems to be boosted by debt in vehicles where Trump only has a part interest).

Whatever the answer, the number must be higher today as a result of Covid losses, meaning Trump’s investment into his Scottish properties may be curtailed.

Planning may have been approved, but construction of a new golf course will not begin for some time, if at all.

More about Behind the Balance Sheet can be found here

Main image credit: Getty