How do retail investors feel about returns from sustainable investing?

We have all heard the story: sustainable funds are in high demand. By the middle of 2021, their assets had reached an unprecedented $2.3 trillion, mainly driven by continued growth in the European fund market (Source: Reuters).

Net sales in the first half of 2021 had already overtaken those in 2020, which in turn were more than double those in 2019, which were more than double those in 2018.

Such spectacular growth could be driven by a number of things, such as strong performance (particularly in 2020), new fund launches or existing funds being repurposed to add a sustainability tilt. The fund sales numbers would indicate that it is not just a function of increasing supply. Retail investors genuinely want to buy more sustainable funds.

So what makes people attracted to sustainable funds? To what extent is this driven by return expectations? Our flagship Global Investor Study can offer several insights.

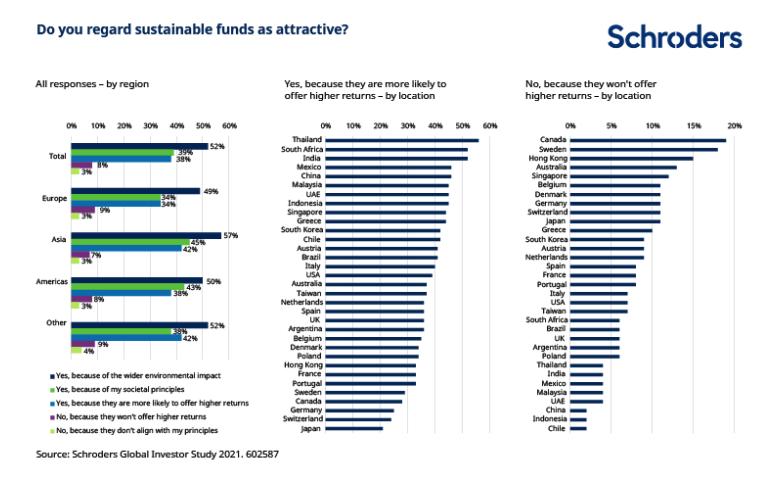

Insight 1: Returns matter to people, but not as much as environmental impact

The results are clear: the most important driver of interest in sustainable funds is the environmental impact they could have. The potential for higher returns matters, but it comes further down the pecking order.

This is consistent across regions, but notably investors in Europe, which has the largest sustainable fund market around the world, are less likely to be influenced by return expectations than other regions. This is consistent when we look at countries within each region, for example, Germany and France compared with the US and China.

In all regions and most countries, only a small percentage of people are put off sustainable funds because of performance concerns. Interestingly, performance scepticism is higher in a number of countries which have been more traditionally associated with sustainability, such as Sweden, Denmark and Germany. US and Chinese individuals, in contrast, seem to be less put off by worries about performance.

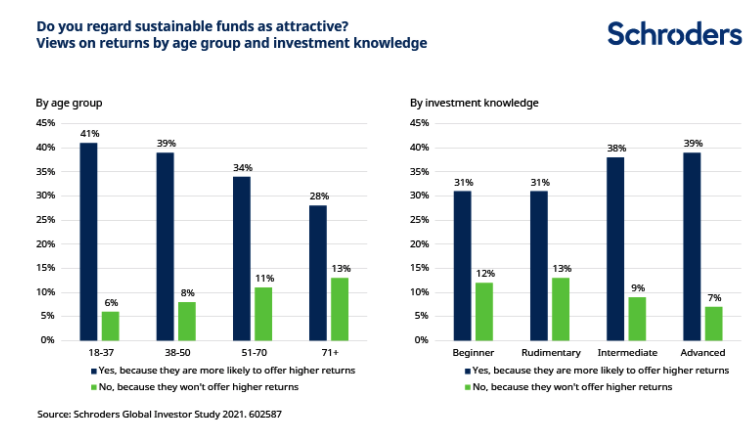

Other Global Investor Study results have shown that younger investors and investors with higher levels of expertise are more inclined towards sustainable investing generally. Consistent with this, they are also more likely to view the potential for higher returns as a positive for sustainable funds.

