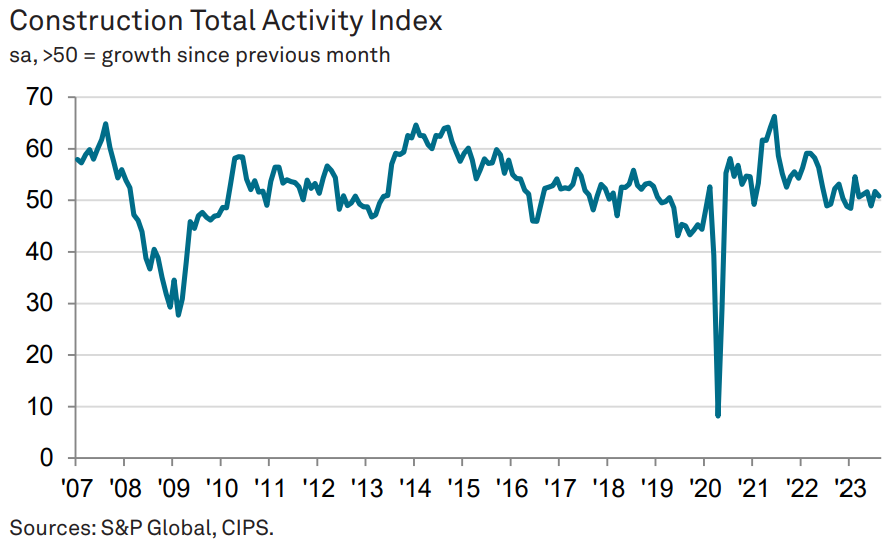

Housebuilding downturn deepens as rising interest rates weigh on demand

House building fell at the fastest pace since the pandemic last month, but office refurbs helped keep the UK construction sector in positive territory in August.

According to the S&P Global and CIPS UK Construction purchasing managers’ index (PMI), housebuilding fell deeper into negative territory in August, as rising interest rates weighed on demand.

The sector recorded a score of 40.8, comfortably below the 50 mark which separates growth from contraction.

“Housing activity fell at its second sharpest level since 2009, excluding the pandemic years, and overall new orders dropped at the fastest rate since May 2020,” John Glen, chief economist at the CIPS, said.

Rising interest rates have sent mortgage rates soaring, knocking demand among many would-be buyers. Firms commented on the “subdued market conditions” and cutbacks to new build projects.

Despite the steep downturn in housebuilding, overall activity in the construction sector remained positive in August at 50.8. This was down from 51.7 the month before, but marginally higher than economists had predicted.

The expansion was driven by commercial building, which recorded 54.2, while civil engineering was also in positive territory at 52.4.

Glen highlighted refurbishments in particular as a source of growth.

Despite this, experts warned that things were likely to get worse over the remainder of the year.

“Resilient demand for commercial work and infrastructure projects are helping to keep the construction sector in expansion mode for now, but the survey’s forward-looking indicators worsened in August,” said Tim Moore, economics director at S&P Global Market Intelligence.

New orders fell at the fastest pace in three years, as rising interest rates and concerns around the economic outlook led to more caution among clients. This suggests that activity will begin to fall in the months to come.

As a result firms were increasingly pessimistic about the future, with concerns about rising rates and a subdued market weighing on sentiment.

Giulia Bellicoso, an assistant economist at Capital Economics who focuses on commercial building in particular, said its performance was “surprising” given the wider economic backdrop.

“We don’t expect this resilience to last,” she said