How the geography of global innovation is rapidly changing

Liam Ward-Proud investigates the cities that are attempting to foster new startup cultures

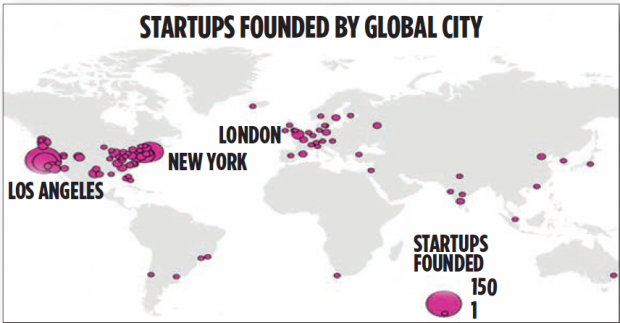

WIKIPEDIA founder Jimmy Wales has called on Britain to extend its entrepreneurship visa scheme to make London more enticing to startups. He joked that “nobody wants to live in San Jose, California – it’s incredibly boring”. But the geography of global innovation is already changing, with cities like London, Tel Aviv, Moscow and Santiago gaining traction. How do they stack up?

LONDON

According to UHY Hacker Young, over 15,000 firms were launched in the year to March 2013 in Tech City alone. And head of Google Campus Eze Vidra believes the key to its success is network density. “With so many skilled individuals packed so tightly together, serendipity can be a very powerful force,” he says. And shared workspaces like Google Campus and Tech Hub “will continue to draw highly talented crowds”, says Matt Cooper of oDesk.

Research by Telefonica Digital found that 81 per cent less capital was raised in London compared to Silicon Valley. But Duncan Clapman of fashion tech startup C-InStore thinks it’s only a matter of time before London catches up – “we’re in our early stages. As the funding ecosystem evolves, capital should be easier to come by.”

TEL AVIV

The Israeli city has developed a specialisation for high-end tech firms, with 63 Nasdaq-listed companies based there in 2009 – more than Europe, India, China, Korea and Japan together. Its most frequently cited advantage is its attitude to risk. Orit Mossinson of venture capital firm Globe International Holdings says that “Israel is a country of immigrants, and they are natural risk takers since they were willing to uproot and start over.” Vidra says that starting a business is “like a national sport in Israel”.

Tel Aviv has an excellent funding structure. The Startup Ecosystem Report 2012, carried out by Startup Genome and Telefonica Digital, says Tel Aviv is equalled only by Silicon Valley in this respect. Despite this, Tel Aviv startups are less likely to tackle bigger markets. The proportion entering markets worth less than $1bn is 46 per cent higher than in Silicon Valley, for example.

MOSCOW

A recent RSM Tenon report into the birth and death rates of global businesses found that Bric nations added a net 4.8m new firms between 2007 and 2011 – a compound annual growth rate of 6.4 per cent. Russia was among the most successful, with 920,000 net new enterprises.

In Moscow, the Skolkovo Innovation Center, founded to “stimulate the development of break-through projects and technologies”, aims to provide a high-tech business area just outside of the capital. This, alongside a 13 per cent tax rate for those with a permanent resident permit, could make Moscow an attractive location. The Startup Ecosystem Report, however, found a “significant funding gap”. And Michael Balkan, managing director at Sociomantic Labs, says that “from a global perspective, Moscow is quite expensive, has a high crime rate, and traffic and climate are a nightmare.”

SANTIAGO

Start-Up Chile, a government initiative, attracted 22 startups from 14 countries in its first year in 2010, providing $40,000 (£25,600) of equity-free seed capital, and a temporary one-year visa to develop projects. Bowei Gei, founder of the World Startup Report, says that “Start-UpChile may go down in the history books as one of the best things to happen to Chile.” Despite this, long-term funding is a serious issue, with Santiago coming bottom out of 20 cities in Telefonica Digital’s Funding Index.