Housebuilding set to drop 35 per cent in 2020, says report

Coronavirus lockdown measures will mean 35 per cent fewer houses will be built in the UK in 2020 than originally planned, according to a new report, a fall likely to add to the stresses in the British housing market over the coming years.

Property consultant Knight Frank predicted in a new report that around 104,000 houses will be privately built in 2020, 35 per cent or 56,000 fewer than an official prediction made in March.

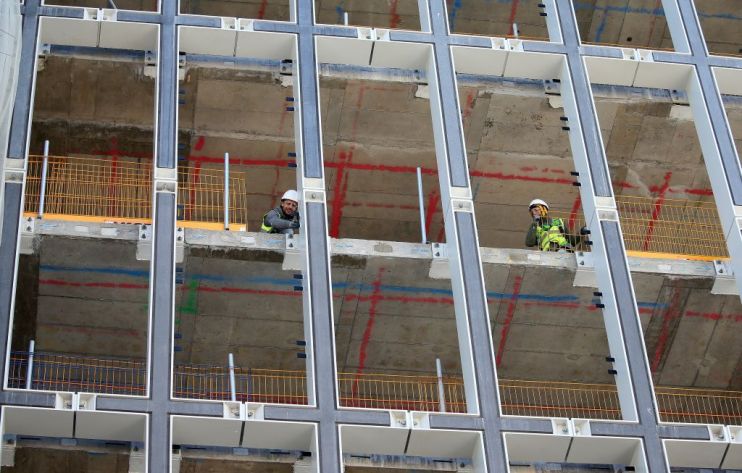

The report comes as some housebuilders such as Persimmon prepare to restart work, albeit while still observing social distancing measures.

However, Knight Frank said social distancing measures will mean the return to work will be slow and gradual. “This is not simply a case of flicking a switch back on,” the report said.

New housing completion in London is set to hit its lowest level in 2014 despite a much bigger population, with 8,000 fewer homes set to be built compared to the five-year average.

Although private housing is just one part of the marking, “the drop will prove a significant setback to the Mayor of London’s yearly target of 55,000 new homes,” Knight Frank said.

The plunge in house completions has been driven by the UK’s coronavirus containment efforts. Although housebuilders are allowed to keep sites open, the majority have shut them due to social distancing rules and fears over spreading the illness.

Knight Frank’s report suggested that as of 17 April work had been suspended on residential schemes capable of delivering nearly 250,000 new homes across the UK.

Justin Gaze, head of residential development land at Knight Frank, said the industry is “also coping with an ever dwindling availability of skilled workers”.

He said the government should step in to help the industry, beyond its coronavirus support packages. Gaze suggested extending the “help to buy” scheme that gives government support to first-time buyers and relaxing planning applications.

Oliver Knight, research associate at Knight Frank, said: “Of course, the key question which will determine the impact is ‘how long’.”

“The longer the disruption the greater the pressure on the market and longer the recovery.”