How digital currencies can generate BILLIONS in tax revenue

According to HMRC, in order for stamp duty to be applied on the trading of cryptocurrencies “they would need to meet the definition of ‘stock or marketable securities’ or ‘chargeable securities’ respectively. However, as of the original date of publication of this paper, HMRC’s view is that existing exchange tokens would not be likely to meet the definition of ‘stock or marketable securities’ or ‘chargeable securities.”

Moreover: “HMRC does not consider exchange tokens to be currency or money, so they do not meet the definition of ‘money’ for Stamp Duty consideration purposes. They will also generally not count as ‘stock or marketable securities’.”

Meanwhile, as recently reported: “Increased trading activity amongst retail shareholders through lockdown is set to help deliver a £1.5 billion boost to stamp duty receipts over the next two years”.

Surely then, HMRC and tax authorities in other jurisdictions will be lobbying their governments to introduce legislation so that, ideally, all trading carried out by citizens will be liable for stamp duty, or the equivalent.

This could prove to be difficult, however, where the exchanges are not regulated and/or not based in the country where the relevant tax authority is located. Exchanges/platforms which are regulated to trade stocks, shares and cryptocurrencies do exist, such as e-Toro, so it would be very easy for these exchanges to levy stamp duty or some form of trading tax.

In Germany, Swarm Markets, which claims to be the only regulated DeFi exchange globally could, in theory, also levy a transaction tax (stamp duty) since having carried out KYC to sign up a client, it could remit the tax collected to the relevant jurisdiction where the client is taxable.

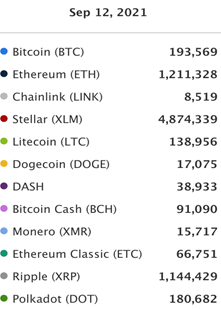

With more than 70 million digital wallets now in existence the volume of digital assets is only set to rise. The table below shows a snapshot of the number of transactions on average per day, for just eleven cryptocurrencies.

Number of daily transactions for the top 11 crypto…

Source: Statista.com

Furthermore, a report published by a data acquisition and analysis company, dAppRadar, highlights that:

- NFTs generated $10.67 billion in trading volume during Q3, an increase of 704% from the previous quarter. Axie Infinity, just one NFT collection has now traded over $2billion historically

- the DeFi total value of asset locked-in rose 53.45% in the last quarter to reach $178.12 billion

- the Blockchain industry grew 25% quarter-over-quarter and 509% year-over-year in terms of Unique Active Wallets (UAW), reaching 1.54 million daily UAW on average during Q3 2021

- on-line games attracted UAW increasing by 140% in the last quarter, with reports claiming that 44% of gamers have purchased or traded game-related items on the Blockchain in the last year.

With trading volumes and assets such as the above, it acts as a powerful driver for those governments, having run up huge deficits due to COVID-19, to look at new ways in which to raise revenue from taxing digital assets. Interestingly enough, there is no reason why smart contracts could not be employed in order to automatically calculate and deduct a small transaction tax for every digital asset traded.

Now, wouldn’t that be ironic for tax authorities globally to be using blockchain technology to collect tax revenue on assets not regulated by their own jurisdictions? But, then again, under the 5th Money Laundering Directive in Europe (and an increasing number of other jurisdictions), regulators are insisting exchanges and platforms must carry out KYC and AML checks on clients even though the assets that are trade and listed on the platforms are not, themselves, regulated – or in some cases, not legally recognised.

Whilst it is difficult to gather any exact numbers based solely on the daily turnover of the top 10 cryptocurrencies in a 24-hour period, according to Coingecko, turnover on November 2 was $338billion. Therefore, if you assumed 365 trading days and then levied a transaction/stamp duty tax of 0.5%, this would raise $600+billion!

Now Mr Taxman, surely this must grab your attention?