How are the FTSE 100, Dow & Dax faring?

Ahead of the ECB committee meeting, BOC rate decision and US earning season, we provide an outlook on how futures are positioned.

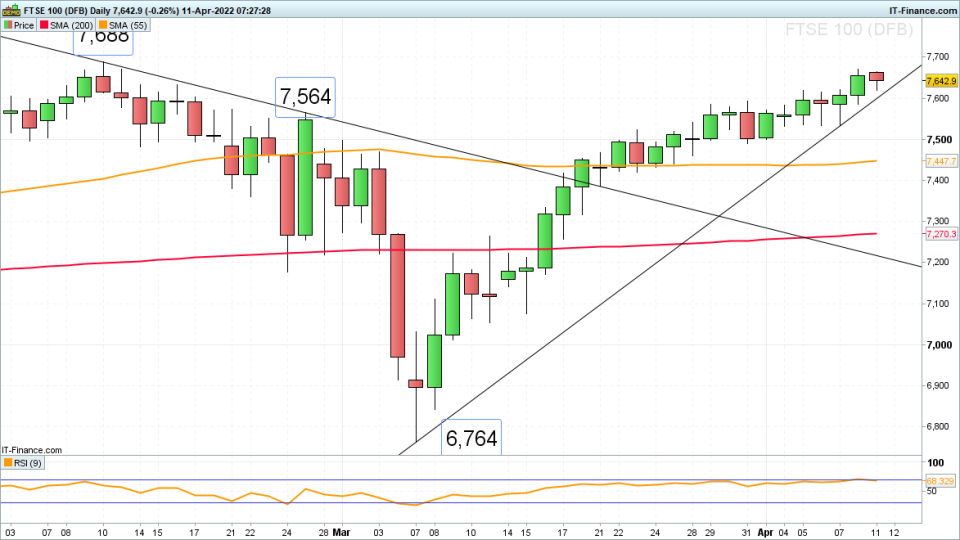

FTSE 100

The FTSE 100 gained over 1% last week as most US, Asian and European equity indices ended the week in negative territory, weighed down by a firm hawkish outlook from the US Federal Reserve (Fed) and worries about the outcome of the first round of presidential elections in France.

However, much weaker than expected month-on-month UK GDP data at 0.1% (versus 0.5% expected), industrial production at -0.6% (versus 0.3% expected) and manufacturing production at -0.4% (versus 0.3% expected) dampened the FTSE 100 advance earlier this morning.

Having said that, the index has so far stayed above its two-month uptrend line and late March high at 7,600 to 7,593 which is encouraging for the bulls. While last week’s low at 7,533 underpins, the uptrend remains intact.

Were last week’s high at 7,671 to be exceeded, the January 2020 and February peaks at 7,688 to 7,690 would likely be overcome with the July 2019 high at 7,730 being targeted next.

DAX

Last week the DAX 40 declined by over 2% in view of the US Fed reasserting its hawkish outlook and talking of a rapid balance sheet reduction, sending US bonds and stocks tumbling and dragging most world indices down with them.

Worries about the outcome of the first round of the French presidential election also weighed on the index which nonetheless managed to stay above the 38.2% Fibonacci retracement of its March rally at 13,975 which, with last week’s low at 14,0226, is expected to continue to offer support.

Since the March rally can be sub-divided into five Elliott waves and the decline from the late March high at 14,927 into three corrective A, B and C waves, further upside is expected to be seen in the not-too-distant future with another five waves to the upside unfolding. However, for such a bullish scenario to be confirmed, a rise above last week’s high at 14,605 needs to be seen.

In case of renewed downside pressure being witnessed instead, the 24 February low and 50% retracement at 13,795 to 13,680 may offer a potential support area ahead of the 15 March trough at 13,577.

Dow

The Dow Jones Industrials Average declined last week amid hawkish comments from several US Fed officials, many of whom apparently would have preferred a 50-basis point increase in the Fed funds rate, instead of last month’s 25 basis points, minutes of the March meeting showed.

Concerning the balance sheet reduction, they agreed to monthly caps of around $60 billion for Treasury securities and $35 billion for mortgage-backed securities, phased in over a period of around three months. That is higher than $50 billion a month cut the Fed made back in 2017-2019.

In view of the above, the Dow slid to 34,189 last week, to marginally above an important support zone at 34,181 to 33,979 which incorporates the breached 2022 downtrend line, which going forward may act as a support line, as well as the 22 February to 3 March highs.

Today the index is trading above the 55-day simple moving average (SMA) at 34,338 but so far remains below the 200-day SMA, the 2022 downtrend line and last week’s high at 35,057 to 35,140 which all need to be overcome for the March uptrend to resume. First, though, Friday’s high at 34,916 will need to be bettered.