How badly will the UK unemployment rate spike when furlough ends?

Chancellor Rishi Sunak’s furlough scheme has so far saved the UK unemployment rate from sharp increases during the coronavirus lockdown, but it is drawing to an end.

Consequently job losses are set to spike after furlough concludes in October, according to economists. Currently the government is paying 80 per cent of over 9m British workers’ wages.

The unemployment rate barely changed between March and May over lockdown. But below the surface, it is clear there are signs of an unemployment crisis ahead.

The unemployment rate is unchanged at 3.9 per cent. But the Office for National Statistics (ONS) said the number of hours worked have plummeted 17 per cent since the start of the pandemic.

And 650,000 people have still lost their jobs despite the scheme.

This, economists agree, means UK unemployment will likely worsen dramatically when the chancellor ends his furlough scheme in October.

“The unemployment rate will surge over the coming months as people re-engage with the labour market and job losses crystallise when the [furlough] scheme ends,” said Samuel Tombs, chief economist at Pantheon Macroeconomics.

Pantheon Macro expects the unemployment rate to push higher than the 8.5 per cent peak in the wake of the 2008 financial crisis later this year.

Furlough scheme masks the extent of the UK’s unemployment crisis

Sunak introduced his job retention scheme in March to help struggling companies. Under it, the government pays 80 per cent of furloughed employees’ wages.

The most recent job retention scheme statistics show the scheme has saved 9.4m people from redundancy.

“The damage to the labour market has been substantially limited by companies’ ability to furlough workers under the government’s Coronavirus Job Retention Scheme,” said Howard Archer, chief economic advisor to the EY Item Club.

The EY ITEM Club predicts the UK unemployment rate will hit nine per cent late in the year before stabilising and then starting to fall back.

“However, there is a risk that unemployment will rise more than this,” Archer added.

Indeed, the Office for Budget Responsibility (OBR) predicted earlier this week that around 15 per cent of those on furlough will lose their jobs when the scheme ends if a second wave of infections hits the UK.

There may well be a round of redundancies ahead of the end of the furlough scheme as companies adjust to the so-called new normal.

A recent survey by the British Chambers of Commerce found almost a third of companies are planning to make job cuts in the next three months ahead of the end of furlough.

And many big employers have already announced substantial cuts, including retailers Boots and John Lewis. Easyjet, British Airways and Virgin Atlantic have also announced a swathe of job cuts. Travel restrictions have had devastating impacts on airlines’ bottom lines.

By City A.M.‘s count, job cuts relating to coronavirus already top 85,000 roles around the UK.

UK unemployment rate predictions

Unemployment rate predictions

EY Item Club: 9 per cent

Pantheon Macro: >8.5 per cent

Capital Economics: 7 per cent by mid-2021

Current government measures are not enough

Calls to extend the furlough scheme beyond the autumn to keep the UK unemployment rate down are multiplying.

Stephen Evans, chief executive of the Learning and Work Institute, urged the government to consider a “flexible extension to the scheme, and put in place urgent support for those at risk of losing their jobs”.

It echoes calls by the Labour party to extend the furlough scheme beyond its October end for workers most at risk.

Shadow chancellor Anneliese Dodds has also asked Sunak to develop a scheme to help businesses hit by local lockdowns.

Sunak has insisted the scheme will wind down in October. But last week he unveiled further measures to stem any surge in the UK unemployment rate.

This included the £2bn Kickstart Scheme. That will create hundreds of thousands of jobs for 16 to 24-year-olds.

Some sectors will bear brunt of job cuts

However, KPMG has called for the UK government to intervene further. It called on the government “to stem the rise in unemployment and facilitate the move to new employment”.

Sectors most at threat like tourism and leisure will see permanent structural changes. KPMG predicts between 200,000 to 1.1m of low and mid-skilled workers will lose their jobs.

“This is both a challenge and an opportunity for government,” the firm added. “Now is a chance to create training and skills programmes to help workers transition to higher-skilled jobs.”

Andrew Wishart, chief UK economist at Capital Economics, predicts a seven per cent UK unemployment rate come 2021.

“Of course, there will be another wave of layoffs when the furlough scheme ends,” he said. “We think that this will cause the one per cent fall in employment we have seen so far in this crisis to grow to five per cent.”

That would be twice the size of the fall in the last financial crisis. “And the unemployment rate [wil] rise to seven per cent in mid-2021. But with the furlough and self-employed income support schemes currently supporting over 12m workers that would be a good result.”

Jing Teow, senior economist at PwC predicts labour demand could fall by around five per cent in 2020.

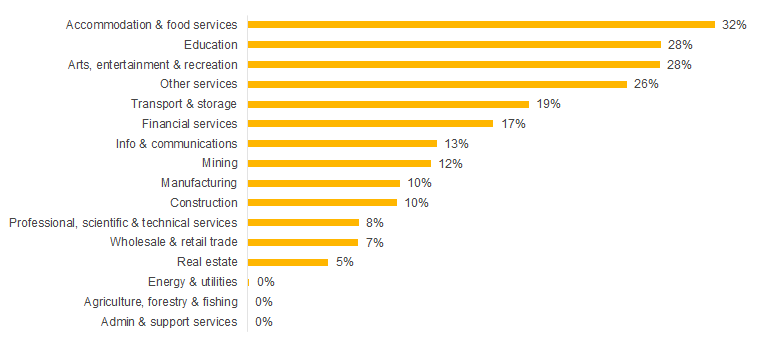

As the labour market remains under pressure, PwC has called for interventions to protect jobs in certain sectors. “The risk is higher for furloughed workers in sectors such as accommodation and food services (hotels and restaurants), the arts, entertainment and recreation sector and education sector,” she added.

Source: PwC

PwC analysis shows a third of furloughed employees in accommodation and food services industries are at risk of losing their jobs, followed by 28 per cent in education. Financial services could also take a significant hit from the economic fallout of the pandemic, with 17 per cent of furloughed staff at risk of redundancy.

An absence of further support will adversely impact those in at-risk sectors but long term trends like automation also poses a risk. The outbreak of coronavirus has accelerated the move towards automation which will hit sectors like retail, transport and manufacturing. Teow predicts “business priorities to improve resilience and maintain social distancing are likely to increase the reliance on automation”.

‘A game of snakes and ladders’

Given how dire the outlook is, it is unlikely that the UK unemployment rate will bounce back quickly.

“Monthly redundancies look set to rise imminently to a much higher level than during the worst phase of the 2008 to 2009 recession,” said Tombs. “We still expect the UK unemployment rate later this year modestly to exceed the 8.5 per cent peak seen in the wake of the last recession.”

Hopes of a V-shaped recovery suffered a blow when the economy grew just 1.8 per cent in May. It was far below the 5.5 per cent analysts had predicted after April’s huge 20.3 per cent drop in GDP.

James Reed, chairman of recruiter Reed, said: “The UK’s economic trajectory could look more like a game of snakes and ladders.

“It’s clear that the road to recovery will be long. There’ll be lots more ups and downs along the way.”

And it is not just coronavirus worries that will dent a recovery. The looming Brexit deadline is also considered to be a threat.

EY Item Club adviser Archer added: “We increasingly suspect that the recovery will be limited by persistently cautious businesses and consumers. Business uncertainty may well be reinforced over the latter months of this year by concerns over the future UK- EU relationship once the transition arrangement ends on 31 December.”

Get the news as it happens by following City A.M. on Twitter.