How Marks & Spark’s reputation helps to predict its share price

Does it help M&S to be an iconic brand?

It has huge traction in the public mind, which can amplify both its successes and its failures. When it does well, everyone notices – but when it reports disappointing results, and the share price plummets, the story is all over our TV screens. And that doesn’t help.

Buzz

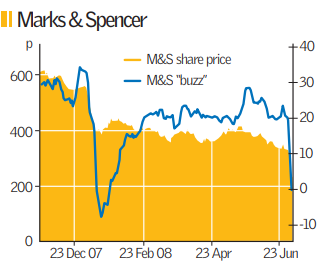

The graph shows Marks and Spencer’s “buzz” as recorded on YouGov’s BrandIndex, and its share price. With most companies, there isn’t much relationship. But it’s very different with the nation’s most symbolic brand. When the share price drops consumers notice. The relationship doesn’t just apply to the big moments, such as last week when the company’s value dropped by nearly a quarter. The correlation between M&S share-price and its “buzz” score (every day we ask the public whether they’ve heard anything positive or negative about the brand) is 0.55 over the last

two years for which we’ve been collecting data, and that is strong. It’s higher than for any of the other brands I’ve looked at.

There’s the rub for M&S: there is also a positive relationship between its “buzz” scores and our other six measures of public perception. In other words, company performance leads to movement in the share price which affects buzz, which affects people’s attitude to the store, which affects its performance and future share-price.

Feedback

People watching their TV screens on Wednesday evening can hardly have found the idea of M&S either cool or reassuring. So an iconic brand can create a kind of feedback loop between the public and stock market. Obviously it’s in the nature of feedback loops to exaggerate effects and create their own momentum — and this effect is certainly visible in the companies studied here.

Next

When we compare BrandIndex scores for M&S and Next, we see bigger drops for Next in its customer satisfaction scores and its general index score. But Next dropped much less in the markets – there were no specific surprises attached to it.

Will this make shoppers regard it as less of a loser than its great rival M&S? And will that become a self-fulfilling prophecy?

Or will the underlying reality have the greater effect if Next soon reports equally disappointing results?

Stephan Shakespeare is co-founder of YouGov