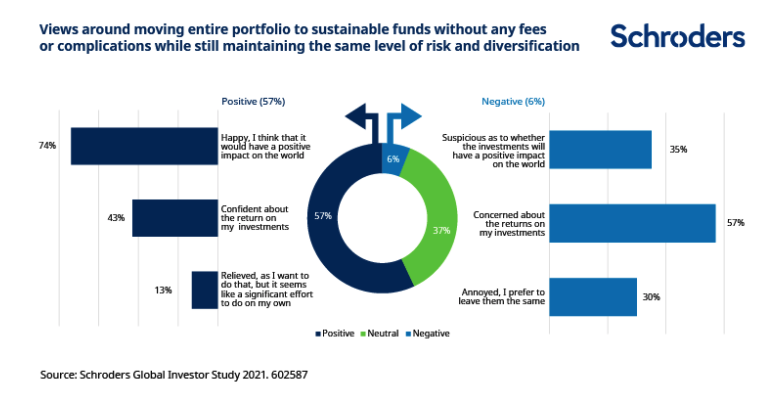

Insight 2: Most people would be happy to move their entire portfolio to sustainable funds, but sceptics are held back by return concerns

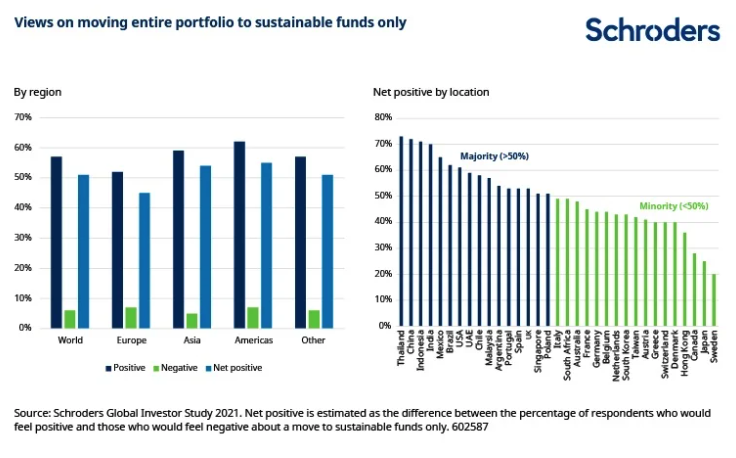

Retail investors are quite open to the possibility of their entire portfolio shifting to sustainable funds (assuming the same level of risk and diversification). Again, their reason for feeling positive about this suggestion is less about performance and more about having a positive impact. However, for the small percentage of people who feel negative about the idea, return concerns are the biggest hurdle.

Indeed, when it comes to why people would feel positive or negative about the portfolio shift, the responses are very consistent across the board. For people who are positive about it, impact ranks ahead of returns in driving that view. But for people who are negative about it, return concerns dominate. This is independent of region, age group and investment knowledge.

Once more, European investors seem less welcoming of a complete portfolio move to sustainability compared to investors in other parts of the world, such as major Asian markets and the US.

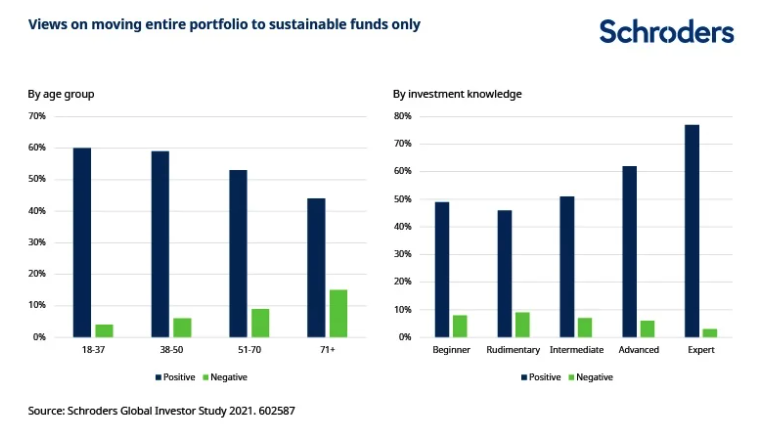

And again, younger investors and those with greater investment knowledge have more positive views around changing their portfolio to be sustainable only.

