How finding the quality within value was crucial in 2020

There are two broad areas of value in the UK market, financials and commodities, that in aggregate make up around a third of the FTSE All Share index. Within this, however, there are vast differences in both quality and performance. (Please see the end of this article for a glossary of terms).

2020 was a year where it was important for a UK investor to distinguish between “value traps” and “quality at a reasonable price”.

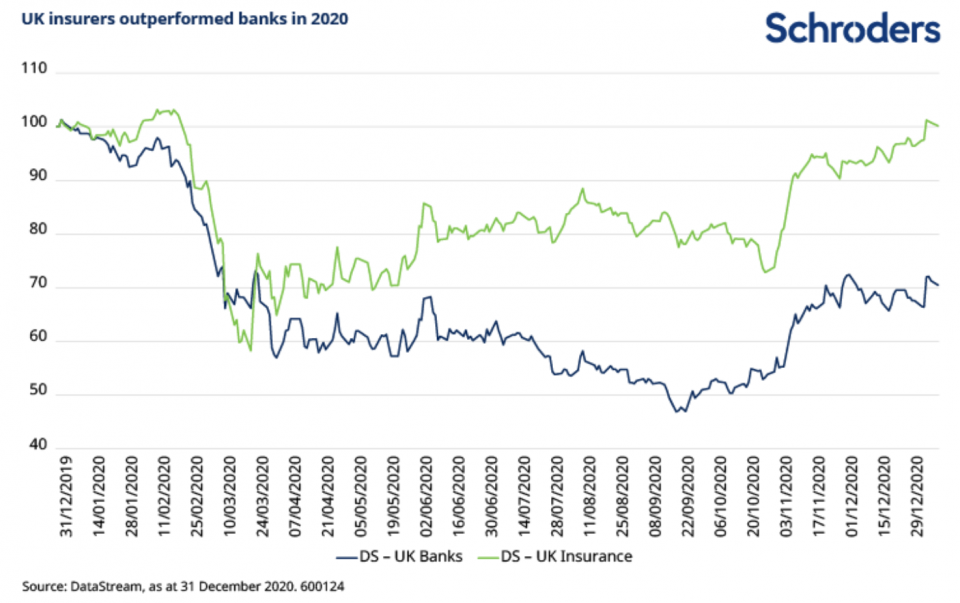

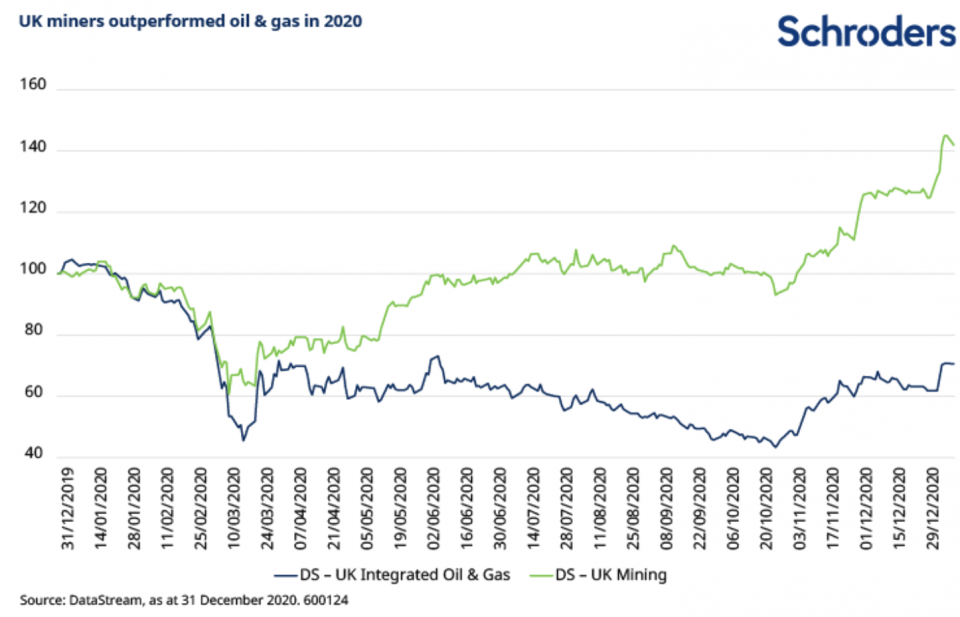

We illustrate this with two sector examples: insurers compared to banks, and miners compared to oil stocks.

