Household energy bills to hit £3,000 per year in the depths of winter

Annual household energy bills will spike to over £3,000 next January, putting more pressure on cash-squeezed Brits in the coldest month of the year.

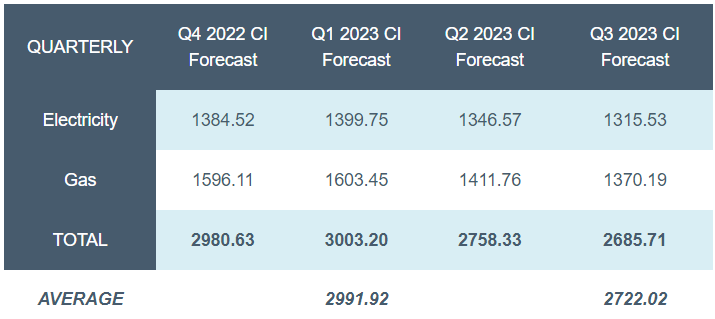

Energy specialist Cornwall Insight has forecast that the price cap could rise to £2,980 when it is next updated in October, and climb again January to £3,003, when energy demand is at its peak.

This is dependent on Ofgem reforming the cap to a quarterly mechanism, with the watchdog unveiling a tend-to consultation earlier this year.

Ofgem has argued this will ensure consumers will feel the benefit of lower energy prices quicker.

However, with Cornwall Insight gloomily predicting elevated energy prices into 2024, it leaves households exposed to the painful potential of continued hikes.

It has upgraded its estimates from earlier this month by around £100 for the next two potential price cap windows.

This follows Ofgem chief Jonathan Brearley warning Parliament the price cap will likely rise to at least £2,800 per year this autumn, and growing tensions in Europe – with Russia starting cut off gas flows to the continent, raising the prospect of supply shortages.

Gazprom has already reduced deliveries into Germany, Italy and Austria, with multiple countries bringing in emergency plans that could eventually lead to European governments dictating the provision of supplies.

Cornwall Insight are still forecasting a drop in the cap in summer 2023, but its predictions have risen in absolute terms over the past few weeks across all periods, reflecting higher wholesale prices across the traded market.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight said: “With the geopolitical events in Russia causing significant barriers to energy flows and the situation showing no sign of abating, we are unfortunately predicting average consumers will be facing a bill over 50 per cent more than the existing cap – itself an unprecedented rise.”

“While the UK gets very little energy from Russia, ultimately the countries that do are seeking alternative sources of gas. This will impact the energy flows to the UK from Continental Europe and cause further volatility in the market, adding fresh upward pressure to prices.”

Regulator scrambles to fix broken energy sector

The government has unveiled a £15bn support package for households – which will provide vulnerable energy users up to £1,200 per year savings on their bills.

Nevertheless, the industry remains in crisis with Ofgem announcing a raft of reforms to improve the energy sector and make supplier more resilient to market shocks.

This includes fit and proper person rules, stress tests, market stabilisation charges, and most recently, protections to credit balances.

However, it has stopped short of demanding firms ringfence 100 per cent of balances, with the topic hotly debated by suppliers.

Energy bills are already at record levels, climbing to £1,971 per year in April – powered by rebounding energy demand and supply shortages which have driven wholesale costs to all-time highs.

Wholesale prices touched £8 per therm in March when the US and UK targeted Russian energy supplies with sanctions, and remain high at £2,15 per therm.

For context, prices were hovering at 48p per therm this time last year on the UK’s benchmark.

This has contributed to serious market carnage , which has seen 29 suppliers collapse since September, directly affecting over four million customers.

Energy firms have also been constrained by the price cap, which prior to the recent hike to £1,971 per year in April, prevented firms from passing on the high prices to customers.

Bulb Energy, the UK’s seventh biggest supplier, was the largest casualty of the crisis – becoming the first energy firm to fall into special administration, being propped up by the taxpayer in the biggest state bailout since RBS in 2008, currently estimated at over £3bn.

The firm is subject to a bidding war between multiple energy firms, and City A.M. understands Octopus Energy, Centrica and Masdar are all vying for the fallen supplier and its 1.6m customers.