Insight 3: More than anything, it is evidence that sustainable funds delivering better returns would incentivise most people to increase their sustainable investments

The earlier results highlighted that most people invest in sustainable funds to have a positive impact, and that most people would also be happy to move to a sustainable-only portfolio for the same reason. In both cases, returns matter but take lower priority – other than for the sceptics, where their return worries are the biggest disincentive.

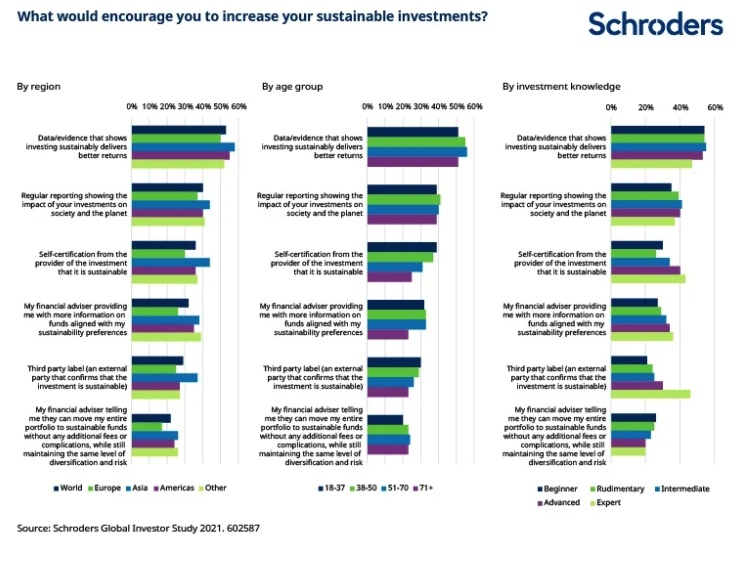

But the Study also highlights a seemingly contradictory result. Namely, the thing that would make most people increase their sustainable investments is data or evidence that investing sustainably delivers better returns. This is by far the strongest trigger compared to other possibilities such as regular impact reporting or third party sustainability labels.

Importantly, this result holds independently of region, age group and investment knowledge level.

In other words, while returns may not be the most important driver of most people’s views on sustainable investing, they have the potential to be the biggest accelerator of change.

Viewing sustainability as both an investment input and an investment output

There is a wide debate raging on the topic of sustainable investing and performance, with strong views on both sides. It can be argued that more sustainable businesses will be more resilient to risks to their business models. High carbon emitters, for example, are likely to face increasing pressures. Others argue that if that is already reflected in the price then returns for more sustainable strategies won’t necessarily benefit. And that forcing constraints on a portfolio can only result in worse outcomes.

We have written why, theoretically, one might expect companies with strong sustainability credentials to underperform but, importantly, why this doesn’t have to happen in practice. Different factors are at play, such as to what extent the market is pricing sustainability risks correctly, how these credentials are assessed and how blurred the line is between fundamental and sustainability analysis.

But should people expect a specific level of return from sustainable funds? The results of our Study would imply that, broadly, there are two groups of people. The first group are those who view sustainability as that little extra, that magic ingredient that can lead to higher returns. The second, much smaller, group are those who view sustainability as a portfolio constraint and as such, it can only lead to a worse or suboptimal risk-return outcome than if there were no such constraint.

What they both have in common, is that they view sustainability solely as an input. But what if sustainability is not only an input but also an output?

We could be thinking of sustainability as an outcome where it is all about sustainable business models that can identify trends, risks and opportunities and adapt in an ever-changing environment. This is how value is created.

Investors have many tools at their disposal in order to assess which businesses operate sustainably. Some tools involve financial metrics. Some are non-financial. Some cannot even be quantified properly, like culture. Taking sustainability factors into consideration is about broadening the toolkit and using multiple lenses to assess if a company is likely to continue to operate and grow.

A company that is harming people and/or planet while creating profits is not sustainable. Its social licence to operate will expire sooner or later through litigation, consumer action, policy action etc.

There are different approaches one could take to get to address this and achieve sustainability. One may involve screening, which is probably where the perception of a constraint originates. Another may involve targeting an outcome alongside returns such as impact or thematic investing. Yet another may involve active ownership, which is using your influence as an investor to help a company improve and become more sustainable.

At the end of the day, it matters very little what road to sustainability one takes. It is the end-station that is important: sustainable businesses underpin sustainable returns.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.