Insurance vs banks

In March 2020, at the start of the Covid-19 crisis, the UK’s financial regulator (the Prudential Regulatory Authority) allowed insurance companies to continue to pay dividends but decided that banking dividends should be scrapped and remain capped at low levels for 2021. Why was this?

The answer lies in the various regulatory regimes on capital requirements. The Solvency II regulatory regime for insurers is now more mature and stable compared to the alphabet soup of ever-changing banking capital regulations.

The other nuance has to do with risk. Insurance companies’ assets tend to be dominated by high quality bonds held to maturity with default risk very low, even in times of global crisis. Bank balance sheets are more open to default via unsecured loans and higher risk loans to small and medium-sized enterprises (SMEs).

Coming into the Covid crisis, both sectors traded with dividend yields in the 6-8% range, but one industry has paid out these handsome dividends and the other has not. You can therefore see why the insurance sector has outperformed the banks both in recent years and again in 2020.

Discover more from Schroders:

– Learn: Outlooks 2021: What can we expect n the coming year?

– Read: Is the vaccine the shot in the arm the market needs?

– Watch: How climate change could affect your investment returns?

Miners vs oil companies

These are two very capital intensive sectors and both have chequered pasts on capital allocation, particularly during the “supercycle” years of the 2000s. However, there are a few key differences which in 2020 led to a huge divergence in performance.

Firstly, the large mining companies de-geared their balance sheets (i.e. reduced long-term debt) in a big way following the trouble after the last cycle ended in 2013/14. Despite six years of low metal prices, miners’ balance sheets have been buttressed by capital discipline, disposals, and consolidation.

Now, the iron ore and copper markets are dominated by three or four global players that have a high level of supply discipline. As we head in to the 2020s, and as the world electrifies its energy and transport networks, metals such as copper, cobalt, and nickel are to be increasingly in demand. Indeed, copper prices hit a seven-year high in December 2020.

The oil majors, on the other hand, have failed to de-gear their balance sheets. This is partly because oil prices remain low, but also because they have been forced to invest in growth to replace declining barrels. They have also faced pressure from shareholders to reinvent themselves as renewable players in the long term, which could end up being a very costly transition.

Secondly, geology plays a role. Miners have decades-long mine lives, sometimes even as much as 70 or 80 years (for some Rio Tinto and BHP Billiton mines) compared to the oil reservoirs that decline quickly over a decade or so. In this sense, oil is a more capital-intensive industry and investment decisions have to be made with more urgency than for miners who can wait many years to invest when the time is right.

Lastly, there is a wedge appearing between the two with regard to fossil fuel generation. The large FTSE-listed miners are increasingly moving away from coal and other fossil fuels and investing in ore assets that will enable the electrification of the world.

Focus on finding quality

Our investment process involves seeking out quality at a reasonable price. The key arbiter of quality for financials tends to be return on equity through a cycle, and for capital intensive sectors like miners and oil stocks it is return on invested capital.

For the insurance stocks, returns have been in the teens/twenties compared to the banks in the mid-single digits. This means the difference between the amount of capital generated to fund ongoing dividends is like the difference between night and day. It is the same story in the commodity space where the large diversified miners are seeing return on capital in the teens compared to single digits for oil majors.

As investors, our main focus is in buying stocks with high returning cashflow streams, regardless of whether they be in growth or value industries. Keeping that focus on quality was an important lesson for 2020, and will be for the coming year as well.

- For more on what lies ahead for the investors in 2021, please see our article Outlook 2021.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.