BP’s share price shows it’s weathering the oil price crisis – in charts

BP has suffered under the pressure of falling oil prices, as the continued low cost of the black stuff reshapes the oil industry.

The company’s results, released today, showed a 20 per cent drop in profits – which, amazingly, was still above market expectations. Analysts expected earnings could fall to $1.28bn (£840m), but in the event, they came in at $1.6bn (£1.05bn).

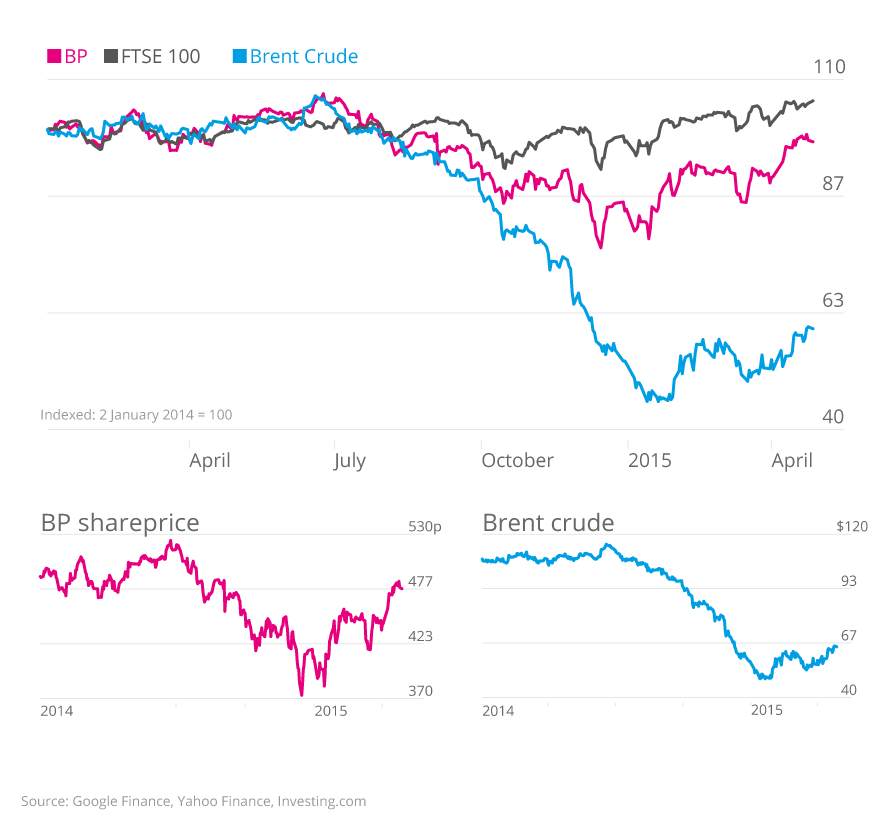

The market knows what's coming from oil companies: Brent crude averaged out at just $54 a barrel during the first quarter, exactly half what they were for the first three months of 2014. BP’s profits and share price have suffered, and it’s being forced to re-balance; selling off assets and abandoning projects.

More pain is expected, as BP group chief executive Bob Dudley pointed out:

We are resetting and rebalancing BP to meet the challenges of a possible period of sustained lower prices. Our results today reflect both this weaker environment and the actions we are taking in response.

Its response seems to have kept investors sanguine: in recent months BP’s share price has followed the FTSE more closely than it has the price of crude oil.

This means it is fighting a decent rearguard action and managing the crisis to a level where results are surpassing expectations. Its troubles aren't over completely, but the company could be doing a lot worse.