Price of the average London home on the rise as UK demand rockets

The ‘average’ London home will now set you back more than £530,000 after house prices in the capital increased for the first time since April 2023, according to figures released today.

Data from Zoopla’s latest house price index revealed that London property prices were up 0.2 per cent year on year in the first seven months of 2024, with the average home now costing £536,300.

London was one of eight regions that saw prices increase during the period, with Northern Ireland seeing the biggest jump at 5.1 per cent.

The East of England was one of only four regions to see prices fall, with the average down 0.9 per cent year on year.

The South East also experienced a price reduction, with the average home now costing 0.7 per cent less than this time last year.

UK-wide, house prices rose by 1.4 per cent during the period and are on track to 2.5 per cent higher by the end of 2024.

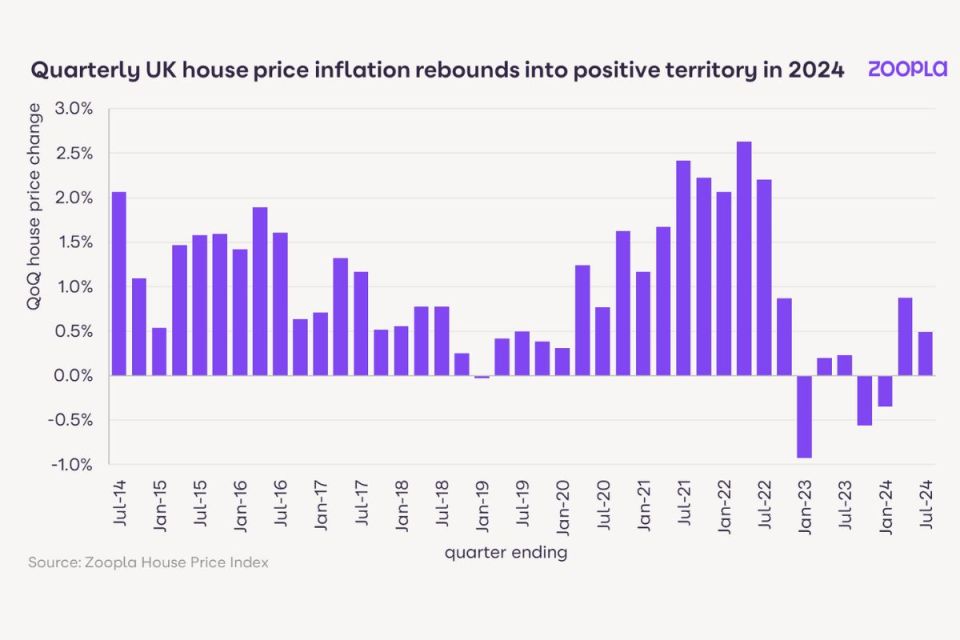

Over the last decade, average UK house prices have only fallen in three quarters – Q4 2022 and again in Q3 and Q4 2023, both times in response to a spike in mortgage rates.

Demand rebounds from slump

The surge in mortgage rates also slowed demand among home owners in 2023. However Zoopla’s latest figures showed that buyer demand increased by 20 per cent during the first seven months of 2024, with agreed sales up 23 per cent.

The supply of homes is also on the rise, with the property website revealing that the average estate agent listing property on Zoopla currently has 33 available unsold homes – the highest level since 2017.

However, because many of these sellers are also buyers the company said this had not impacted the number of agreed sales.

Richard Donnell, executive director at Zoopla, said: “Momentum in the sales market continues to build as mortgage rates drift lower and more and more sellers gain the confidence to list their home for sale.

“Buyers have much greater choice which will support sales numbers, but this will keep prices rises in check.

“Buyers have less purchasing power than two – three years ago and remain price sensitive meaning sellers can’t afford to get ahead of themselves on where to set the right price for their home.

“If you need to cut the asking price by five per cent or more then your home will take twice as long to sell or may not sell at all”.

House prices a ‘positive sign’

Tom Bill, head of UK residential research at Knight Frank, added: “The simple equation for the property market this autumn is that buyer demand will increase as mortgages rates continue to fall.

“As underlying inflation comes under control, more sub four per cent mortgages appear and a further rate cut is expected before Christmas, we think UK house prices will increase by three per cent this year.

“Financial pain will continue to enter the system as buyers and sellers roll off favourable rates and there is uncertainty surrounding October’s Budget, which means the scope for price exuberance is low.”

Nathan Emerson, CEO of Propertymark, said: “There is a real positivity within the housing market now that the economy seems to have stabilised.

“This is the UK government’s chance to take advantage of current market confidence by clarifying a more precise time frame for enacting the Planning and Infrastructure Bill as this will build the homes desperately needed in order to keep up with ever-growing demand and start to form a plan of action if the government wants to meet its target of building nearly two million new homes across the next parliamentary term.”